Brent Crude Oil experiences upward trend

Brent prices have been rising for three consecutive days as of this Monday. The price of a Brent barrel has climbed to 79.00 USD, and there are underlying reasons for this surge.

The focal point of attention is the unfolding events in the Red Sea, where the situation is challenging. This holds significant importance for the crude oil market as numerous tankers with energy carriers pass through these waters. Any disruptions in transportation accessibility could potentially impact the crude oil supply. The market incorporates this concern into its quotes. While some tankers have already altered their routes, others continue passing through the Red Sea.

The Libyan factor also supports oil bulls. Protests in the country might lead to a shutdown of two additional oil and gas organisations. Earlier, operations were halted at the Sharara field, causing the market to lose approximately 300 thousand barrels of crude oil daily.

Meanwhile, various drivers exert pressure on the market. Increasing crude oil production among non-OPEC+ members, including the US, is one such factor. Additionally, there is uncertainty in Chinese crude oil demand.

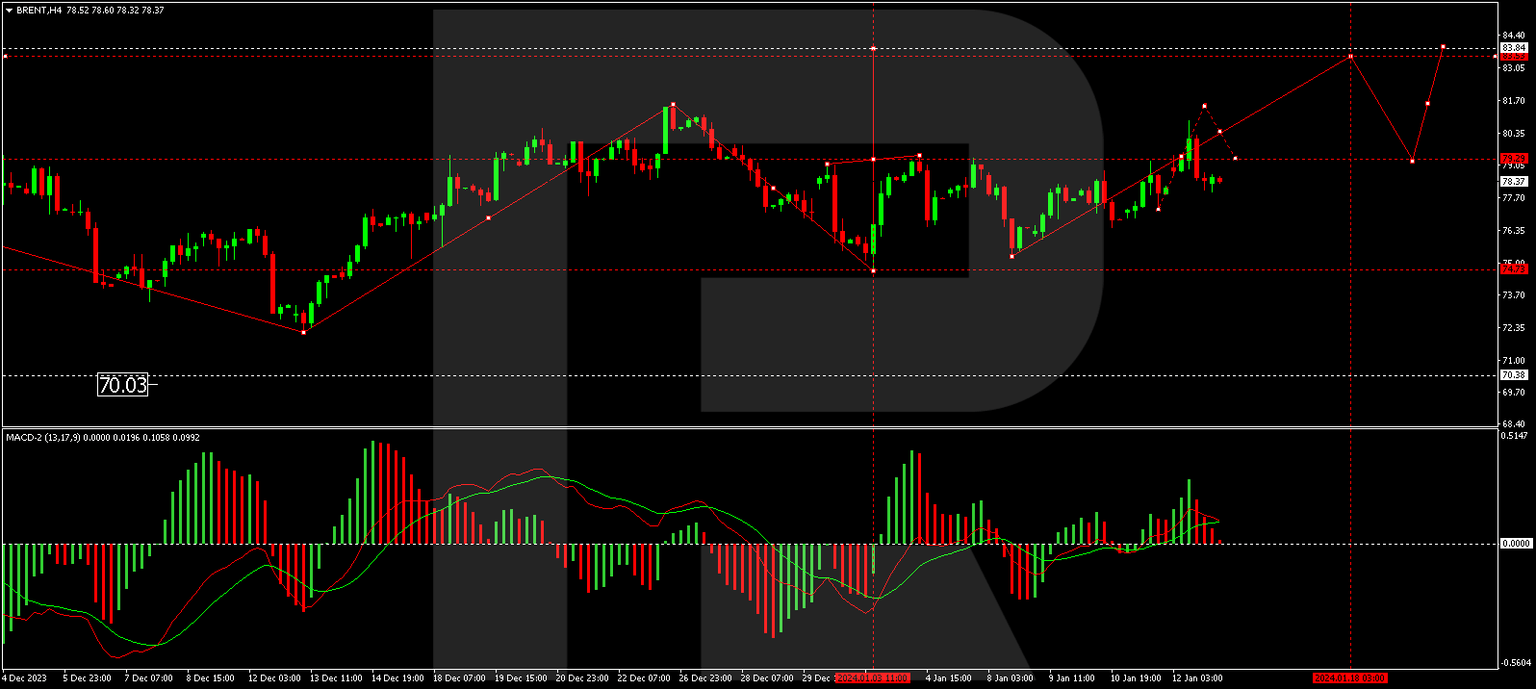

Brent technical analysis

On the H4 Brent chart, a growth wave structure is emerging towards 82.15. Once this level is reached, a correction link to 79.30 is expected, followed by a rise to 83.43. This is a local target. Technically, this scenario is confirmed by the MACD: its signal line is above zero, strictly pointing upwards.

On the H1 Brent chart, a consolidation range is developing around 79.35. A growth structure to 81.45 is expected, followed by a correction to 79.40 and a rise to 82.15. This is a local target. Technically, this scenario is confirmed by the Stochastic oscillator, with its signal line above 50, aiming strictly upwards to 80.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.