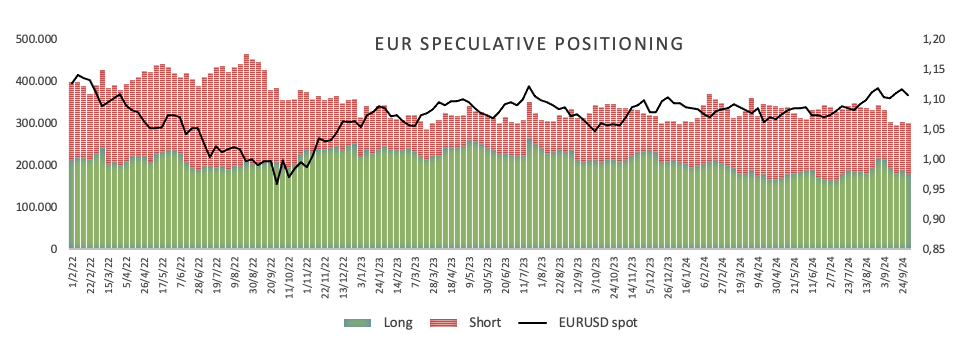

CFTC Positioning Report: EUR net longs kept shrinking

These are the main takeaways of the CFTC Positioning Report for the week ending October 1.

- Non-Commercial traders trimmed their net longs in the European currency to their lowest level since late August, around 55.3K contracts. Hedge funds, in the meantime, reduced their net shorts to six-week lows, all amidst a humble decline in open interest. Following a move to 2024 tops past 1.1200 the figure, EUR/USD embarked on a corrective decline pari passu a recovery in the US Dollar, which would eventually gather further steam.

- Speculative net longs in the Japanese yen retreated for the first time since late August, dropping to three-week lows along with a reduction in net shorts held by Commercial players. Open interest, in the meantime, receded modestly. USD/JPY maintained its gradual ascent on the back of the recovery in the Greenback and dovish remarks from the BoJ.

- Speculators increased their net longs in the British pound to four-week highs amidst an acceptable advance in open interest. GBP/USD came under renewed downside pressure soon after hitting new tops in levels last seen in March 2022 north of the 1.3400 barrier exclusively following a rebound in the US Dollar.

- Non-Commercial net longs in the US Dollar retreated to their lowest level so far this year, around 150 contracts, while open interest retreated marginally. The US Dollar Index (DXY) met decent contention just above the psychological 100.00 yardstick, from where it started a strong recovery helped by speculation of a smaller rate cut by the Fed in November.

- Net longs in Gold eased to three-week lows just below 300K contracts amidst an acceptable retracement in open interest. Prices of the ounce troy navigated an erratic path around $2,650-$2,660, always close to their recent all-time highs.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.