S&P 500, breakout or fakeout?

S&P 500 recovered from the opening setback reasonably fast, and had reached 4,188 before getting rejected. Temporarily rejected, and soon back on the way to 4,209. Stock market improvement was that broad to let me call still in 4,19xs for a serious breach of 4,209.

Let‘s examine where stocks stand right now – as comparred to yesterday‘s extensive analysis, published before the opening bell:

(…) it became clear early in the regular session that bears would be absent. … flipping the daily outlook decisively bullish, calling for a break above 4,177 already yesterday. Volume overall picked up sufficiently to repeat the daily bullish call for today in the European morning as well.

… Rising volume in XLK, VTV, and good enough SMH transparently prepared the ground for improving market breadth – but the one factor that made me reconsider the requisites of the medium-term (bearish) outlook, was this.

Financials.

Back when I took the medium-term bearish view (mid Mar), it was well justified as two significant banks had fallen, CS was getting back on the radar screen, deposits outflows continued, and demand for the Fed emergency programs was rising. It was questionable whether KRE and XLF would stabilize.

The incentives for deposit outflows were still present (Fed hadn‘t yielded to market pressures to ease, and still doesn‘t, short-term yields kept solidly above 5%, Fed balance sheet kept declining, M2 and margin debt shrinking while consumer inflation expectations went on surging). It took too long for FRC to fail – the odds of a sharp downside move were high in the prior two months, yet almost every market reaction to banking or disappointing data (on the correct recessionary call front), had been quite readily bought – and not even my correct call for hawkish May FOMC forced a lasting break of 4,078.

That explain why I had been issuing so many daily bullish calls with upside targets met in all these weeks and days.

Big picture, S&P 500 remains confined to a prolonged and tight trading range that took shape in the final days of Mar, and is still persisting after one failed breakout attempt – and my other risk-on metrics don‘t indicate a break higher out of their ranges either.

Crucially, this is all happening while the real economy prospects keep darkening, from JOLTS to unemployment claims (again pinned as Mar/Apr uptrend start) to consumer confidence, to manufacturing, to bank lending standards, you name it. LEIs are still declining, volume retail sales are down so much more than value retail sales (indicating that companies are squeezing the consumer, hence XLP is picking up). Then, China growth data are as mixed as U.S. retail sales figures while markets keep expecting over 175bp cuts till 1H 2024 is over, which I doubt thoroughly.

This means to me that the worst isn‘t over – not in terms of real economy deterioration, banking and the stock market. It merely indicates the upcoming stagflationary reality (subpar growth outdone by persistent, sticky inflation affecting markets there where it matters, in necessities of life, well beyond the owners‘ equivalent rent optics).

Yet, several developments yesterday made me urgently reevaluate the medium-term bearish outlook – crucially the parameters of it being, remaining justified (beyond the fact of positive stock market returns not exactly correlating with plunging LEIs).

First, KRE might not be in the mood of sliding too much more while XLF is reluctant to move even below May lows only – all on solid daily volume yesterday.

Second, Russell 2000 is showing signs of life, and the IWM mid Mar lows are at risk of becoming distant – again on solid daily volume.

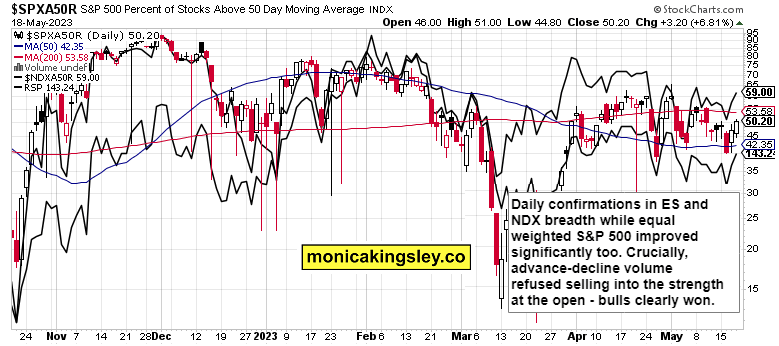

Third, market breadth as measured by percentage of stocks trading above their 50-day moving averages, improved a lot yesterday both in NDX and ES. Should we see more of that, rotations getting stronger, and leaving the 500-strong index less dependent on the Top 10 chiefly tech stocks, the buyers would rejoice.

Fourth, this weaknening tech (and communications) leadership is underlined by defensives (utilities, staples) turning considerably more constructive, which is what financials seek to follow. Add in XLI refusing more weakness while XRT goes up, and things could get dangerous for the bears fast.

The key thing that changed, is that we‘re dealing with a breakout now – above both 4,188 and 4,209. Unconfirmed for now, so let‘s examine its odds to answer that „breakout or fakeout“ question.

First, neither daily volume nor market breadth changes stand in the way of either ES or NDX.

Seconds, bonds held up in the risk-on mode well, and the low HYG volume wasn‘t met with poor price action while yields rose.

Third, XLI strongly refused the daily downswing, XLF pulled out a nice daily consolidation, and Russell 2000 as the greatest underperformer behind KRE, rose within its practically horizontal range.

This makes me think that S&P 500 is likely to consolidate the breakout rather than come crashing down. Unless Fed speakers today „surprise“ with further insistence on no rate cuts any time soon (quotation marks are ironical as they wouldn‘t relent – both 3m and 10y yields registered strong increases yesterday, and Jun 25bp rate hike odds went up considerably) – that‘s the most probable factor to drive an ES breakout today apart from typical opex day volatility.

Not even the heavily bought into tech and semiconductors flash warning signs for S&P 500 as the rotations yesterday have been shown to be strong, and this kind of performance doesn‘t usually disappear within a day.

USD isn‘t standing in the way – earlier calls for 101 to hold, and greenback relief rally are working out fine, now over 103 and in need of consolidation after the reflexive „debt ceiling resolution“ (not yet, but the interim positive signs won‘t disappear today) rally.

The extent of opex day volatility is the key variable today – together with the Fed speakers comments revealing what the broad rally yesterday was made of (strength of foundations and rotations). Odds are good for a no meaningful setback.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren't enough) – combine with Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram - benefit and find out why I'm the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts – today‘s full scale article contains 5 of them.

S&P 500 and Nasdaq outlook

I‘m looking for 4,180s to definitely hold on any (Fed generated) pullback today. Muddle through in the high 4,210s is a probable possibility – the bulls appear in need of taking a daily breather, and sectoral with intermarket analysis would reveal the degree they remain in control. Simply put, only hammering stocks below 4,154 on a closing basis allows the bears to even the game (and that‘s highly unlikely to happen even on Monday).

Percentage of stocks trading above their 50-day moving averages picked up sharply over the last two days. Quite some fuel appears left till it approaches spring highs, or as a minimum (more probable) takes out its red 200-day moving average.

Credit markets

Bonds are delivering for stock market buyers – especially the junk ones doing this well yesterday when Fed fund rate odd for June went up to 5.50% cconsiderably vs. a day ago. Stocks are leading quality bonds, which is bullish risk-on assets.

Yields aren‘t likely to sink the stock market now, tech can still be defying them, but nonetheless signals lower growth environment the real economy is moving into, with higher inflation and yields (10-y to close the year around 4.50% after all it seems).

Crude Oil

Real assets may still suffer in the short term thanks to USD and yields, and nowhere it‘s better seen than in precious metals ($1,970 gold broken, but $23.15 silver still far off due to the inflationary reality – expectations, not the headline disinflation). Copper keeps confirming in the risk-on posture, much closer to $3.72 than $3.55. Crude oil grind higher would continue, and $74 should fall next week.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.