Canadian jobs preview: Lose-lose situation for the loonie and two parallel developments to watch

- Canada is expected to report a record loss of jobs and a leap in the unemployment rate.

- The Canadian dollar may suffer even if the outcome is relatively upbeat.

- The simultaneous release of US jobless claims and the OPEC+ meeting complicate matters.

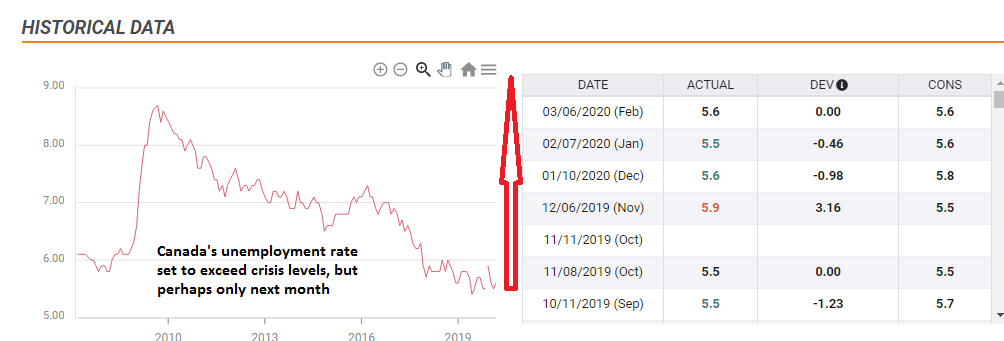

Will Canada's unemployment rate top 10%? It seems like a matter of time. The jobs report for March – published on Thursday due to Good Friday – will likely be bad for the loonie even if the figures are relatively upbeat. Canada is under lockdown due to the coronavirus pandemic, and the economy has ground to a halt.

The latest weekly jobless claims report dates to the five days ending on March 30 have reached 2.13 million – implying an unemployment rate of around 11%. The surveys that make the labor market figures are compiled earlier, but also in the week ending March 16, a total of 929,000 Canadian applied for benefits. Both figures eclipse the previous record low in job losses recorded of 499,200 recorded in 1957.

The government led by Justin Trudeau – whose wife tested positive for COVID-19 – took steps to keep workers in their jobs, thus reducing layoffs. However, this furloughing of workers is insufficient to stem the tide.

Fast-moving event

Similar to US jobless claims and the Non-Farm, Payrolls, economists are unable to keep up with the fast pace of events, and there is no clear consensus. However, a loss of over one million positions cannot be ruled out. Back in February, the nation gained 30,300 jobs.

The unemployment rate may not rise above 10%, as the statistics may reveal a plunge in the participation rate. Many people may have stopped looking for a job and have, therefore, dropped from the workforce. Canada's participation rate stood at 65.5% in February.

Why is it a lose-lose situation for the loonie? If Canada loses over a million jobs, the C$ has room to fall in response to the depressing news. If it surprises with a loss of hundreds of thousands of positions, traders will likely conclude that this is only the beginning, and more job losses will come.

Employment figures for April may provide a better picture of how Canada is coping – showing how much coronavirus is costing the economy and how much the government's measures are mitigating the effect. However, the upcoming figures may be horrible, with traders awaiting even more horror.

Timing

Canada's jobs report is due out at the same time as the US publishes weekly jobless claims. These figures have soared from a range below 300,000 to 6.7 million within two weeks. Another disastrous statistics may trigger safe-haven flows into the dollar, thus pushing USD/CAD even higher. A drop in the number of applications could trigger the opposite reaction.

In any case, Dollar/CAD's reaction could be driven by the American figure rather than the Canadian one.

The second factor to consider is the OPEC+ videoconference scheduled for the same day, April 9. Oil prices – Canada's critical export – have crashed due to falling demand and also as Saudi Arabia and Russia kicked off a price war. Both oil-producing countries were pushed by US President Donald Trump to strike a deal to reduce production. US shale companies and other countries are also involved in the effort to halt the plunge in petrol prices.

Headlines coming out of the meeting – and the preliminary talks – may also whipsaw USD/CAD and skew the reaction to the jobs report.

Conclusion

Canada is set to report a terrible loss of jobs and a surge in the jobless rate. The nature of the extraordinary situation makes estimating the outcome harder than usual. Traders may sell the loonie in response to weak data and also abandon the currency if figures beat expectations – amid fears that the next report will be worse. US jobless claims and the OPEC+ meeting may skew the reaction in USD/CAD.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.