Canadian jobs preview: Three reasons why USD/CAD may extend its falls

- Canada is set to report a return to job gains in November, supporting the loonie.

- Wage growth will likely remain at high levels, adding to C$ strength.

- Downbeat US Non-Farm Payrolls may weigh on the US dollar.

The Canadian dollar is having a good week – that may even get better. Oil prices are supporting the C$ and the Bank of Canada has seen the glass half full in the economy. Friday's jobs report for November may send it higher, especially against the greenback.

Here are three reasons for a potential upside for the loonie and another leg down for USD/CAD.

1) Return to job growth

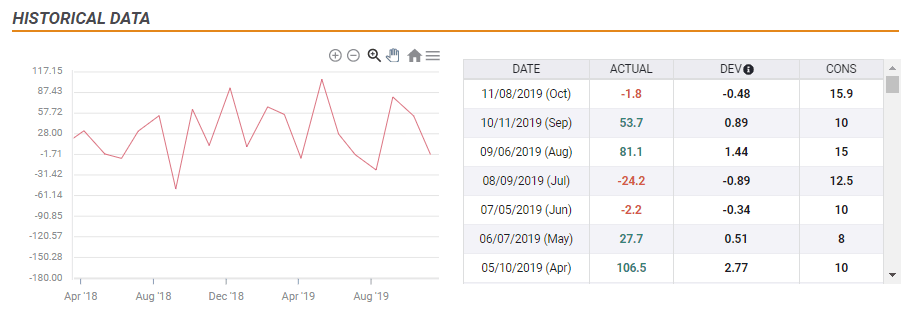

Changes in Canadian employment tend to surprise markets – mostly to the upside in the past year. The workforce has been expanding rapidly alongside population growth, but some months witnessed a loss of jobs. The previous employment figures were disappointing, with a loss of 1,800 positions against an increase of 15,900 that was expected.

Economists foresee an increase of 10,000 positions, but these projections may be modest in comparison to previous positive months this year, which have seen gains ranging from 27,700 in May to a whopping 106,500 in April. Therefore, a more significant increase may be seen in November.

Canada's Unemployment Rate is expected to remain unchanged at 5.5%. While the figure may have political implications, traders tend to shrug it off as it is heavily dependent on the participation rate. The focus in on the change in the number of the employed, and their paychecks.

2) Wage growth is accelerating

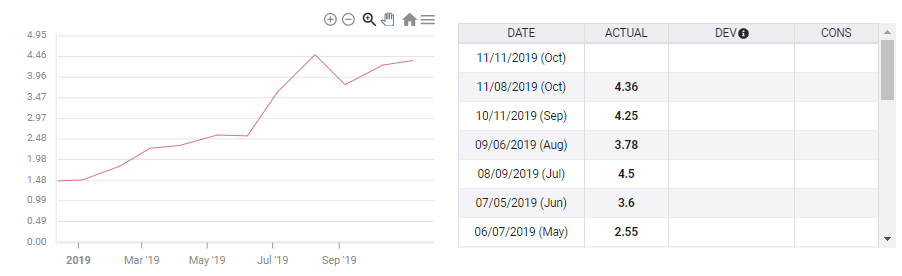

The pace of pay increases has been on a rising trajectory throughout 2019 and stood at 4.36% yearly in October. For comparison, US Average Hourly Earning stabilized at 3% back then.

The BOC is awaiting an increase in consumption and higher wages may push spending and prices higher.

Even if the economy loses positions for the second consecutive time, it may be triggered by a tight labor market, which causes employers to raise salaries. And that may also cheer C$ bulls, as the central bank is unlikely to cut interest rates when Canadians are making more money and inflation is set to rise.

3) US Non-Farm Payrolls may disappoint

Canada and the US are publishing their jobs reports at the same time, 13:30 GMT. USD/CAD is set to react also to America's Non-Farm Payrolls figures – which may drag the US dollar down.

ADP, America's largest payroll provider, has reported a meager increase of only 67,000 private sector positions in November – half the early expectations. While the correlation between the firm's numbers and the official government figures are not always well-correlated, it is hard to expect a substantial deviation.

Overall, downbeat figures – even if partially priced in – may weigh on the greenback.

USD/CAD scenarios

1) Above expectations: If Canada gained more jobs than expected and wage growth remains robust, USD/CAD may plunge. That is the base-case scenario. An increase of over 20,000 jobs would count as a beat, and wage growth exceeding 4% is more than satisfactory.

2) Within expectations: In the unlikely case that Canada's figures are in line with projections, Dollar/CAD may still retreat as the chances for a downbeat US jobs report are high.

3) Below expectations: If Canada posts another month of job losses and the US NFP surprises to the upside, the currency pair has room to rise.

Conclusion

Canada's jobs report is set to rock the loonie and carries modest expectations. A beat may push the loonie higher and send USD/CAD down. It would take another downfall in Canadian job growth and upbeat US employment to push the currency pair higher.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.