Central bank fest as Dollar continues its decline

The focus this week is the Federal Reserve meeting, the Bank of England rate decision and Monetary Policy Report and the ECB meeting. This troika of central bank decisions could set the tone for the rest of the year: the Federal Reserve passing the baton of global leader when it comes to tightening monetary policy. The Fed is now expected to hike rates by 25 basis points, the market is convinced that the Fed will slow the pace of rate hikes further, CMC Fed watch is predicting a 98% chance of a 25 bp rate hike to 4.5% - 4.75% on Wednesday. The Bank of England decision will be closely watched to see if they hike by 25bps or by 50bps, while the ECB is expected to continue with super-size hikes and raise rates by 50bps.

The Fed passes the baton to the ECB and the BOJ

As the Federal Reserve is fading as the key driver in central bank policy, this is having a major impact on the FX market. The dollar is no longer king, after having a stunning ascent in 2022. Instead, the euro, yen and the pound are catching up after falling sharply last year; for example, since October last year, EUR/USD is up some 12%. The key driver of the future direction for forex is likely to be the ECB policy and the Bank of Japan. Added to this, falling commodity prices is improving the terms of trade story for these countries, which is also benefitting their currencies. What is interesting, is that the Eurozone current account has already bounced back into surplus, according to the latest official data. All that gas storage and the fall in energy prices has paid off. This should benefit the euro in the long term, and we expect to see the euro to remain in the ascendency for the first half of this year, especially vs. the USD.

Terms of Trade improvement in the UK: Small, but stable

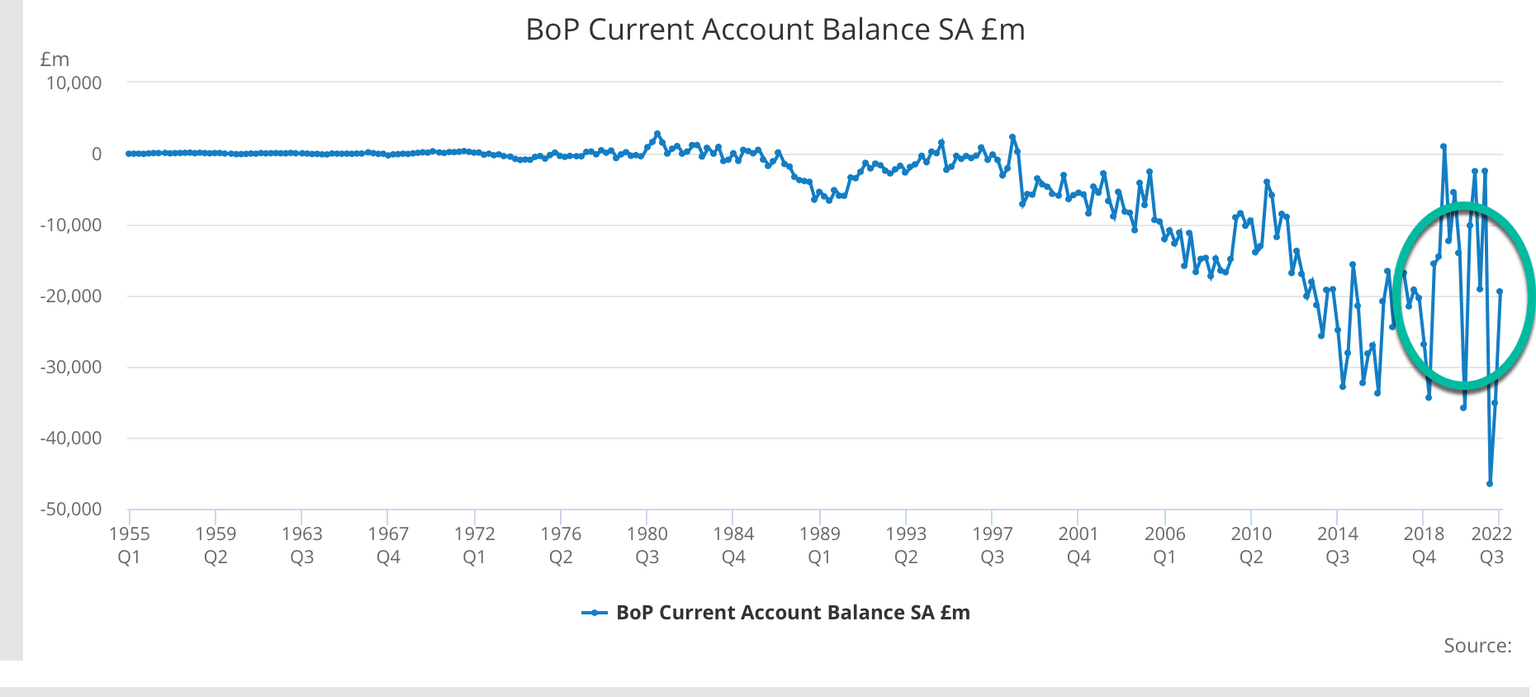

In contrast, while the UK is also likely to benefit from the falling energy prices, the benefits are coming in at a slower pace due to a few things: the lower gas storage capacity available in the UK, and the weak fiscal position of the UK due to persistent deficits and high interest spending costs. This means that the UK current account remains in deficit, even if it is moving to a more sustainable path. For example, the latest data from the ONS showed that the UK’s current account deficit reduced to £19.4bn or 3.1% of GDP in Q3 2022, see the chart below. We shall have to see if this improves further when the Q4 data is released later this year. An improvement in the Terms of Trade data for the UK, even if it is coming from a low base, is welcome, and could help sterling to hold its own in the coming months, even if we believe the euro will outperform, especially against the dollar. While the dollar continues to fade, we could see EUR/GBP and EUR/JPY remain range bound for the foreseeable.

Source: ONS

BOE to “upgrade” UK economic forecast

One of the key themes in the market coming into 2023, was the extremely bearish outlook for the UK and for the pound. This has not come to pass, and as we wait for the BOE meeting this week, we expect the Bank to change its forecasts for the UK economy and to now predict a shorter and shallower recession. Some analysts expect the length of the recession to fall from a whopping 8 quarters to 4 quarters of negative growth, and for the decline in the growth rate to be reduced from 2.9%, which was the BOE’s November forecast, to a 1.5% decline, as market-based interest rates fall, which should support consumption.

MPC: will the doves take charge?

It will be worth watching how the MPC votes at this meeting. In the November meeting, two members did not vote to raise interest rates. We expect the core group of MPC members to push through a 50bp rate hike on Thursday, however the decision is on a knife edge and there is still a chance that the MPC could deliver a 25bp rate hike. The market currently expects rates to rise to approx. 4.38% in August, before rates start to decline in Q4. The market is currently pricing in 22 basis points of cuts through to the end of the year, on the back of weaker economic survey data at the start of this year. However, the market will be looking to see if Andrew Bailey will reinforce this view, or shoot it down, as the deceleration of price growth in the UK is not as fast as our peers. With inflation running at 10.5%, we think that a 50bp hike is justified. However, we also expect a steer about what to expect in terms of the future size of rate increases and how close we are to the BOE’s terminal rate which is currently just under 4.5%.

Proxy UK rates continue to fall, even if the BOE hasn’t finished hiking

Interestingly, mortgage rates in the UK have continued to fall, even though the BOE is still hiking rates, as the mortgage market normalises post the volatility that was experienced last September. Mortgage rates are also reacting to expectations that the BOE will end its hiking cycle this year and will then start cutting rates. Thus, any sign that UK rates are nearing their peak at this week’s meeting, should lead to further declines in UK mortgage rates, which is good for housebuilders, even if it weighs on UK banks.

Tech’s big hitters report Q4 earnings

Elsewhere, stock markets closed higher last week, with European luxury goods surging ahead. LVMH results defied the gloomy outlook and raised its dividend by 20%. Burberry and Hermes reached stock prices also reached record highs. Looking ahead, there are some key earnings releases in the US including Apple, Amazon, Alphabet, McDonald’s, and Caterpillar. However, while we will obviously keep a close eye on the outlooks that these companies give with their Q4 results, we think that stocks could continue their recovery rally in the US and elsewhere if the Fed sticks to its dovish script on Wednesday. We believe that there are still animal spirits in the system, and this will help to propel stocks and other risky assets, including bitcoin, higher in the coming days.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.