British pound's rebound amid tax-cuts and inflation

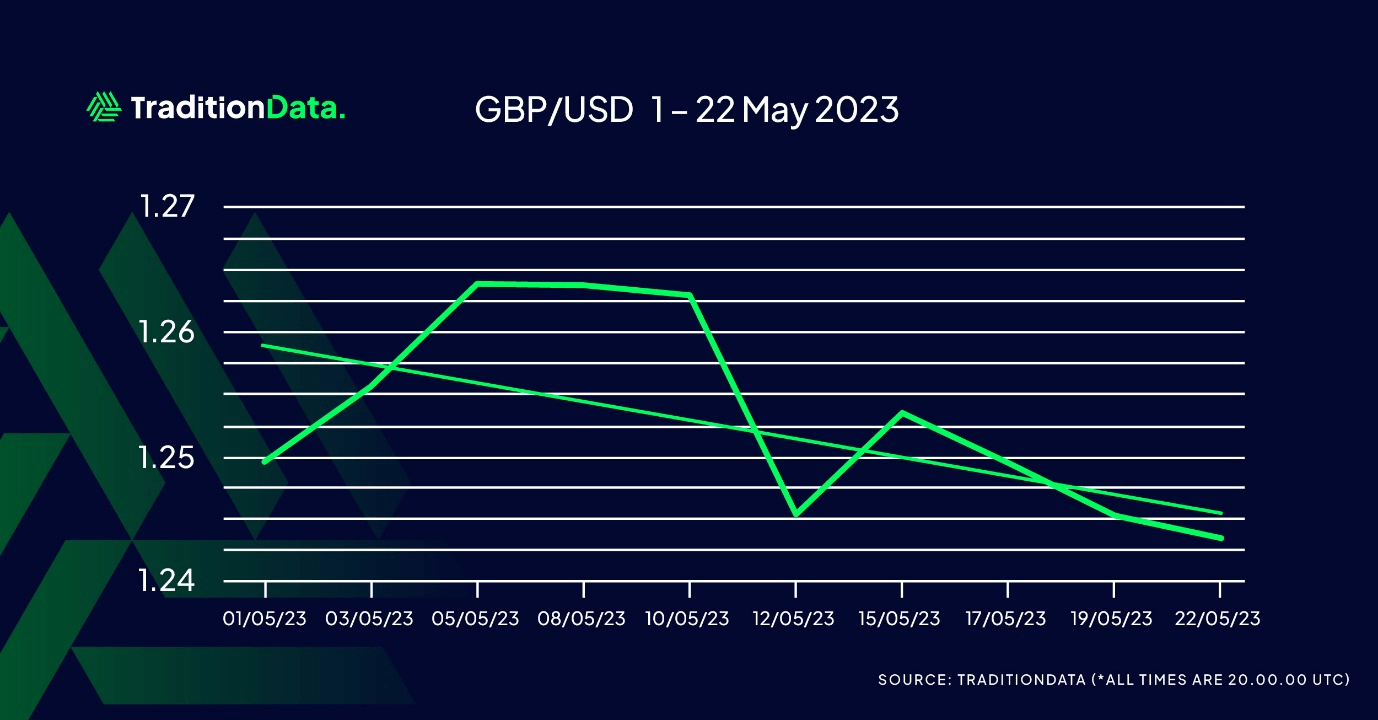

We have seen the British Pound make a remarkable rebound from its record lows in late September 2022, following the controversial tax-cuts plans that were instituted by former Prime Minister Liz Truss. The Pound (GBP) has appreciated vs. USD from below $1.0400 to approximately $1.2680 during that time frame.

There are many predicting that the Sterling run is getting closer to reaching its peak. With the Bank of England maintaining a hawkish approach to persistent inflation throughout the balance of 2023, this Tuesday’s Purchasing Manager’s survey suggested that UK has increased at a slower pace in May, and manufacturing output decreased more sharply. This could be early signs that higher interest rates could be taking its toll on both households and businesses, as banks are also slowing down on the lending side.

CPI data released on Wednesday showed that UK headline CPI inflation rate fell by less than expected in April to 8.7% from 10.1% in the previous month. The core inflation numbers (excluding food and energy) rose to 6.8%. The persistent consumer inflation pressures are pointing to a prolonged tightening policy by the Bank of England. The markets are beginning to price in 2-3 more 25 bps rate increases over the next 3 meetings. Similar to what is shaping up in the US, the UK is adamant to get inflation under control, which will result in an economic slowdown of the UK economy in the second half of 2023.

Having access to quality market data from TraditionData during this period of heightened Central Bank monetary policy decision making, is critical for financial institutions to ensure they are making the appropriate FX trading and hedging decisions.

Author

Sal Provenzano

TraditionData

Sal Provenzano Is the FX Product Manager for the TraditionData business and has been tasked with shaping the future of the FX product range.