Canadian Federal Elections: Not a very crucial vote

- Canadian elections are generating little market concern or attention.

- Federal Reserve policy is the ruling factor for credit and currency markets.

- Prime Minister Justin Trudeau is running for a third term.

Markets are taking a hands-off approach to Monday’s Canadian Federal election between Prime Minister Justin Trudeau's Liberals and Erin O'Toole's Conservatives.

Direct polling between the two parties is neck and neck but given the distribution of each party’s support a repeat of the 2019 result is most likely.

In that election, the Liberals lost both their parliamentary majority and the popular vote, but won the most seats and remained in office as a minority government, in cooperation if not an official coalition, with the fourth ranking New Democratic Party. The Conservatives, who had gained seats and won the popular vote, continued as the opposition

2019 results: Liberals 157 seats (currently 155) popular vote 33.12%; Conservatives 121 seats (currently 119) popular vote 34.34%; Bloc Quebecois 32 seats (currently 32), popular vote 7.63%; New Democratic Party 24 seats (currently 24), popular vote 15.98%. Popular vote count is nationwide.

The concentration of Bloc Quebecois voters in the Province of Quebec makes their seat totals much higher than the twice-as-large national vote total for the New Democrats.

The race

Prime Minister Trudeau called an early election in hope of obtaining a parliamentary majority. In a move reminiscent of British Prime Minister Teresa May’s Brexit vote, Mr. Trudeau called a vote during a national crisis, in order to fortify his hold on power, but now faces the possibility of losing to the opposition.

The Liberals have been in power for six years. In the last election the Conservatives won the popular vote but as Liberal vote is better concentrated, they won far more seats in Parliament, though not an outright majority.

Trudeau has been hard pressed to explain why he called an election during the pandemic. The Conservatives have been relentless in accusing him of personal ambition in trying to capitalize on the national struggle. For his part, Mr. Trudeau is staking his premiership that a majority of Canadians will reward him and the Liberals for their handling of the coronavirus.

After a slow start the Canadian vaccination rate is one of the highest in the world. Trudeau recently reopened the border, but only to the vaccinated.

Canada has seen fewer cases and deaths than many other nations. Ottawa has spent hundreds of billions of dollars to support the economy amid provincial lockdowns that lasted longer and were more encompassing than those in the United States.

The Bank of Canada has enacted the same program of extremely low rates as the US Federal Reserve. Its closely tied economy has benefited from the Fed’s massive $120 billion a month of bond purchases.

Mr. O’Toole and Conservatives hope to capitalize on public anger at the vote, which many see as an unnecessary power grab by the Liberals. After calling the election Mr. Trudeau's polling lead vanished. There is also a sense of fatigue with Mr Trudeau who has had his share of political missteps and scandals.

Mr.O’Toole opposes vaccine mandates which Trudeau supports. The Conservatives have promised to balance the government’s books which are badly in deficit after the pandemic spending.

Market response

The election has barely made a ripple in currency and credit markets. If the election was threatening to change economic policy and the government’s approach to the pandemic, or represented a strong streak of dissatisfaction in the electorate, attention would surely be more focused.

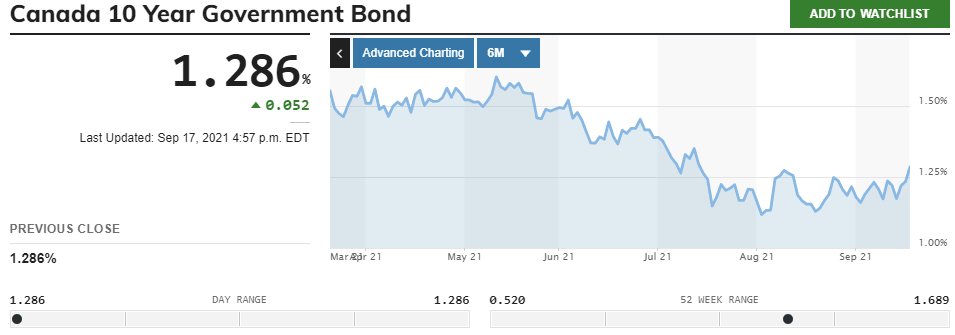

Canadian sovereign returns have largely followed developments in the United States. The 10-year yield rose 8 basis points last week, but, as in the US, it remains well below its early May peak.

Canada 10-year sovereign yield

MarketWatch

The USD/CAD reached a one-month high on Friday, closing at 1.2763 as speculation increased that the Federal Reserve is approaching its long-expected policy reversal. Fed Chair Jerome Powell has promised that the reduction of bond purchases will begin before the end of the year. Even If the amount and schedule is not announced at Wednesday’s FOMC meeting, a taper is the operating market assumption.

Conclusion

The Canadian election, whatever its political outcome, will change almost nothing in Ottawa.

If Trudeau wins economic and monetary policy will remain and the general approach to the pandemic will continue.

If the Conservatives win they will govern in a tacit or overt coalition. The scope for substantive policy changes will be close to nil.

Only if, in the weeks after the election, neither side can form a government, will markets take notice.

Given those circumstances, the US Federal Reserve is, quite logically, the dominant factor in financial markets.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637676779483306191.png&w=1536&q=95)