Brent crude oil prices have declined to 71.65 USD per barrel as the commodity market remains tense ahead of this week’s postponed OPEC+ meeting, now rescheduled for Thursday, 6 December. The market is concerned about the direction of future global oil supply amid fears of oversaturation. The prevailing expectation is that OPEC+ might delay its planned increase in oil supply for the third time, reflecting persistent supply uncertainties.

Despite these pressures, there are optimistic signals from the oil sector, particularly China, where a resurgence in production activity is seen as a sign of gradual economic improvement in one of the world’s largest importers of raw materials. This development could bolster the energy sector.

The geopolitical landscape remains mixed, with traders closely monitoring tensions in the Middle East. Any escalation could heighten regional instability and affect the overall oil supply dynamics in these areas.

So far, the recent strengthening of the US dollar has not significantly impacted oil prices. However, future market dynamics could shift as global economic conditions evolve.

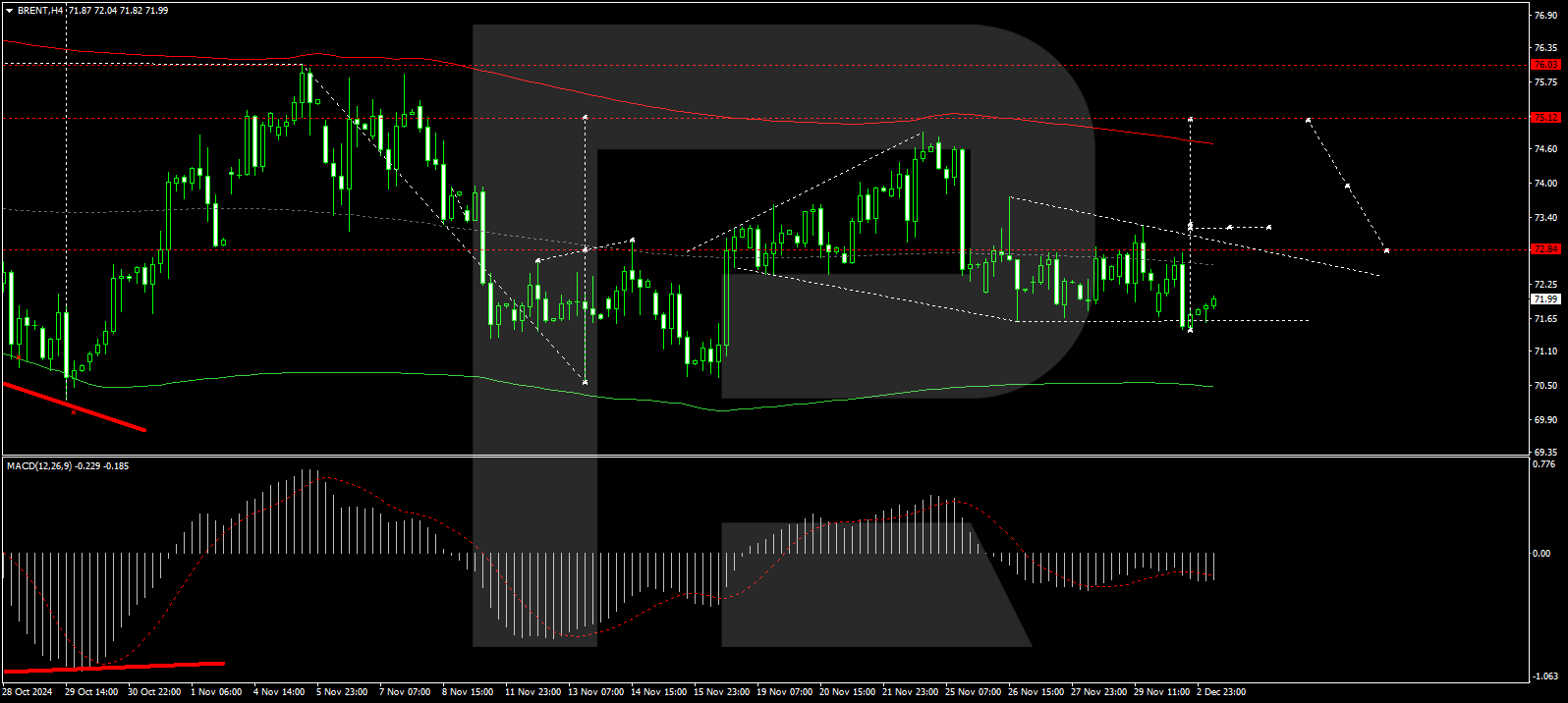

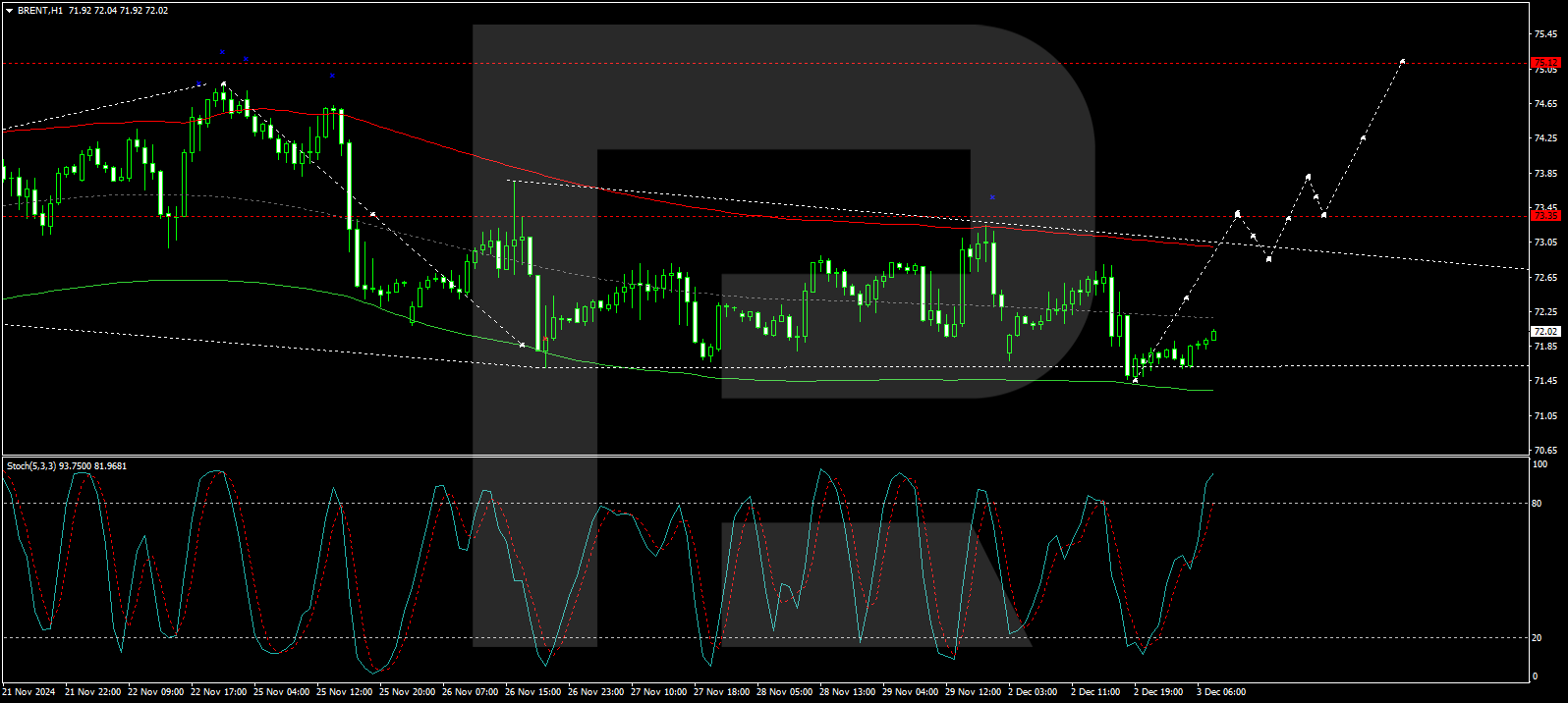

Technical analysis of Brent Oil

H4 chart: the market is navigating a broad consolidation range centred around the 73.33 level, with recent extensions downward to 71.55. An upward movement towards 73.33 is anticipated today. Should the price exit this range on the higher side, there may be potential for a growth wave targeting 75.15, potentially extending up to 80.00. The MACD indicator supports the bullish Brent outlook, with its signal line below zero but pointing upwards.

H1 chart: Brent has found support at 71.55, initiating a growth wave towards 73.33. Upon reaching this level, a compact consolidation range might form. A breakout above this range could lead to a rise towards 75.15. This potential growth trajectory is corroborated by the Stochastic oscillator, with its signal line currently above 50 and trending towards 80.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds near 1.0500 ahead of Powell speech

EUR/USD holds steady at around 1.0500 in the American session on Wednesday. The weaker-than-expected ADP Employment Change and the ISM Services PMI data hurt the USD and help the pair keep its footing. Fed Chairman Powell will speak later in the day.

GBP/USD recovers toward 1.2700 after US data

Following a pullback, GBP/USD edges higher toward 1.2700 in the second half of the day on Wednesday as the US Dollar loses strength following the disappointing data releases. Markets eagerly await Fed Chairman Jerome Powell's speech.

Gold advances to $2,650 area as US yields edge lower

Following a consolidation phase near $2,640, Gold gains traction and rises to the $2,650 area. The benchmark 10-year US Treasury bond yield pushes lower after weak macroeconomic data releases from the US, helping XAU/USD stretch higher.

UnitedHealth unit CEO murdered early Wednesday in Manhattan Premium

UnitedHealthcare CEO Brian Thompson was gunned down in Manhattan Wednesday morning. Thompson was shot by a masked gunman as he was in the city for an investor meeting.

Four out of G10

In most cases, the G10 central bank stories for December are starting to converge on a single outcome. Here is the state of play: Fed: My interpretation of Waller’s speech this week is that his prior probability for a December cut was around 75% before the data.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.