Both precious and base metals moving up

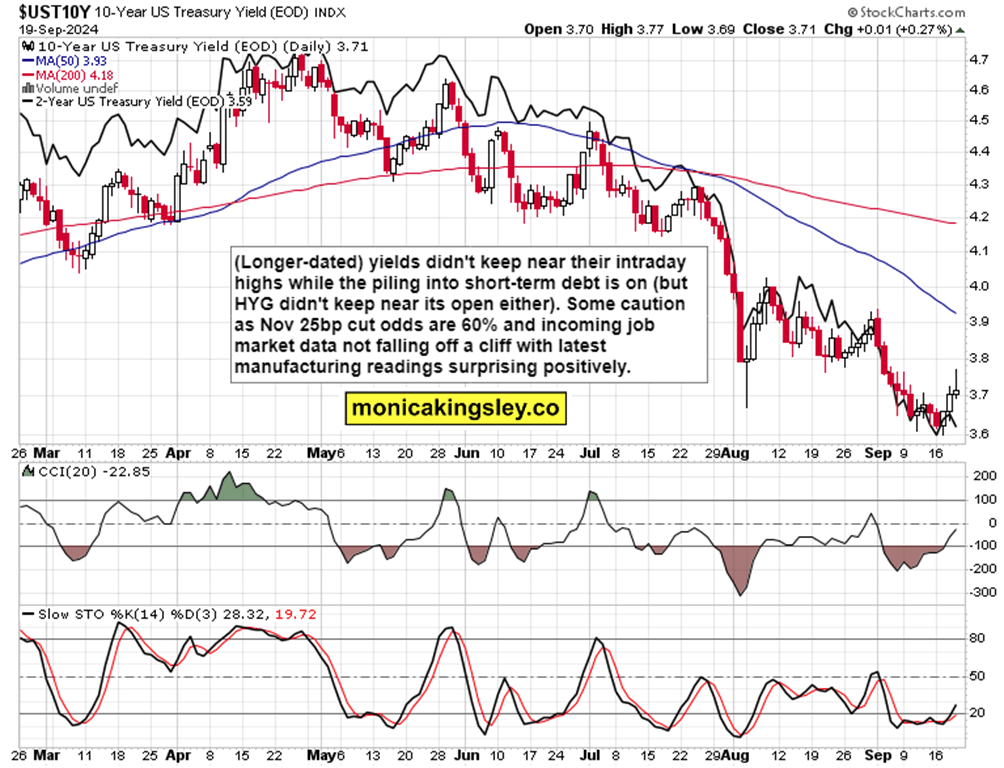

No serious attempt to close the bullish gap yesterday, and triple witching ahead today into reasonably good S&P 500 market breadth. Bond woes that I telegraphed well before FOMC as knocking on the door, are affecting prior star performers of XLRE, XLP and XLU – clients were in the picture ahead of time, and the same applies to TLT as longer maturities show the rising yields pressure best (just as 10y yield highlighting the disconnect regarding short-term yields in the below chart).

Remarkable array of winners features as well real assets with both precious and base metals moving up, and oil belatedly joining, making it to the top area that I considered achievable yesterday – good performance tipping the scales real asset way as we‘re no longer facing (all that) restrictive monetary policy when positive economic surprises are popping up here and there (at least no sharp deterioration, and I mean the job market here not sliding further, but just lukewarm keeping roughly where it is now).

So, the next days and weeks will be about adjusting to the slightly more likely reality of only 25bp Nov cut (60% odds for now) – and the great trades called in the run up to the start of rate cutting, will temporarily just consolidate steep gains in, with ITB, XLI and IGV to name just three, standing out.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.