Brent crude oil prices are witnessing a moderate rise as the week begins, with the cost per barrel currently near $78.40. This upward trend is primarily influenced by the evolving outlook on energy demand. Recent macroeconomic data have cast some doubts on future demand, somewhat offsetting factors previously buoying prices, such as tensions in the Middle East.

Currently, Brent crude seems poised for a phase of consolidation within a specific price range. Despite some existing downward pressures, the ongoing geopolitical tensions in the Red Sea and the Gulf of Aden are maintaining a significant risk premium in crude oil prices. Market dynamics are also reflected in the backwardation between the current Brent price and its six-month futures, suggesting an anticipation of potential future oil supply limitations.

Brent Crude Oil technical analysis

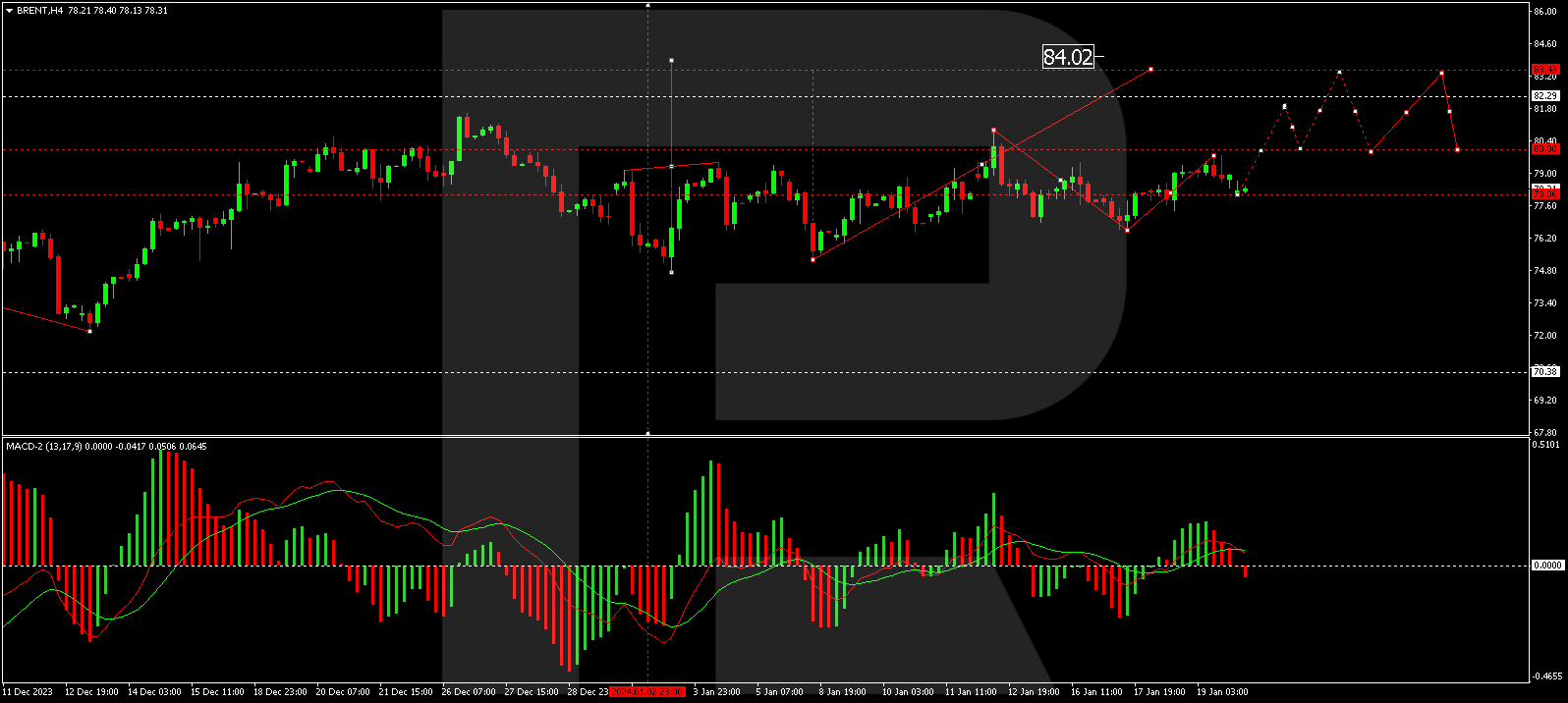

The H4 chart for Brent indicates a recent rise to $79.74, followed by a correction to $78.06. It's likely that a tight consolidation range will form above this level today. A break above this range could signal a growth trajectory towards $80.00, and potentially higher to $81.84 as a local target. The MACD indicator, with its signal line positioned above zero, supports the likelihood of continued growth.

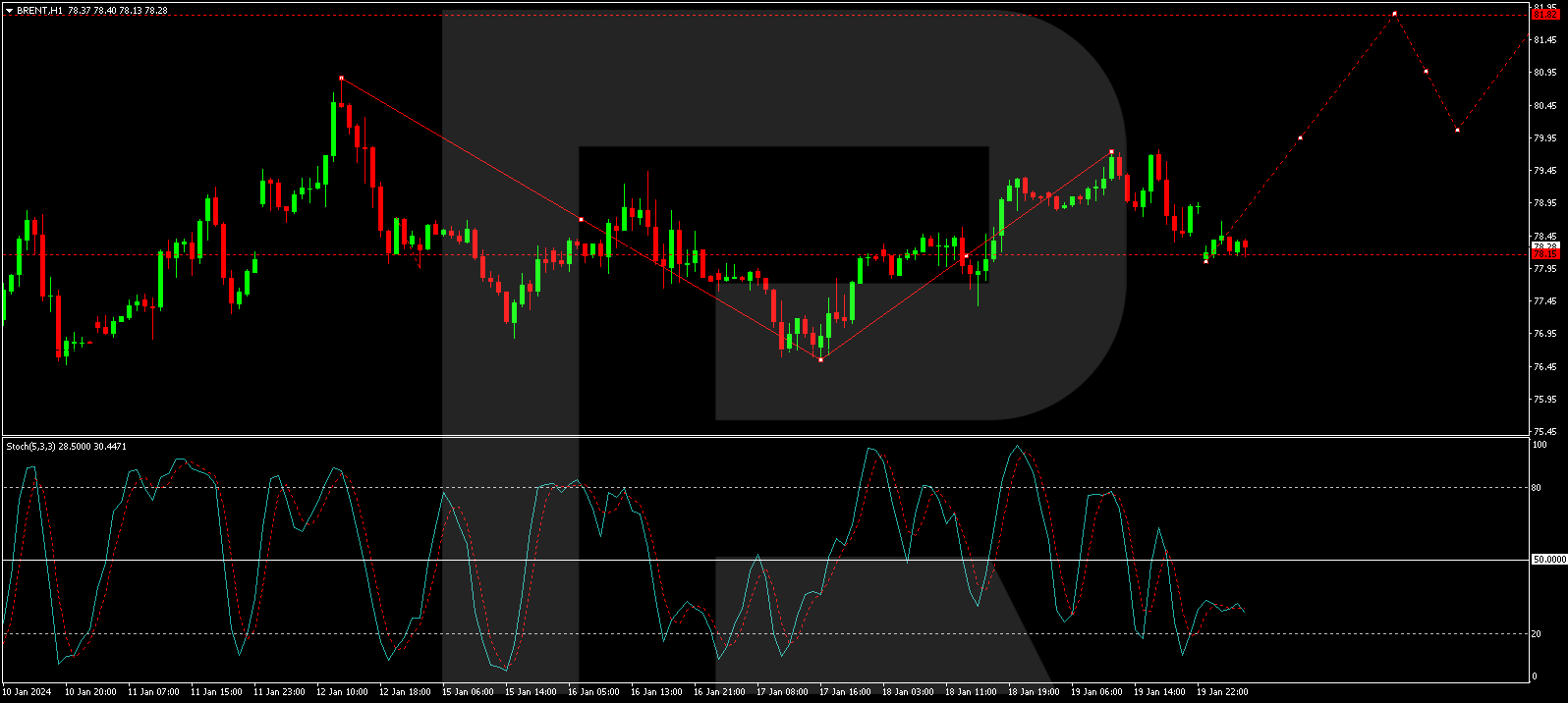

On the H1 chart, a correction phase appears to have concluded. The price may start ascending towards $79.79. Following this, a new consolidation phase around this level is anticipated. An upward breakout from this range could propel the price further to $81.84. This outlook is reinforced by the Stochastic oscillator, indicating a signal line trajectory from above 20, aiming towards 80.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0950 ahead of US CPI release

The EUR/USD pair attracts some buyers to around 1.0980 during the Asian session on Thursday. The Euro edges higher against the Greenback as German conservative leader agreed on a coalition deal with the center-left Social Democrats on Wednesday.

GBP/USD trades near 1.2850 after recovering recent losses, BoE's Breeden speech awaited

GBP/USD recovers its daily losses and continues its winning streak for the third successive session, hovering around 1.2850 during Asian trading hours on Thursday. The British Pound came under pressure following the release of weaker-than-expected data from the RICS Housing Price Balance.

Gold price rallies further beyond $3,100; eyes all-time high amid US-China tariff war

Gold price continues to attract safe-haven flows amid rising US-China trade tensions. Bets for multiple Fed rate cuts weigh on the USD and also benefit the precious metal. A solid recovery in the risk sentiment fails to undermine the safe-haven XAU/USD pair.

XRP back above $2 liquidating $18M in short positions, will the rally continue?

Ripple seeks support above $2.0020 on Thursday after gaining 14% in the past 24 hours. The token trades at $2.0007 at the time of writing, reflecting growing bullish sentiment across global markets.

Tariff rollercoaster continues as China slapped with 104% levies

The reaction in currencies has not been as predictable. The clear winners so far remain the safe-haven Japanese yen and Swiss franc, no surprises there, while the euro has also emerged as a quasi-safe-haven given its high liquid status.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.