Breaking out, but not truly

S&P 500 held above my 5,735, and sellers were repelled twice intraday as the main indices benefited most from slightly increasing rate cut odds (dialing back a little Monday‘s panic that we benefited mightily from intraday). The second most important factor to mention is China stock market reopening after holidays (with a giant Hong Kong selloff aka booking the gains while it was closed), which starts looking like a bottoming process.

Hence, flows back into the US names, with some encouraging signs mentioned further, alongside CPI expectations. The premium positive mention less than a week ago of IGV strength is bearing fruits for clients, and the same goes for NVDA technical developments and momentum, to name just a fraction of what I‘m bringing you daily.

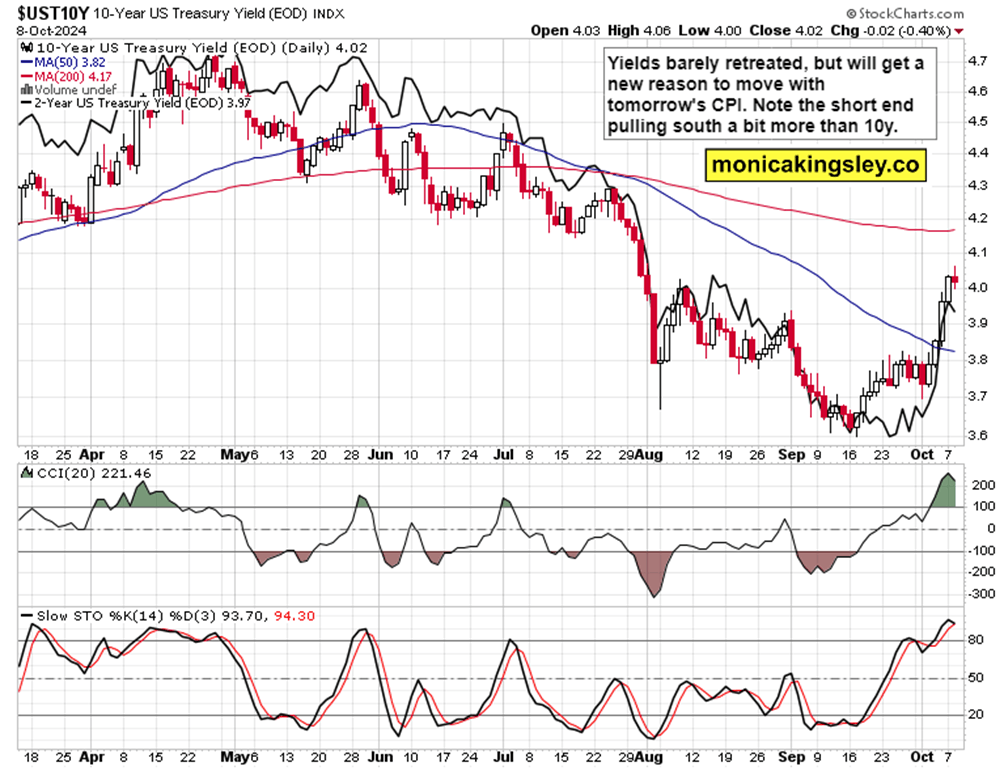

Let‘s have a look at the yields chart, and then dive into individual markets, with precious metals and copper that I also got right in sounding very cautious.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.