BRICS, the West and the rest – global trade hubs and de-dollarization

- World trade is fragmenting into opposing blocks, warns the IMF.

- The BRICS and their allies are distancing themselves from the West.

- BRICS are attempting to de-dollarize and replace SWIFT to circumvent the threat of sanctions.

Widening cracks in global trade networks along geopolitical fault lines have prompted a warning from the International Monetary Fund (IMF), who fear the trend may lead to a breakdown in world trade, leading to a slowdown in global growth.

In a speech at Stanford last week, Gita Gopinath, the First Deputy Managing Director of the IMF, warned: “Countries are reevaluating their trading partners based on economic and national security concerns,” adding that if the trend continued, “we could see a broad retreat from global rules of engagement and, with it, a significant reversal of the gains from economic integration.”

The warning comes as nations become increasingly polarized in their trade relationships amid a growing trend away from globalization to a more protectionist agenda.

The impact might be reflected in a slowdown in global trade after the trade in goods and services expanded by “the slenderest of margins” in 2023, “an estimated 0.2%,” which was “the slowest pace in 50 years,” according to Ayhan Kose, Deputy Chief Economist of the World Bank.

“It would have declined outright but for the growth of trade in services,” adds Kose, whilst goods trade alone “shrank roughly 2.0%, the sharpest contraction during this century outside of a global recession.”

The seeds of the discord have been around for some time, reflected in events such as Brexit and the US’s trade war with China; but the war in Ukraine and tensions in the Middle East are deepening existing divisions.

BRICS lead the trend towards de-dollarization

BRICS’ attempts to de-dollarize the world economy is another development within the fragmentation theme.

At a meeting with President Xi Jinging of China on Thursday, for example, President Vladimir Putin of Russia talked of how the "timely" decision of the two nations to make settlements in their own national currencies rather than the US Dollar had helped strengthen trade between the nations.

"Today, 90% of all payments are already made in Roubles and Yuan," boasted Putin at the meeting, according to Reuters.

The acievement is considerable when viewed from a global perspective. The Dollar is still the main life-blood of the global economy with between 80% and 90% of all global cross-border transactions made in USD, according to the Bank of International Settlements (BIS) and the Society for Worldwide Interbank Financial Telecommunications (SWIFT).

BRICS’ main motive for de-dollarizing the world is the desire to circumvent the threat of trade sanctions and the seizure of foreign assets by Western governments. These are easier to implement and more damaging to target nations because of the US Dollar’s widespread use.

Higher interest rates and de-dollarization

Threats of sanctions are not the only motive behind BRICS’ desire to decouple from the Greenback. Recent higher interest rates in the West have provided another incentive.

Due to the US Dollar’s dominance in trade and finance, many companies in emerging markets issue Dollar-denominated debt. It is estimated, for example, that approximately half of China and India’s external debt is denominated in US Dollars. The same goes for countries like Ethiopia and Argentina, and many other emerging market nations too, according to Carnegie Endowment for International Peace (CEIP), an advisory service based in Washington.

Higher interest rates in the US, therefore, have substantially increased the cost of servicing this debt. Higher borrowing costs also make trade finance – on which much global trade is dependent – more expensive.

Since investors tend to prefer parking their capital where it can earn a high return, higher interest rates in the US have also strengthened the US Dollar as a currency. This has further exacerbated the cost of servicing USD-denominated debts.

This is especially true for emerging market creditors whose own currencies have devalued.

A shortage of Dollars

For some countries the devaluation of their own currencies has made it almost impossible to maintain adequate reserves of US Dollars in order to properly conduct international trade.

“Three BRICS invitees–Argentina, Egypt, and Ethiopia–are facing severe Dollar shortages and high inflation. Dollar shortages reflect an imbalance between the economy-wide demand for and supply of Dollars. Dollar shortages in Argentina and Ethiopia were so severe at times in 2023 that black market exchange rates were reportedly nearly double the official rates. In Egypt, the banking system’s net foreign assets (a measure of foreign currency shortages) hit a record deficit in June 2023,” says CEIP.

Rising inflation and currency devaluation in many emerging market economies is a vicious circle made worse by the dominance of the US Dollar in trade and finance. Almost all the global trade in commodities is conducted in US Dollars so when domestic currencies devalue it raises the cost of importing Dollar-denominated raw materials for those countries, causing further inflation.

BRICS’ alternatives to SWIFT

Alongside the BRICS’ desire to dismantle the global hegemony of the US Dollar has been their development of alternatives to the most commonly used method of transfer and settlement for international trade – SWIFT.

The weaponization of SWIFT by the West against its adversaries has led to the evolution of alternative payment systems, in a further example of the trend towards “fragmentation” mentioned by Gopinath.

After the outbreak of the Russia-Ukraine war, for example, a large number of Russian banks were excluded from SWIFT as part of sanctions by the European Union and the United States against Russia.

This has led to the development of alternatives such as Russia’s System for Transfer of Financial Messages (SPFS) and China’s Renminbi-based Chinese Cross-Border Interbank Payment System (CIPS).

SPFS, developed by the Central Bank of Russia (CBR), has 129 participants in 20 countries and CIPS, which was developed by the People's Bank of China (PBoC), is used by 1,427 financial institutions in 109 countries and regions.

CIPS offers clearing and settlement services for its participants in cross-border Renminbi (RMB) payments and trade.

Europe also has its own international payments system known as SEPA, which can be used for Euro-based clearing and settlement. There are also other international systems such as WISE and crypto-based cross-border transfer services.

BRICS alternative to the Dollar – the Renminbi?

Some BRICS nations have avoided the Dollar by trading directly with each other in their own currencies. India and Nigeria, for example, recently established a trade pact whereby all trade between the two nations would be conducted using their own national currencies.

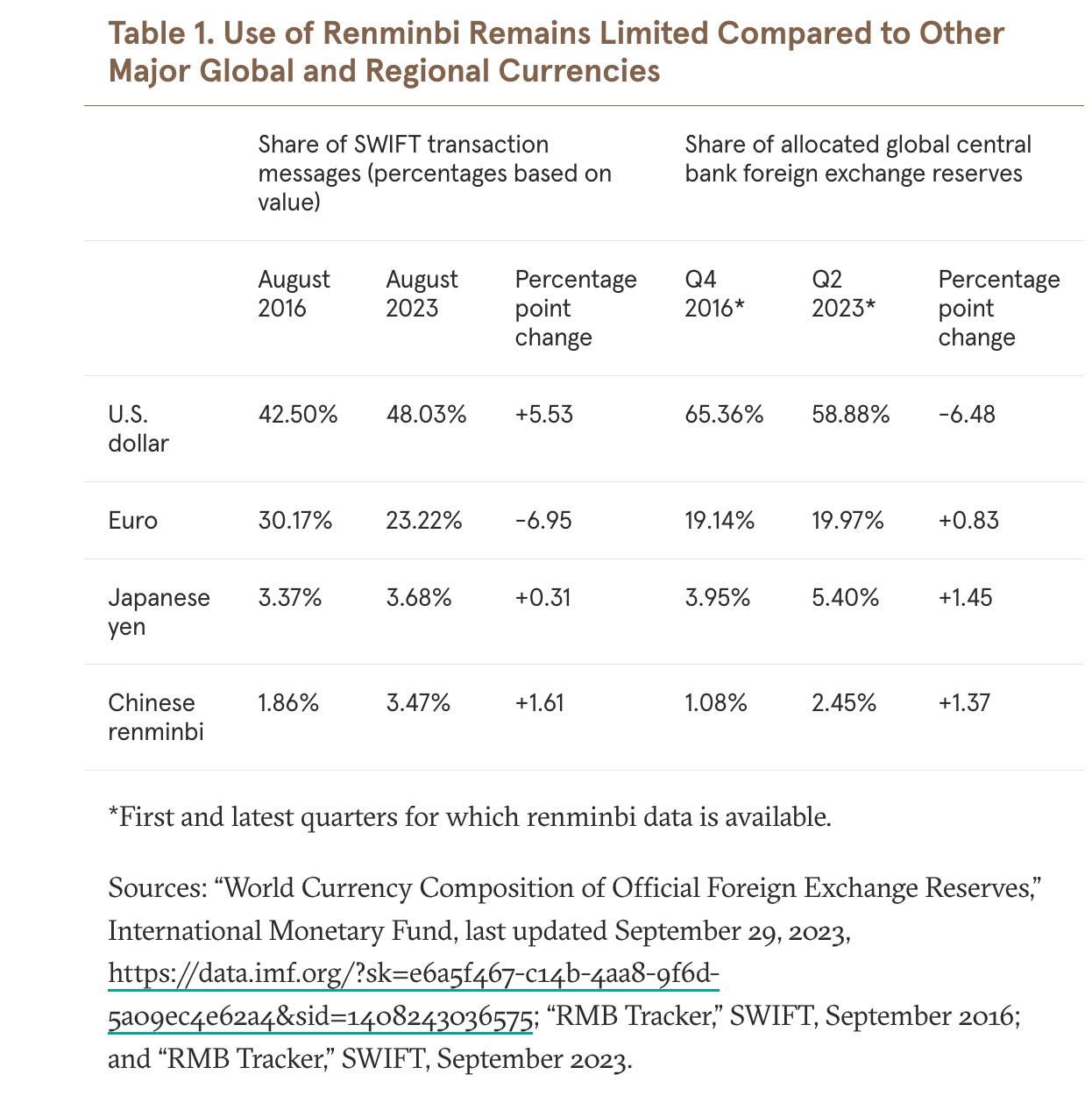

The Chinese Renminbi has also seen an ascendency as a medium of exchange and many BRICS commentators view it as the most likely alternative to the US Dollar because of its relative stability and liquidity.

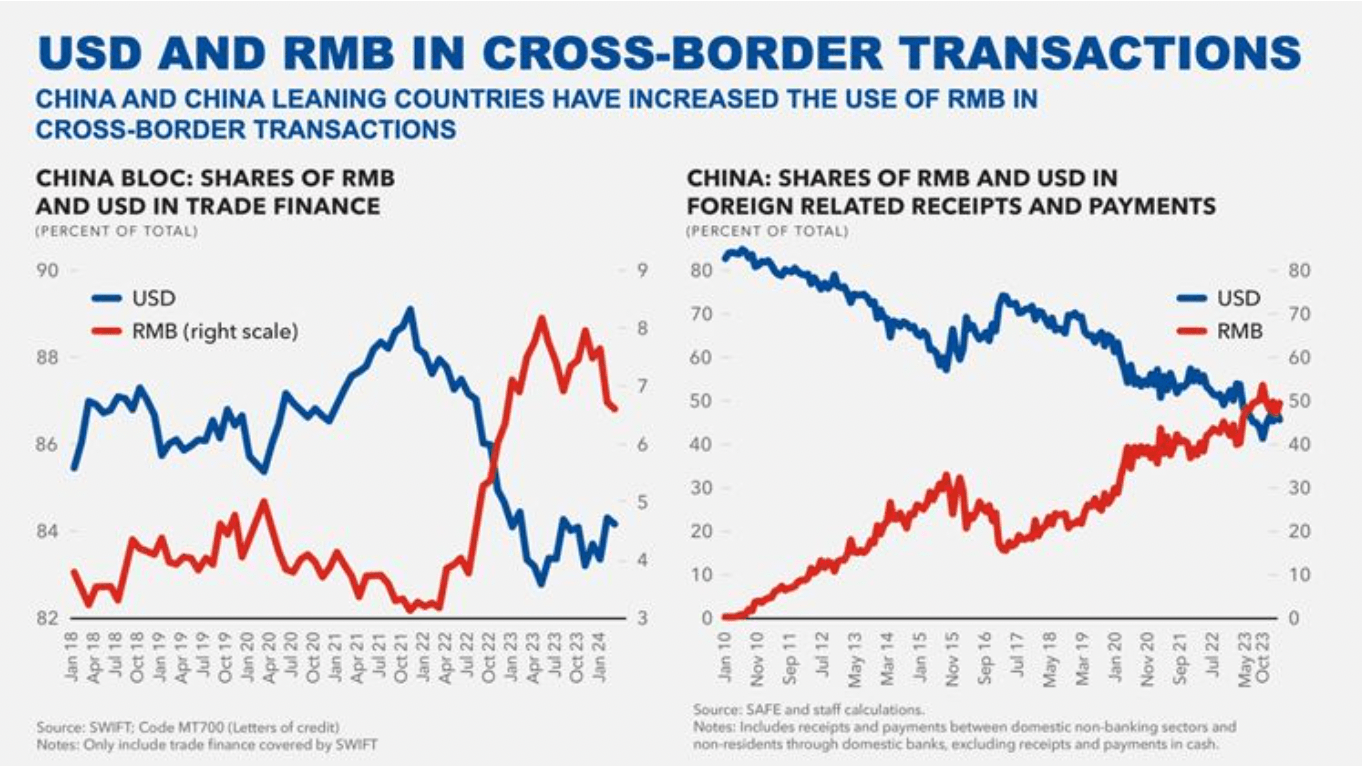

Whilst still modest in terms of gross volume, the Renminbi has seen an increase in use as a medium of payment as the chart below, taken from Gopinath’s speech shows.

Central banks have also increased their RMB reserves, mainly at the expense of the US Dollar.

The Renminbi’s increasing use in international trade, meanwhile, has come at the expense of the Euro (EUR), as the data from the IMF, cited by CEIP shows.

Use of the Renminbi is limited, however, by the fact that China has not fully liberalized its capital account, making it difficult to trade freely with the RMB.

Gold sets a standard

A further development resulting from the increasing fragmentation of the global trade landscape is the hoarding of Gold by non-Western central banks.

“Looking at global FX reserves, the most notable development during 2022-23 has been an increase of Gold purchases by central banks,” says Gopinath, noting that the reserves of countries in the “China bloc” have seen all the rises compared to Western central banks whose holdings have remained steady.

“Gold purchases by some central banks may have been driven by concerns about sanctions risk, " adds Gopinath.

However, the hoarding of Gold by BRICS and their allies may not only be as a hedge against the risk of sanctions. It is also possible they may be harking back to the time of the Gold Standard, when currencies were underpinned by Gold reserves.

“The BRICS countries own a lot of gold,” says Mike Maharrey of Money Metals Exchange. “Even if there is some distrust between BRICS nations in using each other’s currencies, Gold could fill the role of the Dollar as an intermediary currency.”

BRICS FAQs

The BRICS is the acronym denoting the grouping of Brazil, Russia, India, China and South Africa. The name was created by Goldman Sachs’ economist Jim O’Neill in 2001, years before the alliance between these countries was formally established, to refer to a group of developing economies that were predicted back then to lead the global economy by 2050. The bloc is seen as a counterweight to the G7, the group of developed economies formed by Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

The BRICS is a bloc which intends to give voice to the so-called “Global South”. The alliance tends to have similar views on geopolitical and diplomatic issues, but still lacks a clear economic integration as the governing systems and cultural divergence between its members is significant. Still, it holds yearly summits at the highest level, coordinates multilateral policies and has implemented initiatives such as the creation of a joint development bank. In August 2023, the group announced that six other members were invited to join the bloc: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates.

The BRICS alliance – without counting the six new members invited to join the group – accounts for 32% of the global economy measured at purchasing power parity as of April 2023, according to data from the International Monetary Fund. This compares with the 30% of the G7 group.

There has been increasing speculation about the BRICS alliance creating a currency backed by some sort of commodity like Gold. The proposal is meant to reduce the use of the dominant US Dollar in cross-border economic exchanges. In the BRICS’ 2023 summit, the group stressed the importance of encouraging the use of local currencies in international trade and financial transactions between the members of the bloc as well as their trading partners. The group also tasked finance ministers and central bank governors “to consider the issue of local currencies, payment instruments and platforms” for this purpose. Even if the bloc’s de-dollarization strategy looks clear, the creation and implementation of a new currency seems to have a long way to go.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.