Cable drops on weak data, strong rise of EUR/GBP cross

Cable lost traction on Tuesday and fell around 100 pips, deflated by downbeat CBI survey of the retail sector and strong rise of EURGBP cross.

Fresh weakness moves focus to the lower boundary of the range in which the price action moves for the sixth straight day.

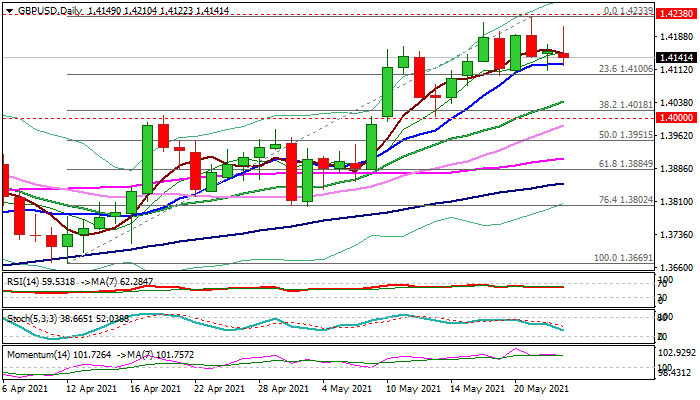

Long upper shadows of daily candles points to strong headwinds bulls face at 1.42 zone, following few spikes close to 2021 high (1.4238), but repeated failures to register a daily close above 1.4200 handle, generate initial signal of stall and possible pullback.

But these signals require verification on break and close below two initial pivotal supports at 1.4124 and 1.4100 (10DMA / Fibo 23.6% of 1.3669/1.4233 rally) that would expose next key support levels at 1.4038/18/00 (20DMA / Fibo 38.2% / psychological), break of which would confirm reversal.

The other two scenarios are: extended consolidation above 1.4100 ahead of continuation of larger uptrend and healthy correction which will be contained above 1.40 zone before bulls regain traction.

Daily techs are positive overall and support both scenarios, but strong loss of bullish momentum and stochastic reversing from overbought territory on weekly chart warn of deeper correction.

Res: 1.4171; 1.4200; 1.4238; 1.4265

Sup: 1.4124; 1.4100; 1.4036; 1.4020

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.