Canadian GDP Preview: Slowdown unlikely to weigh on CAD, five scenarios

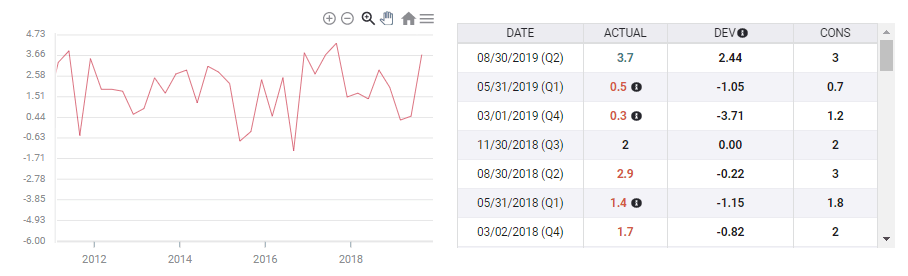

- Economists expect Canada's third-quarter growth to slow to 1.2%.

- The critical figure feeds into the Bank of Canada's next decision.

- The Canadian dollar may react positively despite the deceleration.

A downfall in growth or above-average expansion for a developed economy? These competing narratives may be confusing for Canadian dollar traders. Gross Domestic Product is set to slow down to 1.2% annualized in the third quarter, down from 3.7% beforehand. Nevertheless, it matches the UK and beats the euro-zone.

The slowdown will not be a total shocker for C$ traders, as Canada releases GDP figures monthly, with July and August's numbers already showing more modest growth. The global economy has been slowing over the summer, and Canada seems to have weathered the storm better than others.

Nor will it surprise the Bank of Canada, which has been shrugging off expectations for a rate cut in its upcoming meeting next week. Governor Stephen Poloz has been mostly content about the economy, which continues creating jobs at a satisfactory pace and has seen healthy inflation.

Moreover, the wind is blowing in favor of the loonie, after American lawmakers have made progress toward ratifying the USMCA – the new trade agreement that replaces NAFTA.

Overall, it would take a substantial downfall to send the Canadian dollar lower.

Five scenarios for USD/CAD

1) Within expectations: If quarterly GDP comes out between 1% and 1.4% annualized, the ongoing expansion will likely be cheered by markets and the Canadian dollar may gain ground, sending USD/CAD lower. However, the moves may be limited. The probability is high.

2) Below expectations: A sub-1% growth rate may cause worries and weigh on the C$, but the falls may be limited as long as the economy has expanded by over 0.5%. There is always a chance of disappointment.

3) Well below expectations: Under 0.5% annualized, the expansion is virtually non-existent. That could already send the loonie substantially lower, and USD/CAD considerably higher. This scenario is highly unlikely.

4) Above expectations: A growth rate of 1.5% or higher would already be encouraging, showing that the Canadian economy is solid. USD/CAD may suffer a meaningful slide. The probability is medium.

5) Well above expectations: If America's northern neighbor grew by 2.1% – America's growth rate – or higher, that could already send USD/CAD plunging. The chances are slim.

Conclusion

Canada's quarterly GDP report is forecast to show a slowdown in the third quarter, but the Canadian dollar may weather the storm.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.