Canada: CPI (Feb)

-

CPI rose by 0.4% m-o-m in February. The consensus expectation was for a rise of 0.5%.

-

The annual rate of inflation fell to 5.2% from 5.9%. This also came in below the expected 5.4%.

-

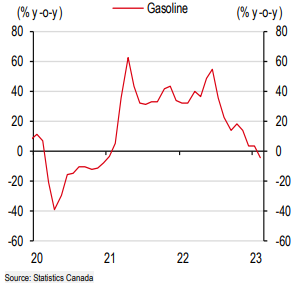

Gasoline inflation fell into negative territory, thus shifting from inflation tailwind to headwind for the first time since January 2021.

Facts

CPI rose by 0.4% m-o-m in February. The consensus was for a rise of 0.5%. In the month, the main upward contributors to the monthly change in prices were telephone services, mortgage interest costs, rent, women’s clothing, and non-electric utensils. The main downward contributors were child care services, natural gas, gasoline, meat, and air transportation.

The annual rate of inflation fell to 5.2% from 5.9% in January, and below the expected reading of 5.4%. The main upward contributors to inflation were mortgage interest costs, food purchased from restaurants, rent, passenger vehicles, and homeowners’ replacement costs, The main downward contributors were gasoline, child care services, passenger vehicle registration fees, purchase of digital media, and video equipment.

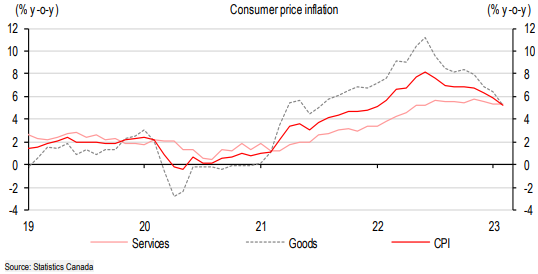

Notably, as shown in Figure 1, the annual rates of headline, goods, and services inflation have all converged at just over 5%. The drop in headline inflation since June 2022 has been primarily due to a drop in goods price inflation.

1. Inflation rates have temporarily converged as easing goods price inflation weighs on headline inflation

Implications

The February CPI report showed that the factors that had pushed inflation up in 2021 and 2022 are dragging inflation lower in 2023. For example, gasoline prices declined on a y-o-y basis for the first time since January 2021. In June 2022, the month that CPI inflation peaked at 8.1% y-o-y, gasoline prices were up by 54.6% y-o-y (figure 2). Thus, gasoline has gone from an inflation tailwind to a headwind. Further downward pressure is likely in March, given the recent decline in oil prices.

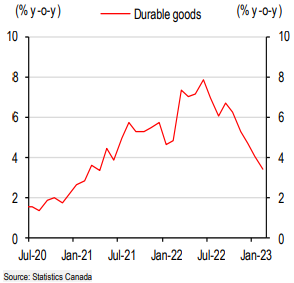

As well, as global supply chain disruptions continue to ease, durable goods price inflation continues to decline (figure 3)

2. Gasoline prices have shifted from inflation tailwind to headwind

3. Durable goods inflation has been falling sharply for the past few months

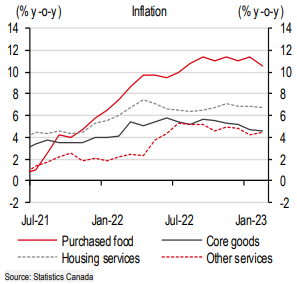

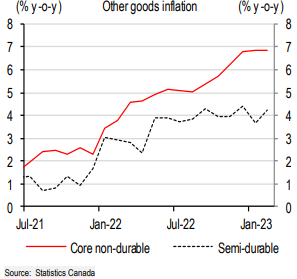

There has been less progress, however, in those components of CPI that are sensitive to domestic demand and that are relevant to the Bank of Canada’s determination of whether monetary policy is restrictive enough. For example, housing services inflation, other services inflation, and food price inflation show few signs of sustained decline (figure 4). As well, beyond the pull-back in durable goods inflation, core goods inflation remains elevated as semi-durable goods and core non-durable goods inflation have stayed high (figure 5).

4. There are few clear signs of a broad decline in inflation

5. Non-durable and other goods prices are still rising quickly

In my view, headline inflation is falling more quickly than anticipated, in part due to base effects, but underlying inflation remains elevated. That said, I think the results are sufficient to allow the Bank of Canada to leave its policy rate unchanged at 4.5% at its 12 April policy meeting in order to continue to assess the evolution of underlying inflation pressures, and the potential effects of the increase in global financial sector uncertainty.

RISK WARNING: Foreign exchange and derivatives trading carry a high level of risk. Before you decide to trade foreign exchange, we encourage you to consider your investment objectives, your risk tolerance and trading experience. It is possible to lose more than your initial investment, so do not invest money you cannot afford to lose。 ACY Securities Pty Ltd (ABN: 80 150 565 781 AFSL: 403863) provides general advice that does not consider your objectives, financial situation or needs. The content of this website must not be construed as personal advice; please seek advice from an independent financial or tax advisor if you have any questions. The FSG and PDS are available upon request or registration. If there is any advice on this site, it is general advice only. ACY Securities Pty Ltd (“ACY AU”) is authorised and regulated by the Australian Securities and Investments Commission (ASIC AFSL:403863). Registered address: Level 18, 799 Pacific Hwy, Chatswood NSW 2067. AFSL is authorised us to provide our services to Australian Residents or Businesses.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains need to clear 0.6400

AUD/USD rose for the third day in a row, approaching the key 0.6400 resistance on the back of the acute pullback in the US Dollar amid mounting recession concerns and global trade war fear.

EUR/USD: Powell and the NFP will put the rally to the test

EUR/USD gathered extra steam and advanced to multi-month peaks near 1.1150, although the move fizzled out somewhat as the NA session drew to a close on Thursday.

Gold looks offered near $3,100

Prices of Gold remain on the defensive on Thursday, hovering around the $3,100 region per troy ounce and retreating from earlier all-time peaks near the $3,170 level, all against the backdrop of investors' assessment of "Liberation Day".

Interoperability protocol hyperlane reveals airdrop details

The team behind interoperability protocol Hyperlane shared their upcoming token airdrop plans happening at the end of the month. The airdrop will occur on April 22, and users can check their eligibility to receive $HYPER tokens via a portal provided by the Hyperlane Foundation by April 13, the team shared in a press release with CoinDesk.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.