Canada’s CPI inflation data on the radar

Overextended to the downside in the Canadian Dollar

Unsurprisingly, the CFTC COT positioning data shows that large speculators are heavily weighed on the short side of the Canadian dollar at the moment, which is at its highest since 2017 and resembles an overstretched market (reportable open interest is net short Canadian dollar futures by more than 80,000 contracts). This is due to both data deterioration and the markets expecting the Bank of Canada (BoC) to cut rates at June or July’s meeting. Markets are currently pricing in around a 50% probability of a move in June, with July fully priced in (-27bps).

Inflation data eyed

Inflation remains a key talking point, and today’s inflation print marks the last major risk event ahead of June’s BoC meeting. As you may already know, this central bank works with an inflation target of 2.0% within an inflation-control range between 1.0% and 3.0%, and, as of writing, we are within that range. For March, core year-on-year CPI inflation is at +2.0%, while headline year-on-year CPI inflation is at +2.9%. The BoC, however, has three preferred core measures that it tracks: CPI-trim, CPI-median and CPI-common, and the average of these three reports is shaking hands with the upper edge of the inflation-control range at +2.9%.

Estimates heading into today’s event are for the April headline year-on-year CPI inflation to slow to a rise of +2.7%, down from +2.9% the month prior (estimate range between +2.9% and +2.4%), with the month-on-month release expected to remain unchanged at +0.6% (estimate range between +0.7% and +0.4%).

Absent any strong upside deviation in the data, a miss in today’s numbers could help seal the deal for a rate cut at June’s meeting. In terms of trading the event, however, a +2.7% print in the YoY headline CPI release or below will likely be enough to trigger CAD downside, but given how stretched the Canadian dollar is at the moment, it may be a short-lived move. What would surprise the markets more would be a broad beat in the data, a release that could see the CAD bid and markets potentially pricing out the possibility of a cut in June in favour of another hold.

Technically speaking?

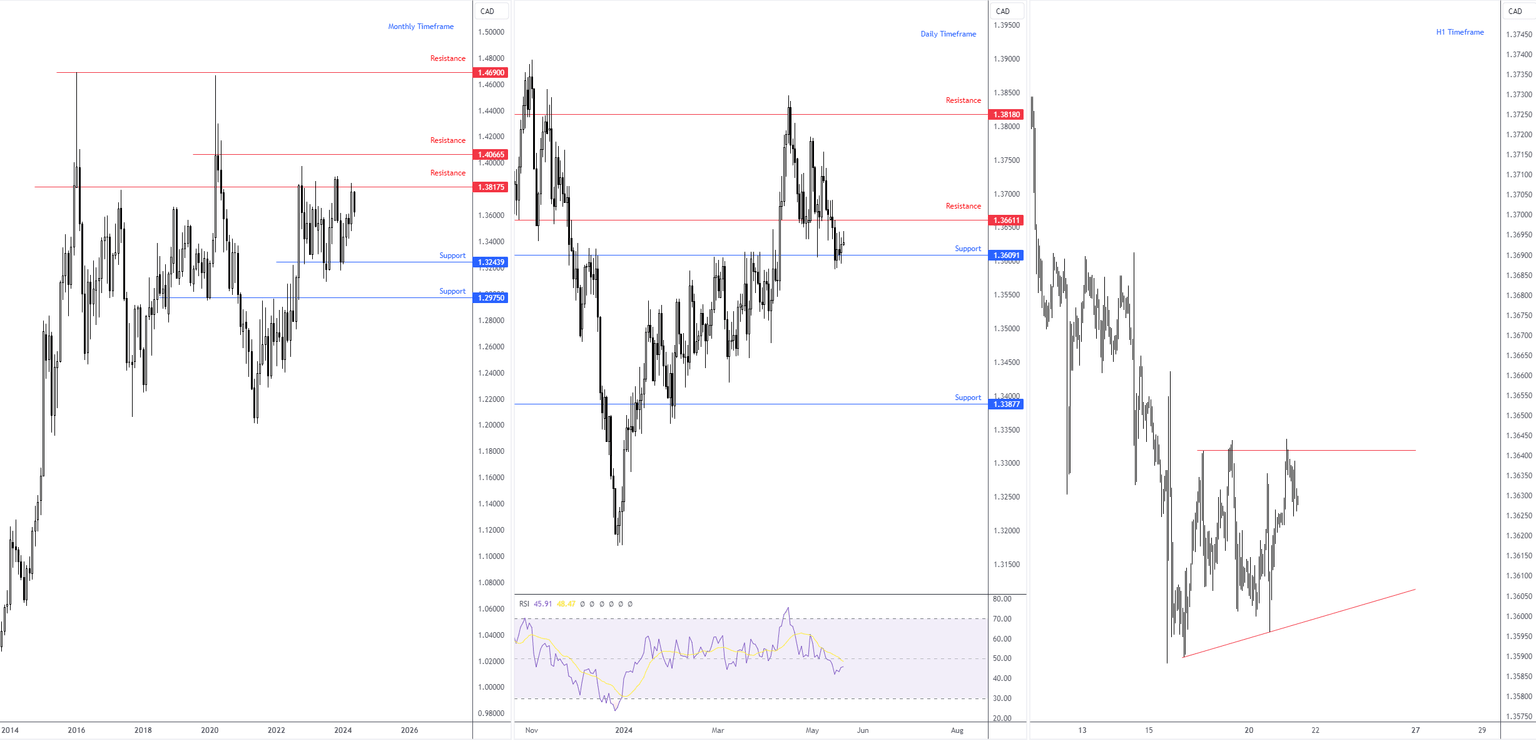

From a technical standpoint, the USD/CAD currency pair remains rangebound between support at CAD1.3244 and resistance from CAD1.3818, with the pairing recently fading the upper edge of the said range this month. Beyond this consolidation, support calls for attention at CAD1.2975 and resistance at CAD1.4067.

Regarding the daily chart, support entered the fray in recent trading at CAD1.3609, and bids moderately defended the level. Resistance demands attention overhead at CAD1.3661, and a break here paves the way for another layer of resistance at CAD1.3818. Interestingly, south of current support, scope to navigate lower can be seen as far south as support from CAD1.3388.

Based on a more short-term view of the pair, H1 flow is currently limited by what appears to be an ascending triangle formation between CAD1.3641 and CAD1.3590.

The focus heading into the CPI inflation release will be on daily support from CAD1.3609 and neighbouring resistance at CAD1.3661. A softer-than-expected release could see the USD/CAD respect current support, break through the upper boundary of the H1 ascending triangle and take aim at daily resistance. On the other hand, an upside surprise might trigger USD/CAD selling and see price break through CAD1.3609 and unearth a bearish breakout scenario in the direction of daily support at CAD1.3388.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,