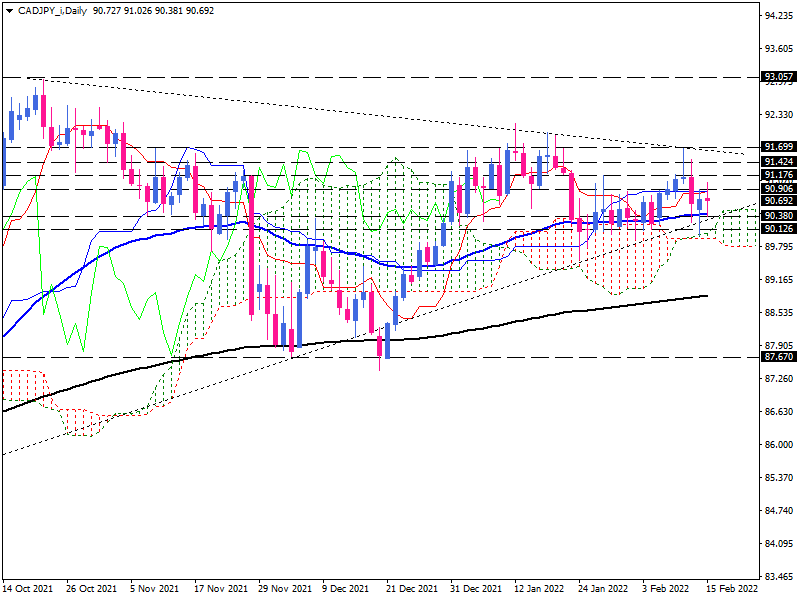

On the daily chart, the CAD/JPY pair continues to move slightly upward along with the 50-day moving average. The confluence of the moving average, the Kumo cloud and the triangle's support line have formed a strong support zone. And these long lower shadows demonstrate that buyers have vigorously defended this area. Considering the position of Kijun-Sen and Tenken-Sen, combined with the thin Kumo future after a bearish Kumo twist, indicates that the pair may not be ready for instant traction. If Tenken-Sen crosses Kijun-Sen upwards, it will signal an increase in buying forces, and positive fluctuations can be expected.

Moreover, the momentum indicators display a relative market balance, which means buyers are not strong enough to push prices higher quickly. The RSI is in the neutral zone, and the momentum is oscillating sideways, just below the 100 level. And the MACD bars, which are about the same height as the flattening signal line, indicate the relative parity of market forces after selling pressure diminished.

Short-term view

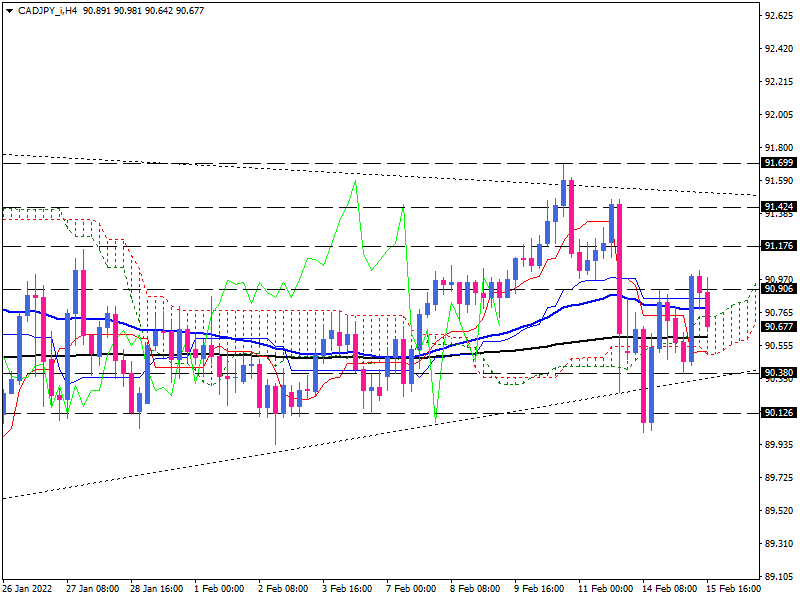

As we can see on the 4-hour chart, the 90.90 price ceiling is breaking with the influx of yen sellers. Should the price remain above this level, the next obstacle that could restrict the upward movement will be located at the level of 91,176. Once buyers overcome this roadblock, they will have to surpass the 91,424 mark before reaching the upper edge of the triangle. Otherwise, as the selling forces intensify, the Kumo cloud could attract buyers' attention as a potential support area. If this level is violated, the 90.380 price floor is expected to provide support. In the event of further declines, 90.126 may serve as the next support level.

Momentum oscillators suggest that the negative pressure is fading, but buyers are not yet strong enough to take the lead. The RSI is in the neutral zone around the 50-baseline, and momentum has moved up from its previous bottom but is still scouring the selling area. Additionally, the MACD bars are also below the zero level and the signal line, which does not support the bullish trend.

The content of this material and/or any information provided should in no way be construed, expressly or by implication, directly or indirectly, as advice, recommendation, or suggestion of an investment strategy in relation to a financial instrument and is not intended to provide a sufficient basis for making investment decisions in any way. Any information, views or opinions presented in this material have been obtained or derived from sources believed to be reliable, but Errante makes no warranty as to their accuracy or completeness. Errante accepts no liability for losses arising from the use of this data and information. The data and information contained herein are for background purposes only and make no claim to be complete or comprehensive.

Recommended Content

Editors’ Picks

AUD/USD: Next on the downside comes 0.6500

Further gains in the US Dollar kept the price action in commodities and the risk complex depressed on Tuesday, motivating AUD/USD to come close to the rea of the November low near 0.6500.

EUR/USD: No respite to the sell-off ahead of US CPI

The rally in the Greenback remained well and sound for yet another session, weighing on the risk-linked assets and sending EUR/USD to new 2024 lows in the vicinity of 1.0590 prior to key US data releases.

Gold struggles to retain the $2,600 mark

Following the early breakdown of the key $2,600 mark, prices of Gold now manages to regain some composure and reclaim the $2,600 level and beyond amidst the persistent move higher in the US Dollar and the rebound in US yields.

SOL Price Forecast: Solana bulls maintain $250 target as Binance lists ACT and PNUT

Solana price retraced 7% from $225 to $205 on Tuesday, halting a seven-day winning streak that saw SOL become the third-largest cryptocurrency by market capitalization.

Five fundamentals: Fallout from the US election, inflation, and a timely speech from Powell stand out Premium

What a week – the US election lived up to their hype, at least when it comes to market volatility. There is no time to rest, with politics, geopolitics, and economic data promising more volatility ahead.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.