Can a cautious risk rally hold this time? GBP slides back on Johnson’s Brexit stance [Video]

![Can a cautious risk rally hold this time? GBP slides back on Johnson’s Brexit stance [Video]](https://editorial.fxstreet.com/images/Macroeconomics/Events/ElectionUK/Brexit_scrabble_XtraLarge.jpg)

Market Overview

There has been a marginal improvement in market sentiment early this week, in moves which begin to pose the thought that a low may have been found in the recent selling pressure. Encouragement has come from the Manufacturing PMIs for January which have tended to come out either less worse than feared (especially in China), marginally better (Eurozone and UK) or encouraging (US ISM). The result has been that traders have managed to look past what is a worsening Coronavirus. The question is, for how long can it again be ignored. In the past few weeks, there have been two or three minor risk rallies, but all have floundered quickly. The virus is spreading by double digit percentages by the day (in terms of the number of cases and also confirmed deaths), but also there are now confirmed deaths coming outside China (in the Philippines and now Hong Kong). For now though, there is an early rebound on bond yields and moves out of safe havens are taking hold. The yen is slipping and the uptrend on gold is creaking. Equities are also showing signs of recovery. These little false dawns have been a feature of recent weeks and there is clearly a big risk. Perhaps watching real world indicators, such as the oil price, or copper will give an indication of a real low in place. For now, the oil price rebound looks very tentative. The Reserve Bank of Australia held fire today on a potential rate cut, keeping interest rates at +0.75% (no change expected, +0.75% last), although a cut in the next few months is still on the table. For now, though the Aussie is reacting positively. However, the same cannot be said for sterling which was hit hard yesterday as the road to a serene trade agreement post-Brexit looks bleak. The stance of UK PM Johnson has hit sterling with further early losses today.

Wall Street closed higher, but well off the highs of the session, with the SP 500 +0.7% at 3249. However, US futures have continued higher early today, by around +0.6%. This has helped Asian markets find a degree of support with the Nikkei +0.5% and the Shanghai Composite +1.3%. European indices look set for a decent open, with the FTSE futures +0.7% and DAX futures +0.6%. In forex, there is a continued slip on JPY, whilst GBP is an underperformer. The RBA holding firm on rates has allowed a rebound on AUD as the main outperformer. In commodities, there is a mild slip back on gold amidst a cautious risk rebound. The oil price is also up for now by around half a percent.

In a week jam-packed with major data, today is fairly light on the economic calendar. The UK Construction PMI only accounts for around 7% of the UK economy but will be interesting nonetheless, expecting a pick up to 46.6 (from a very concerning 44.4 in December). The US data is primarily focused on the US Factory Orders at 1500GMT which is expected to show growth of +1.2% in December (after a decline of -0.7% in November).

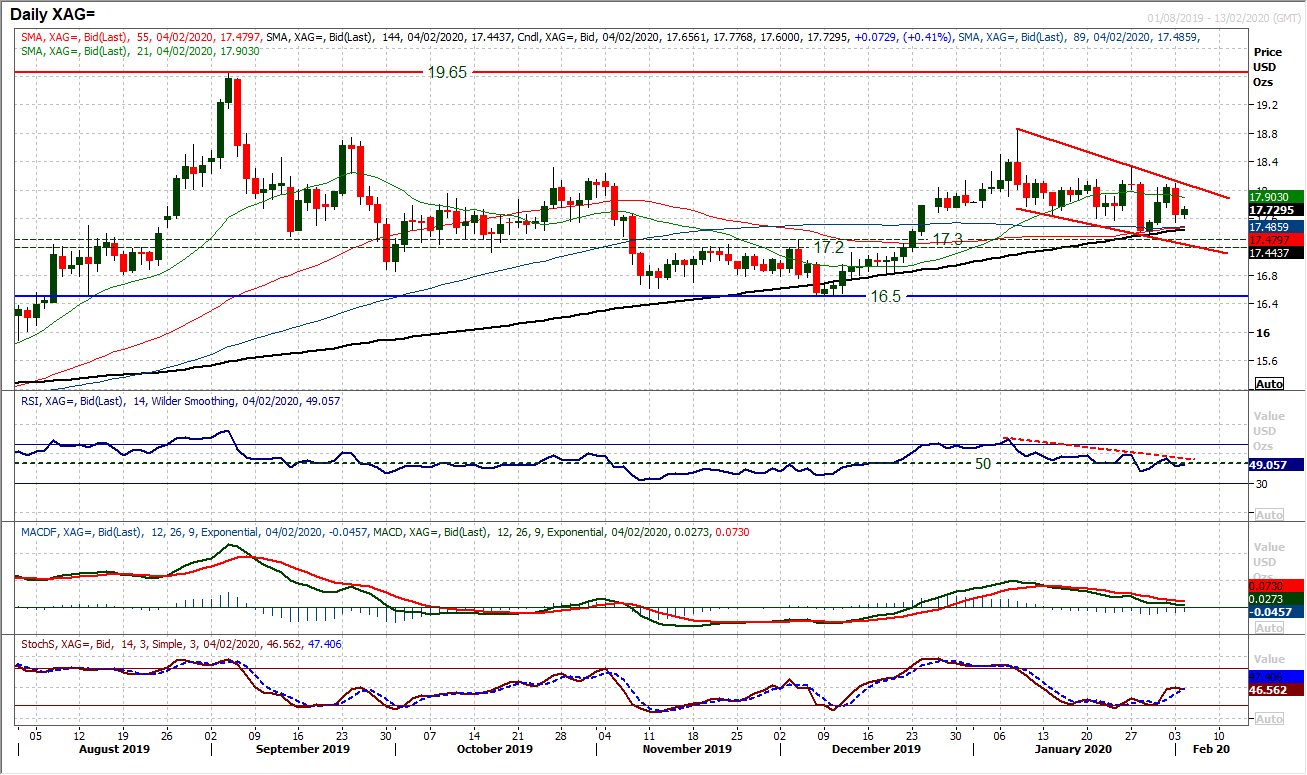

Chart of the Day – Silver

It is interesting to see that whilst gold has spent to past few weeks trending higher, silver has not taken any interest in the move. On the contrary, silver has been forming a downtrend channel over the past three weeks. After again under the resistance $18.15/$18.30, silver formed a bearish engulfing candle yesterday to swing the market back lower once more within the channel. The channel is confirmed by a run of lower highs on the RSI whilst moving back under 50 sees a more corrective outlook forming again. This channel is playing out with what looks to be the building of a test of medium term pivot band support $17.20/$17.30. How the market reacts around this support could now be a defining moment of the medium term outlook. However, despite the deteriorating RSI, momentum does look to be mixed, with the moderating MACD and ticking higher on Stochastics. It is noticeable that whilst trading within a downtrend channel, the outlook for silver remains highly indecisive, lacking trend. Despite this though, using near term rallies towards the $18.00 area as a chance to sell is still the dominant strategy for pressure on $17.20/$17.30.

WTI Oil

After falling back so precipitously in the past three and a half weeks, traders will be wondering where the floor on the oil price correction is. Throughout the past 12 months, $50.50 has acted as a key floor, but that was broken by yet another sell-off yesterday. WTI marginally avoided closing with a $40 handle, but this selling pressure is significant. On almost a daily basis now, there is initial early hope that a recovery is forming (yet again there has been an uptick in the Asian session), however, intraday rallies are consistently being sold into. Momentum is extremely negative still and the way the market has moved in recent sessions, the prospect of a recovery being sustainable is not great. A two week downtrend comes in at $51.75 today, whilst the hourly chart shows significant near term resistance now around $52.00. A close below $50.00 would realistically open the massive support at $42.00.

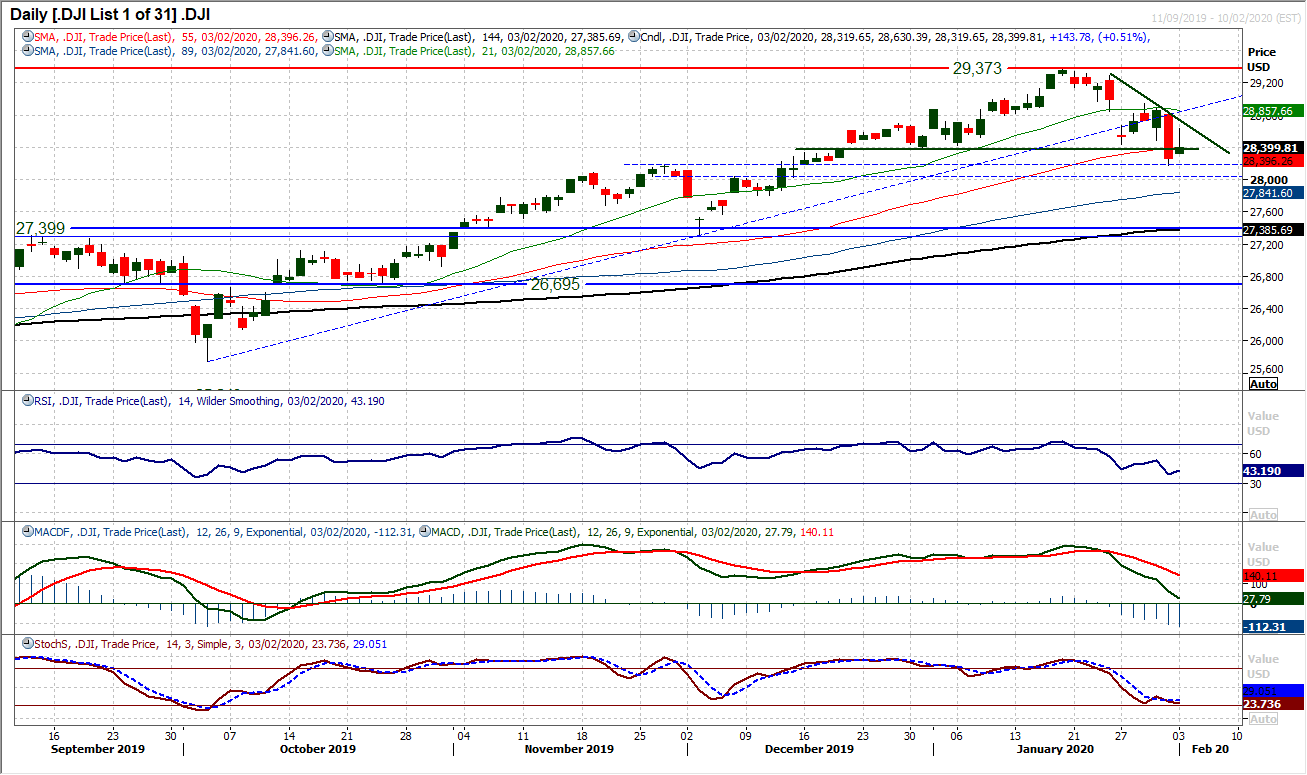

Dow Jones Industrial Average

After the breakdown which was seen on Friday, support duly arrived yesterday for the Dow. A rebound of over half a percent, but it could have been much more as the bulls gave up much of the earlier session gains into the close. However, closing back above the neckline of the breakdown at 28,376 was an important first step if the bulls are about to rebuild. The futures are higher again today so once more a positive open is set to be seen, however, the hourly chart shows very much a corrective bias is in play now. The initial resistance to overcome is yesterday’s high at 28,630. On a technical basis, the hourly RSI is now consistently failing between 55/60 whilst hourly MACD is struggling below neutral. All hourly moving averages are also now falling in bear sequence and the 55 hour ma at 28,660 early today is a basis of resistance in the correction so needs to be breached. The risk is that the market is tentative in a rebound (like last week) and quickly the impetus dissipates. Given the shift in sentiment in the past two weeks, this is a likely scenario still, so we play recovery longs with significant caution. The key resistance to break and change the corrective outlook is now 28,944.

Other assets insights

EURUSD Analysis: read now

GBPUSD Analysis: read now

USDJPY Analysis: read now

GOLD Analysis: read now

Author

Richard Perry

Independent Analyst