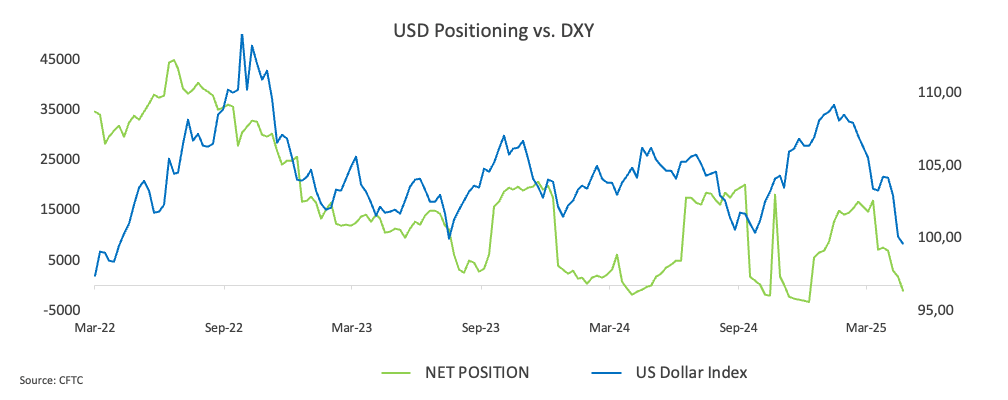

CFTC Positioning Report: Dollar bets turned negative for the first time this year

The latest CFTC Positioning Report, covering the week ending April 22, captures a period marked by the Easter holiday lull, with both volatility and trading activity notably subdued.

Speculators turned net short on the US Dollar (USD) for the first time since early December 2024, holding just over 1K contracts, amid a decent advance in open interest. Meanwhile, the US Dollar Index (DXY) extended its bearish streak, slipping to fresh lows around the 98.00 mark, where some initial signs of support have started to emerge.

Speculative net longs in the Euro (EUR) fell to a two-week low, holding just above 65K contracts. Commercial players, meanwhile, kept their net short positions virtually unchanged near 118K contracts, marking multi-month highs. Open interest climbed to around 719.2K contracts, the highest in six weeks. Over the reporting period, EUR/USD extended its multi-week rebound, reaching the 1.1570 area for the first time since November 2021.

Net longs in the Japanese Yen (JPY) continued to build, reaching fresh highs near 178K contracts, alongside a rise in commercial players' net shorts to almost 201K contracts. The correction in USD/JPY gathered momentum, fueled by tariff-driven demand for safe-haven assets, pushing the pair below the key 140.00 support level for the first time since September 2024.

Non-commercial net longs in the British Pound (GBP) picked up momentum, rising to a three-week high near 20.5K contracts alongside another increase in open interest. GBP/USD extended its uptrend, breaking above the 1.3400 barrier while maintaining a constructive outlook above the key 200-day SMA at 1.2835.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.