Cable is in strong recovery, with price accelerating now even outside of an upward channel which confirms a continuation up into wave C/3 that can be made by a lower degree impulse as pair even breaks above 1,28 which can be interesting support on blue wave four dips.

GBPUSD 4H Chart

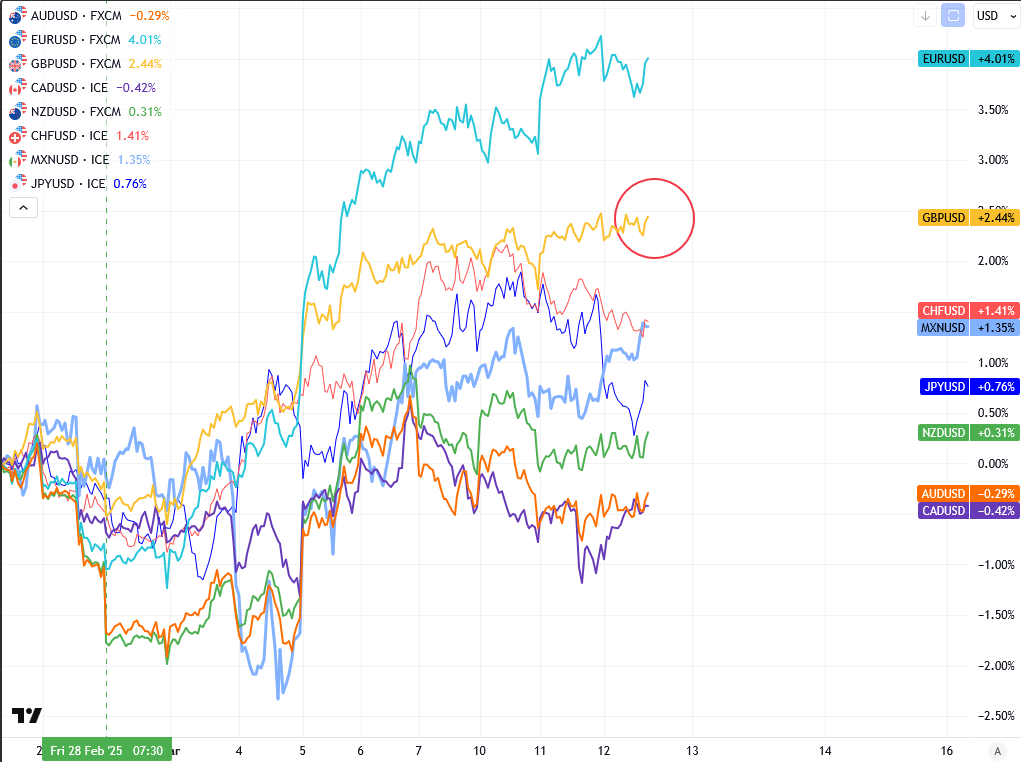

The reason why Cable can stay in an impulsive recovery is because the British Pound is one of the strongest currencies since DXY broke below 106 level, so buying dips makes sense.

For a detailed view and more analysis like this, you may want to watch below our latest recording of a live webinar streamed on March 10 2025:

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

By using Wavetraders website, any services, products, and content contained here, you agree that use of our service is entirely at your own risk. You understand that there is a very high degree of risk involved in trading on the markets. We assume no responsibility or liability for your trading and investment results. The charts, and all articles published on www.wavetraders.com are provided for informational and educational purposes only!

By using the information and services of www.ew-forecast.com you assume full responsibility for any and all gains and losses, financial, emotional or otherwise, experienced, suffered or incurred by you.

Recommended Content

Editors’ Picks

Gold falls amid a possible de-escalation of US-China tensions Premium

Gold pulled back from its all-time high of $3,500 per troy ounce reached earlier on Tuesday, as a resurgent US Dollar and signs of easing tensions in the US–China trade dispute appeared to draw sellers back into the market.

EUR/USD tumbles to near 1.1350 on renewed US Dollar demand

The EUR/USD pair attracts some sellers to around 1.1355 during the early Asian session on Wednesday, pressured by the renewed US Dollar demand. The Greenback recovers after US President Donald Trump said he had no intention of firing Federal Reserve Chair Jerome Powell despite his frustration with the central bank not moving more quickly to slash interest rates.

GBP/USD deflates to weekly lows near 1.3350

GBP/USD loses further momentum and recedes to the 1.3350 zone on Tuesday, or two-day troughs, all in response to the frmer tone in the US Dollar and encouraging news from the US-China trade scenario.

Ethereum rallies 10% amid decline in CME short positions

Ethereum saw a 10% gain on Tuesday after the general crypto market rallied alongside Bitcoin. The rally comes after the ETH Chicago Mercantile Exchange basis plunged from 20% in November to about 5% in April.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.