Brent Crude Oil faces demand concerns despite recent gains

After five consecutive days of upward movement, Brent crude oil is now experiencing a consolidation phase, with prices retreating slightly to 81.80 USD per barrel on Tuesday. Market sentiment is being influenced by renewed concerns over global oil demand, particularly following OPEC's downward adjustment of its demand forecasts for 2024 and 2025. This adjustment reflects weaker-than-expected economic data from China and reduced regional demand projections.

OPEC now estimates global oil demand will grow by 2.11 million barrels per day (bpd) in 2024, down from its previous forecast of 2.25 million bpd. For 2025, the projection has been revised to 1.78 million bpd from 1.85 million bpd. These revisions are mainly due to the sluggish economic indicators emerging from China, a significant driver of global oil demand.

The ongoing conflict in the Middle East keeps market participants on edge. A new round of negotiations could be scheduled for Thursday, although there remains uncertainty about whether they will occur. Market players are particularly concerned about the potential for escalated conflicts involving Israel and Iran, which could disrupt oil supplies from the region and create further volatility in oil prices.

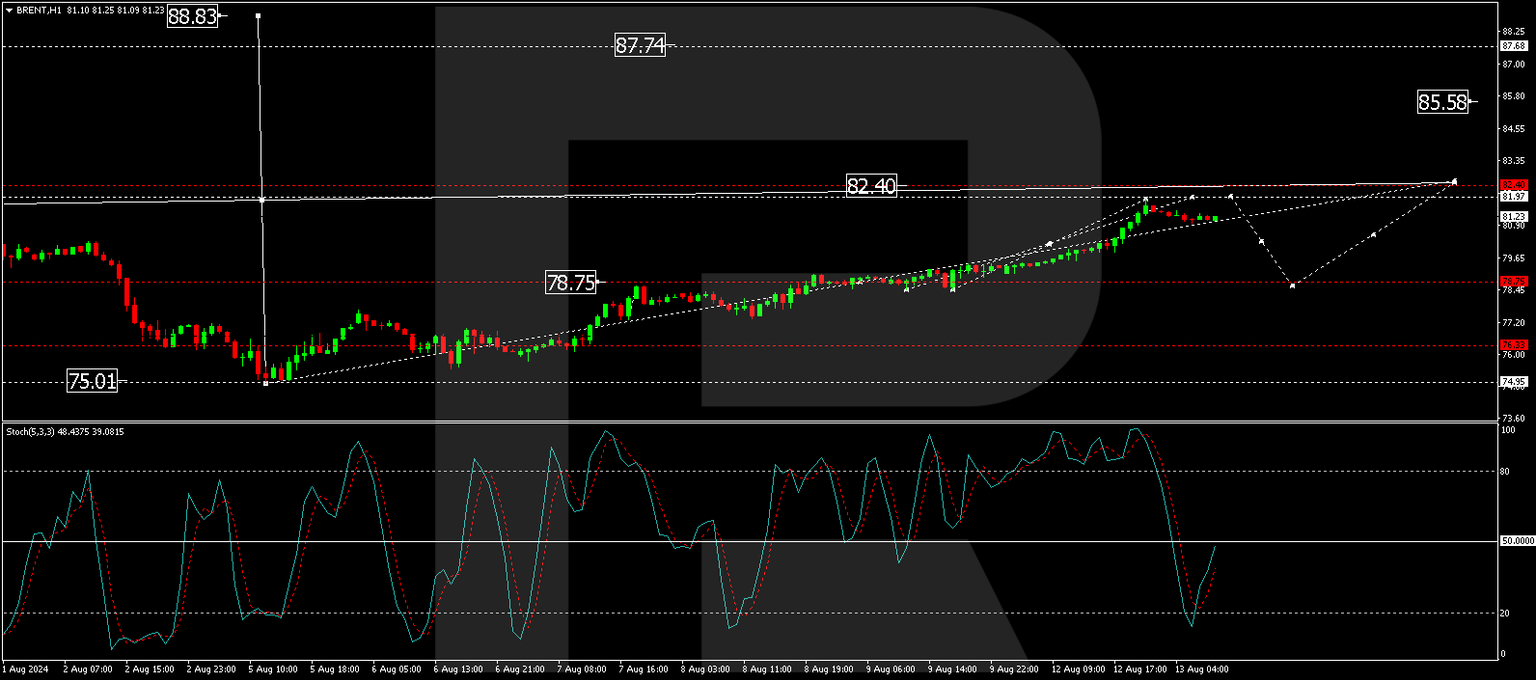

Technical analysis of Brent Crude Oil

The technical forecast on the Brent crude shows that the price is forming a consolidation range around 78.75 USD, with a recent upward breakout continuing the growth trend towards 81.97 USD. This level serves as a local target. Upon reaching this level, a correction back to 78.75 USD may occur, followed by a potential rise towards 82.40 USD. This bullish scenario is supported by the MACD indicator, which, despite being below zero, shows a clear upward trajectory.

On the H1 chart, Brent found support at 78.44 USD and is developing a growth structure towards 81.97 USD. Having already reached a local target at 81.90 USD, a corrective move to at least 80.17 USD could follow before resuming the upward trend. The stochastic oscillator, positioned near the 20 mark, indicates potential for upward movement, aligning with the broader bullish sentiment observed on the H4 chart.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.