CAD traders preparing for BoC’s rate cut

The Loonie has been weakening against the USD, practically over the past eight days, with a small recess on the 16th of July. It should be noted that the rise of the pair seems to be a result of CAD weakening rather than USD strengthening given that the USD Index has presented a different course over the same period. On a fundamental level, we note that the weakening of oil prices may have weighed on the Loonie as well given Canada’s status as a major oil-producing economy. On a macroeconomic level, the easing of inflationary pressures on a headline level in June in combination with the contraction of retail sales for May both on a headline and core level, tended to weigh on the CAD as well. The next big test for the Loonie is expected to be the release of BoC’s interest rate decision on Wednesday. The bank is widely expected to cut rates by 25 basis points and its characteristic that currently CAD OIS implies a probability of 92.53% for such a scenario to materialise. Yet it should be noted that CAD OIS also implies that the market expects the bank to deliver another rate cut in it’s October meeting and one more marginally being priced in for the December meeting. It should be noted that the loosening of Canada’s employment market in June, given the rise of the unemployment rate to 6.4%, and the contraction of the employment change figure add pressure on the bank to start cutting rates again. Furthermore, we note that the CPI rates on a headline level, is just below the bank’s median target, while the core rate has now well entered within the bank’s inflation target range of 2.00%±1.00%, which tends to allow the bank to proceed with a rate cut on Wednesday. Hence should the bank cut rates as expected we may see the CAD losing some ground, yet on a limited basis, given that the market already expects it and positions itself ahead of the release. The bearish effect is expected to be amplified should also the accompanying statement imply that the bank has the intention to continue cutting rates, or proceed with more rate cuts within the year, hence confirming the market’s expectations. On the flip side, should the bank imply in tis accompanying statement, that after the rate cut, it does not plan on any more rate cuts or even hesitates we may see any bearishness being clipped or even the Loonie getting some support. In the remote case that the bank does not cut rates, we expect the Loonie to get asymmetric support.

Technical analysis

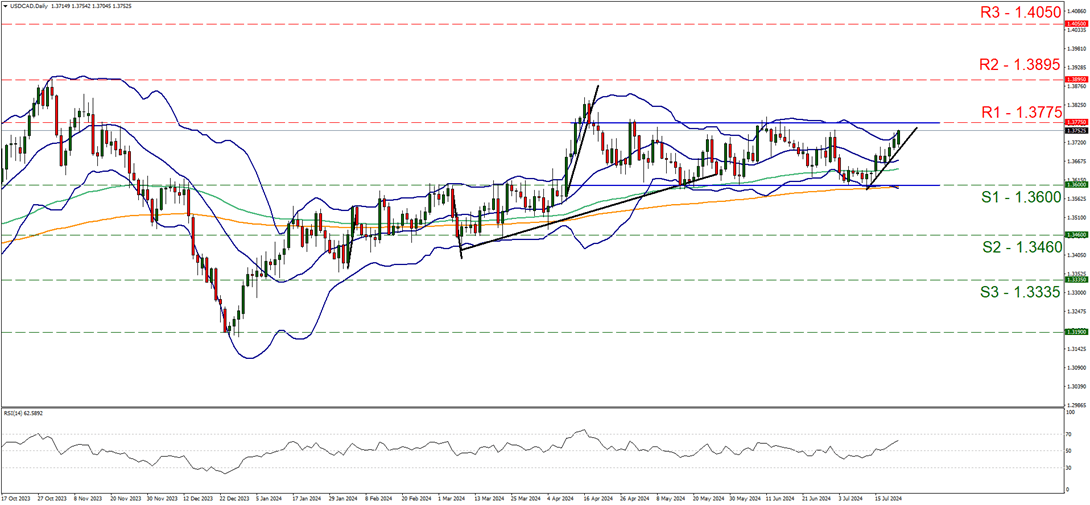

USD/CAD daily chart

Support: 1.3600 (S1), 1.3460 (S2), 1.3335 (S3).

Resistance: 1.3775 (R1), 1.3895 (R2), 1.4050 (R3).

On a technical level USD/CAD continued to rise yesterday, aiming for the 1.3775 (R1) resistance line. Despite the rise of the pair over the past eight days and on a more long-term view, we note that the pair’s price action has been confined in a sideways motion between the 1.3775 (R1) resistance line and the 1.3600 (S1) support level, since around the mid of April. Furthermore, we note that the RSI indicator is rising and currently aiming for the reading of 70, implying a build-up of a bullish sentiment among market participants. The 20 MA(moving average, blue line), the 100 MA (green line) and the 200 MA (orange line) tend to remain flat preferring to reflect the relative stabilisation of the pair’s price action. On the other hand, we note that the pair’s price action is flirting with the upper Bolinger band in a sign of bullishness, yet at the same time it could be a factor that could slow down the bulls or even cause a correction lower. Should the bulls take control over the pair’s direction, we may see USD/CAD breaking the 1.3775 (R1) resistance base and aim for the 1.3895 (R2) resistance line that thwarted the pair’s upward motion on the 1st of November last year. On the flip side, for a bearish outlook, we would require the pair to break the lower boundary of the current sideways motion, namely the 1.3600 (S1) support line and aim for the 1.3460 (S2) support level.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.