Brent Oil with a fresh sell signal

Brent oil has just triggered a fresh sell signal thanks to the huge drop it experienced yesterday. While it remains to be seen whether this signal will prove effective, the current bearish outlook looks promising.

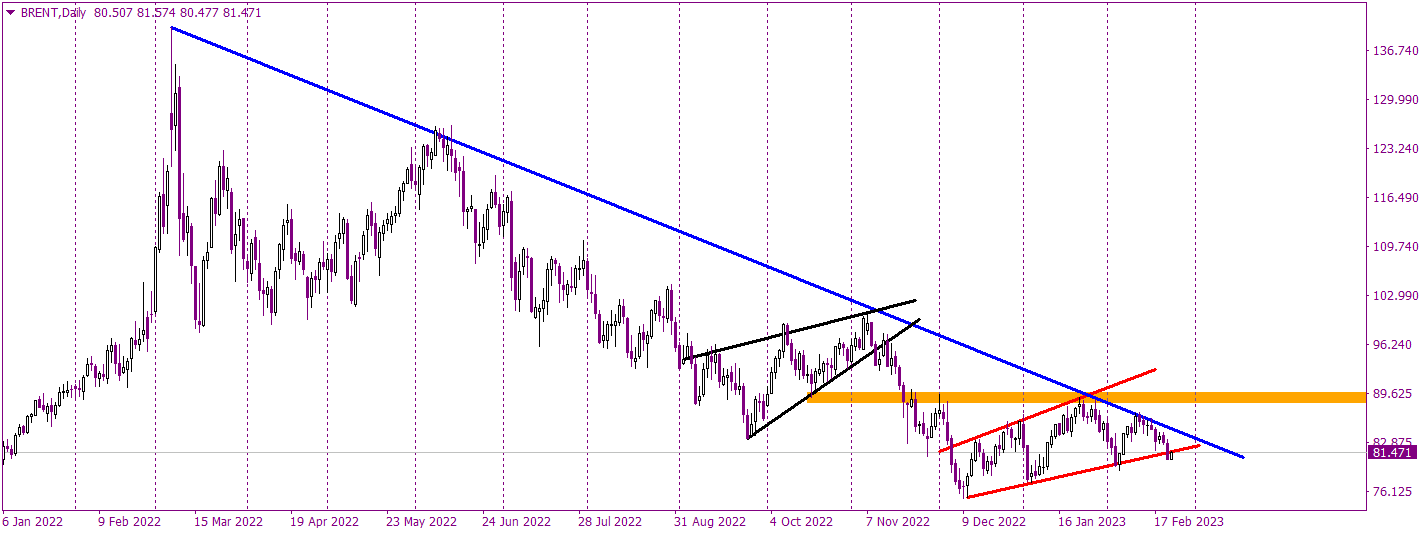

Brent oil has been in a downtrend since March 2022, which means it has been trending downwards for nearly a year now. Recently, sellers managed to defend the down trendline (marked in blue) that graphically represents the bearish sentiment in the market. Furthermore, the oil price is currently breaking out of a wedge pattern (marked in red), which is typically a sign of trend continuation and suggests a further decline in prices. It's worth noting that the previous wedge pattern (marked in black) during the second half of 2022 worked perfectly.

The negative sentiment is likely to persist as long as the oil price remains below the blue down trendline. If the price were to climb back above this trendline, it could signal the start of a new bullish trend. However, to be absolutely certain about bullish intentions, we would need to see a breakout above the orange horizontal resistance level at 89 USD/bbl. Unfortunately, the chances of this happening anytime soon are rather limited.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.