Buy signals for Gold and Silver

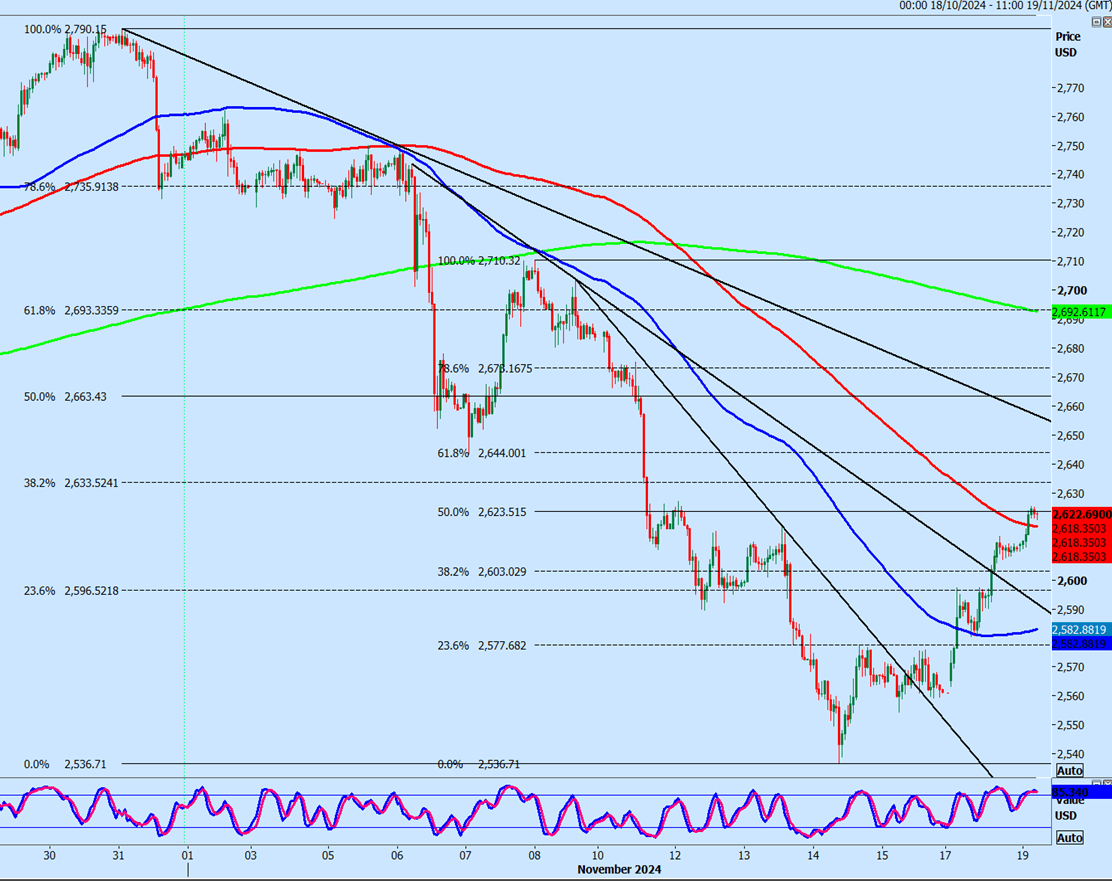

XAU/USD

-

Gold initially held strong resistance at 2594/98 & dipped to 2580.

-

In the afternoon we broke higher & I wrote:

-

This is a buy signal for Gold too as we beat 2603.

Support at 2602/2598 now (although we are unlikely to see this level at this stage) & longs need stops below 2593.

Targets: 2521, 2531. -

We have hit the first target as we look for 2531 & even 2643 is possible.

-

Above here we could reach the 2652/56 area.

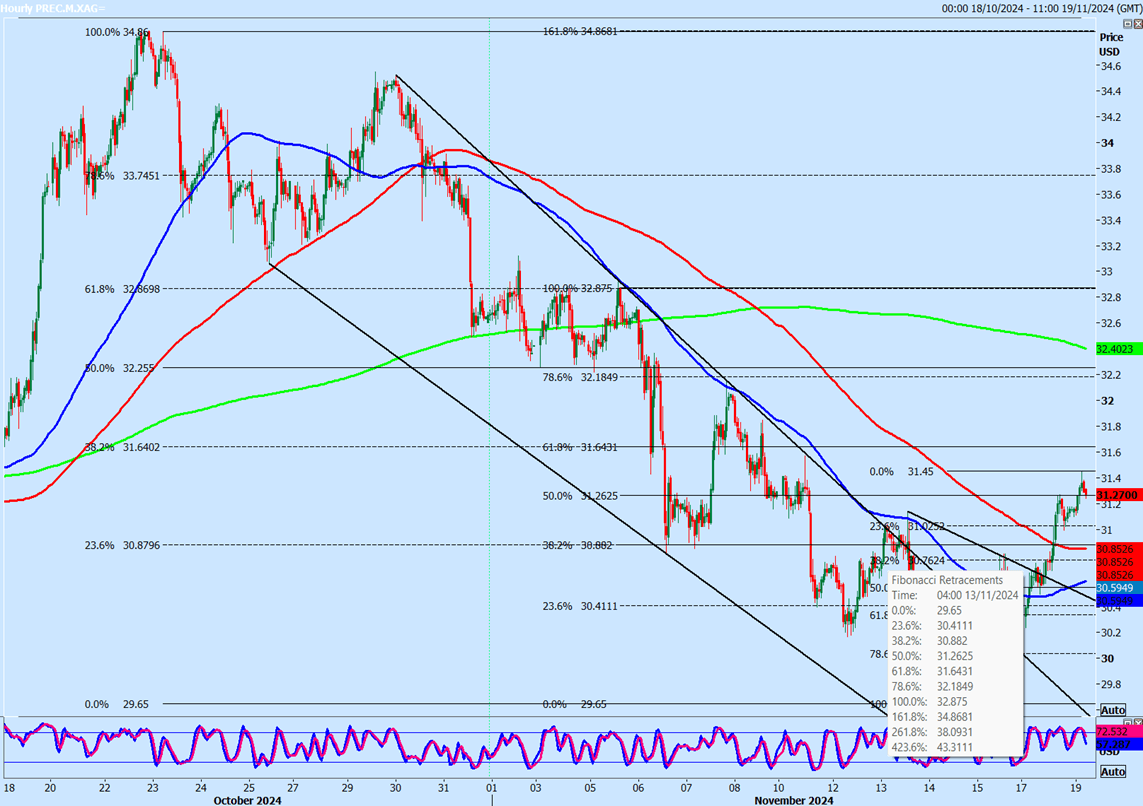

XAG/USD

-

Silver held minor resistance at 3080/3085 all morning but the break above 3090 in the afternoon was our buy signal as we completed the inverse head & shoulders pattern

-

Targets: 3120, 3160/65.

-

It looks like we could even reach 3190 eventually.

-

Support at 3100/3080 & longs need stops below 3070.

WTI Crude December future

Last session low & high for the December contract: 6661 - 6939.

-

WTI Crude collapsed from resistance at 6880/6920 to both targets of 6850/6830 & the late October low at 6690/70 on Friday

-

On Monday we shot higher to recover all the steep losses as WTI Crude remains locked in a sideways range.

-

Note the bullish engulfing candle, although I do not trust the buy signal in the face of the lack of direction for this market & the longer term sideways consolidation.

-

We beat minor resistance at 6775/6795 to hit the next target & strong resistance at 6880/6920.

-

A break above 6950 today can target 6990, perhaps as far as 7040/70.

-

If prices collapse yet again from the low $69 area look for 6870, perhaps as far as 6830/10.

-

Further losses retest 6690/6660.

-

If we continue lower, look for a retest of the 2024 low, set in September at 6545/25.

Author

Jason Sen

DayTradeIdeas.co.uk