Can the Fed influence a softer Dollar?

Macroeconomic snapshot

The macroeconomics situation of the US has improved more than anticipated and is likely to improve further. This is expected to reduce upward support on the dollar’s value.

June Meeting of the Federal Reserve’s, Federal Open Market Committee

The Fed held the Federal Funds rate in June at 5.00%-5.25%, as expected. This was the tenth consecutive hike, and the Fed signalled a "pause". However, the Fed also hinted that it would raise rates further in 2023, to 5.6%. The next meeting is on July 26, 2023.

The interest rate situation is likely to lead to stabilised bond yields which may dissuade investors and may reduce upward support on the value of the dollar.

GDP growth rate report for Q1 2023, Second estimate

The US economy grew at an annualised rate of 2.0% in the first quarter of 2023 led by consumer spending. This was revised up from 1.3% and far higher than the 1.4% expected. The June FOMC projection for the 2023 change in real GDP was raised to 1.0% from the 0.4% projected in March. Trading Economics are forecasting Q3 2023 annualised growth at 1.6%. The advance Q2 report is due on Thursday the 27th of July.

The GDP situation is likely to lead to further growth and see greater investor confidence in US stocks which may reduce upward support the value of the dollar.

CPI for June

Inflation in the US rose 0.2% in June from May, for an annual rate of 3.0% which was slightly slower than the 3.1% expected. CPI is now at its lowest since March 2021 and driven by a 36.6% deflation in fuel (oil) prices. The June FOMC projection for the 2023 Personal Consumption Expenditures (PCE) projection was slightly lowered to 3.2% from the 3.3% projected in March. Trading Economics have their Q3 2023 CPI forecast at 2.5%. The July report is due on Thursday the 10th of August.

The CPI situation is likely to lead to lower (or at least less higher) interest rates and drive growth which may reduce upward support the value of the dollar.

Labour report for May

Unemployment in the US fell to 3.6% in June, from 3.7% in May as expected. NFP fell to 209K from 306K (revised from 339K). The June FOMC projection for the 2023 unemployment rate was lowered to 4.1% from the 4.5% projected in March. Trading Economics are forecasting Q3 2023 unemployment at 3.8%. Over the previous three years since the start of 2020,

Unemployment has been falling since the start of 2020 although has stabilised in the past six months. The July report is due on Friday the 4th of August.

The unemployment situation is likely to lead to stabilised economic growth and perhaps a steady interest in US stocks which may steady the value of the dollar.

Russian invasion of Ukraine

- The war is having a detrimental effect on the global and US economy by causing higher energy prices, higher food prices, higher inflation and is impacting economic growth. This is expected to limit the downward pressure on the dollar’s value.

China-US Trade War

- The trade war is having a detrimental effect on the global and US economy by causing higher prices for consumers, increased uncertainty for businesses, disrupted supply chains, job losses and is impacting economic growth. This is expected to limit the downward pressure on the dollar’s value.

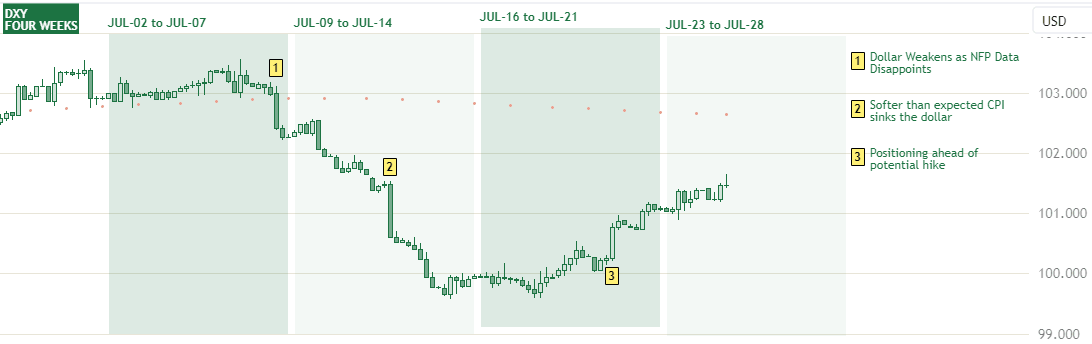

DXY (Four weeks)

The US Dollar Index (DXY) has lost value over the previous four weeks, pressured by a cooling economy that raises the prospect of a less hawkish Fed.

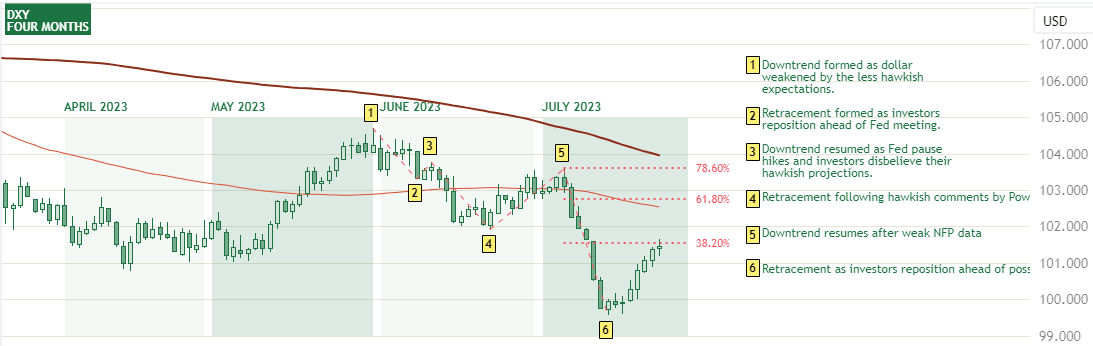

DXY longer term (Four months)

The US Dollar Index (DXY) has formed a downtrend since the start of June when investors began to price a lower peak rate which weakened the dollar. This dovish sentiment has been retraced three times as the Fed has not yet shown any signs that they will look to begin lowering rates in the near future. The DXY is currently retracing from the lows below 100.00 and is looking to test the 38.20% fib. A sustained move beyond the 78.60% level will break the downtrend

Outlook

The events to keep an eye on:

Wednesday the 26th of July:

- Fed Interest Rate Decision Hike to 5.5% exp. from 5.25% prev.

Thursday the 27th of July

- Durable Goods Orders MoM Big fall to 1.0% exp. from 1.7% prev.

- GDP Growth Rate QoQ Adv Fall to 1.8% exp. from 2.0% prev.

Friday the 28th of July

- Core PCE Price Index MoM Slight fall to 0.2% exp. from 0.3% prev.

- Personal Income MoM Slight climb to 0.5% exp. from 0.4% prev.

Friday the 4th of August

- Non Farm Payrolls Fall to 184K exp. from 209K prev.

- Unemployment Rate Remain at 3.6% exp.

CME Group 30-Day Fed Fund futures

- July: rising sentiment of a 0.25% hike, 97% in favour

- September: rising sentiment of a hold, 77% in favour

- November: sentiment of a hold, 60% in favour, 35% for a 0.25 hike

Six Month Bond Yields

- Treasuries: holding at 5.5% from 5.5% last week

Long Term Value of the US Dollar to Steadily Decline: As the US and global economy improves, investors are likely to move away from the safe haven of the dollar. Moves are expected to remain below the three month swing high of 105 unless multiple rate hikes begin to be priced in or the banking crisis deteriorates.

Short Term Value of the US Dollar to Fall: The June FOMC meeting appeared to be a hawkish pause although they raised the terminal rate from 5.1% to 5.6% for this year but market sentiment is in opposition, most likely due to the quickly slowing inflation rate. The Fed may be concerned by this as they know a bullish stock market is likely to increase the risk of inflation heating up again. It is possible that the Fed speakers are going to turn up the hawkish rhetoric and thus dollar selling may steady out. Moves are expected to remain below the four week swing high of 104.

Author

Gavin Pearson

Independent Analyst

Gavin Pearson of Jeepson Trading is a currencies speculator from the UK focused on the G7 economies and is a recognized member of the eToro Popular Investor Program as well as being a funded prop trader with The 5%ers.