Canada CPI Preview: Inflation to soften further while Loonie awaits its momentum

- The Canadian Consumer Price Index is forecasted to rise 3.2% YoY in October.

- The Bank of Canada is expected to maintain unchanged interest rates in upcoming meetings due to slowing inflation.

- USD/CAD is moving sideways, with balanced risks.

Data from Canada on Tuesday is expected to show another dip in the annual inflation rate. This would be welcomed news for the Bank of Canada (BoC) and not necessarily negative for the Canadian Dollar. On the same day, the government will release its fall economic statement.

Canada: CPI to slow again

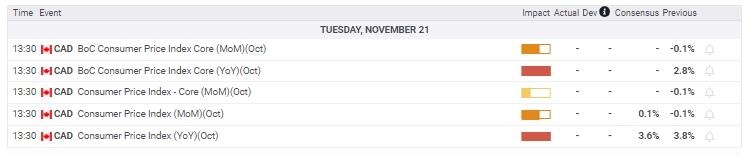

Canada will release inflation-related data on Tuesday, November 21, at 13:30 GMT. Statistics Canada will publish the October Consumer Price Index (CPI), expected to increase by 3.2% YoY, lower than the 3.8% recorded in September, moving closer to the Bank of Canada's (BoC) target of 2%. On a monthly basis, price are seen rising by 0.1% after an unexpected 0.1% decline in September.

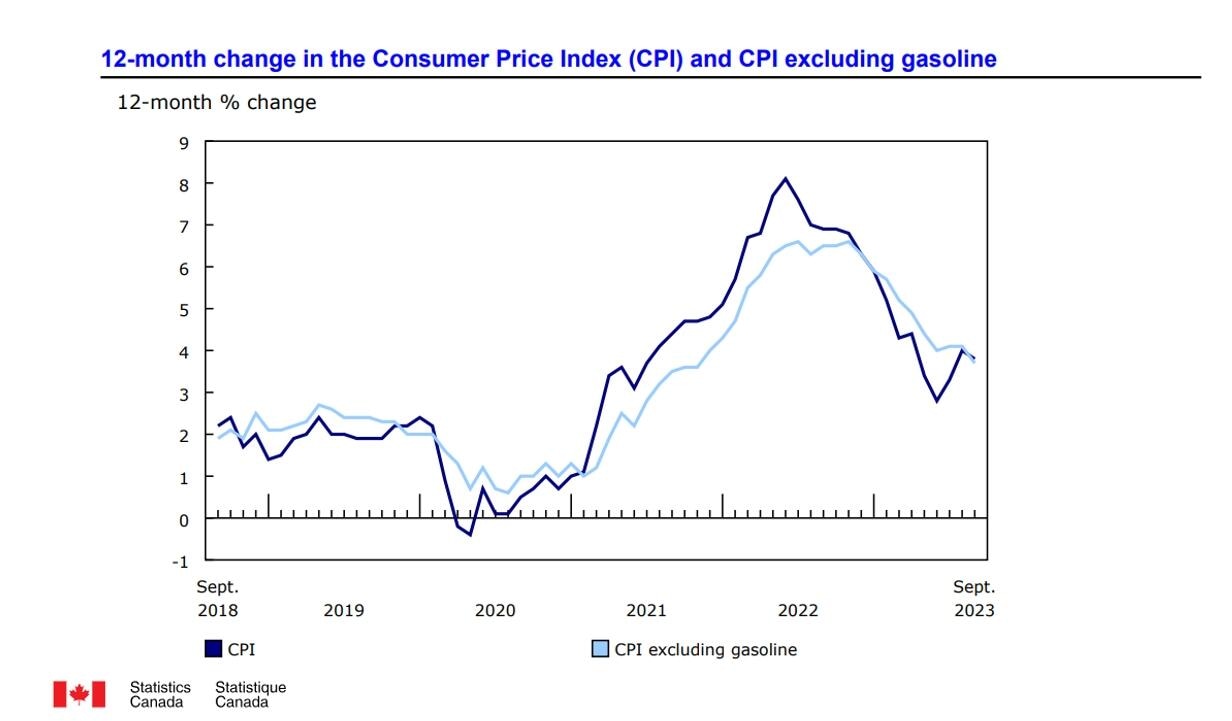

A decline in gasoline prices and a more gradual increase in goods and grocery prices are expected to contribute to a modest increase in the monthly inflation rate, resulting in a subsequent decline in the annual rate. This report would reinforce the expectation that the BoC will not further raise interest rates in the current tightening cycle.

The annual CPI inflation reached its lowest point in June at 2.8% and then rebounded, reaching 4% in August. However, the annual inflation rate dropped to 3.8% in September, below the expected 4%. Additional data from Canada to be released during the week includes September retail sales data on Friday.

The market does not anticipate further rate hikes from the BoC, and according to the interest rate market, the probability of rate cuts stands at around 35% for March next year, increasing to over 60% by the April meeting. Market participants foresee the potential for rate cuts during the first half of next year due to the weak economic outlook. Therefore, slowing inflation is considered good news for the economy and could positively impact the Canadian Dollar (Loonie), even if no further rate hikes are expected.

Inflation pressures are likely to decline further as economic growth slows and the job market softens. The Canadian Dollar (CAD) has been lagging behind in recent weeks, while the Australian Dollar and New Zealand Dollar reached monthly highs against the Greenback. The USD/CAD pair has been trading sideways. The decline in Crude Oil prices weighed on the Loonie in the past few days. However, since Friday, Crude Oil prices have rebounded, providing no additional momentum to the Canadian Dollar.

How could USD/CAD react to Canadian inflation?

The report could have a mild impact as market expectations of the Bank of Canada keeping rates unchanged are firm, and the CPI numbers are unlikely to be a game-changer. A higher-than-expected reading that triggers expectations of further tightening could boost the Canadian Dollar (Loonie), but only temporarily.

Higher interest rates and a gloomy economic outlook are not a positive combination. On the contrary, falling inflation at a steeper rate could increase expectations of rate cuts by the first quarter of 2024, which could be negative for the Loonie. However, weaknesses could be limited as slowing inflation positively affects the economic outlook.

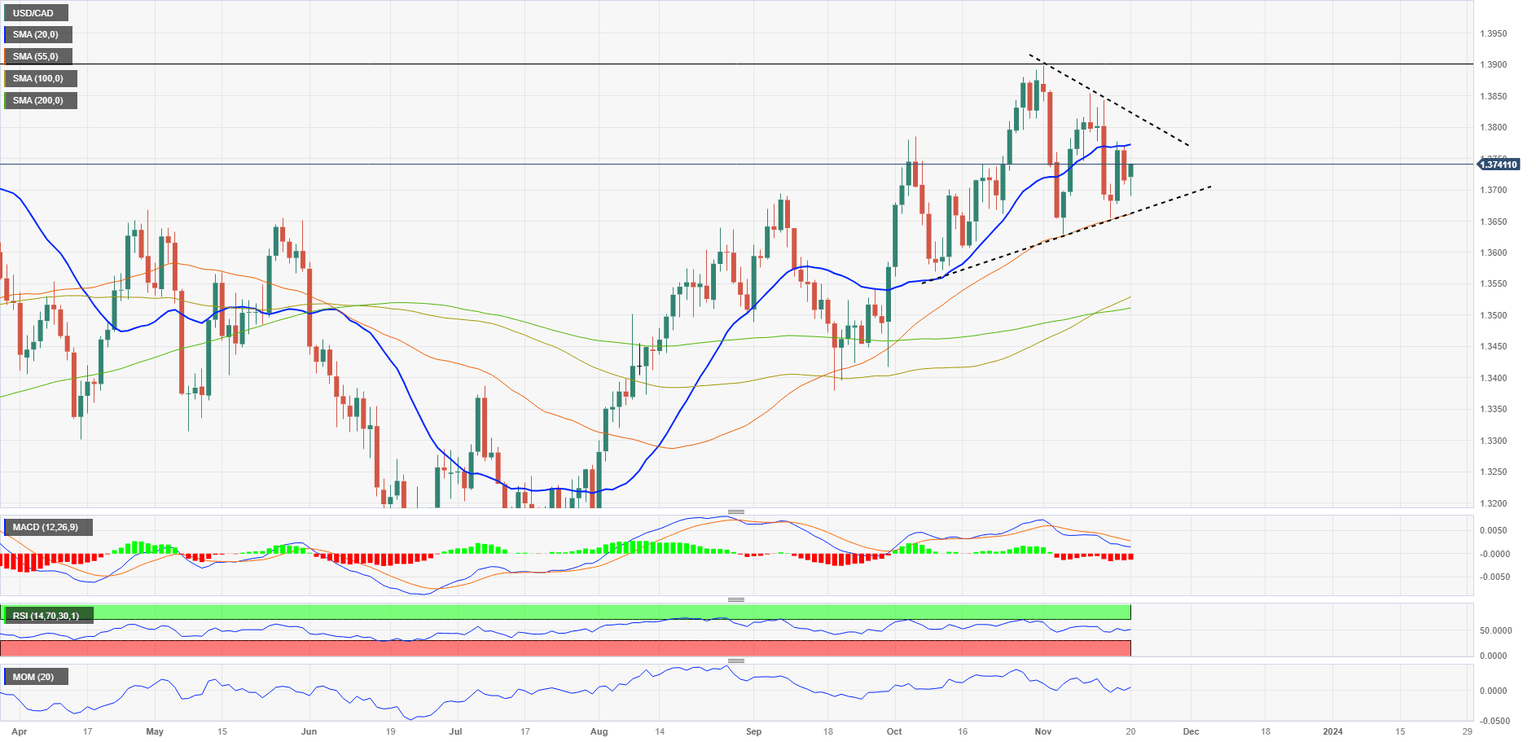

The USD/CAD pair is moving sideways below the 20-day Simple Moving Average (SMA) and has found support at the 55-day SMA. Technical indicators are offering mixed signals at the moment, and the pair moves without a clear bias.

On the upside, a scenario with the price breaking above 1.3775 would point to a test of a downtrend line near 1.3820. A break above that level would expose the critical long-term resistance area at 1.3900, which capped the upside in 2022 and 2023. On the downside, the crucial level is 1.3660, where an uptrend line and the 55-day SMA converge. A break below that area would open the door to further losses toward 1.3500.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.