BOOM! Game over. The Stock Market Crash is Upon Us.

BREAKING NEWS: Markets are crashing everywhere, stocks and currencies, there is likely a catalyst, we will know soon, but with all the pieces in place for a stock market correction and a higher US dollar already in place, there is the risk this can snow ball for weeks even months ahead.

Very Big Price Shifts in the making.

Opportunity abounds.

Really.

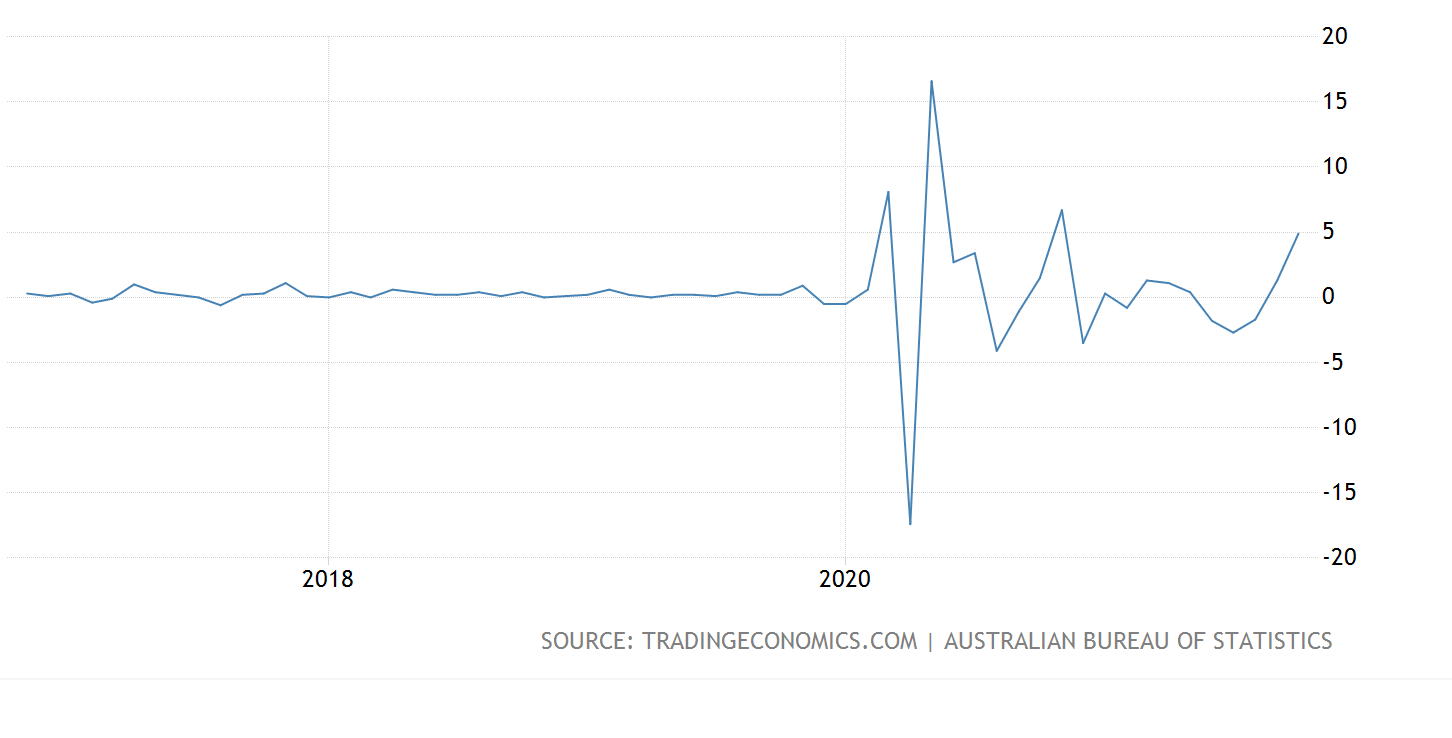

Did you know, the Australian stock market has been going down for a quarter of a year now, and people are still excited?

The penny is beginning to drop, and just in Australia. The Dow Jones topped out nearly three weeks ago. The Nasdaq and SP500 are showing signs of being in serious trouble. Then, we have a long-weekend US holiday and the futures market just kind of floated up yesterday. Only, until it reached the area that has previously seen heavy selling in the past couple of weeks.

This is the point. There is now serious selling about. This is a change. Perhaps a sea change.

Australian Retail Sales.

LOOK: Waves in a bathtub.

I have been saying the data would swash around like waves in a bath, back and forth.

Australian Retail Sales bounced back, but this is no repeat boom. As we have expected, there will be no big super-stimulus wave out of lockdowns this holiday season? A bounce in the data, yes, but an economic boom... no chance.

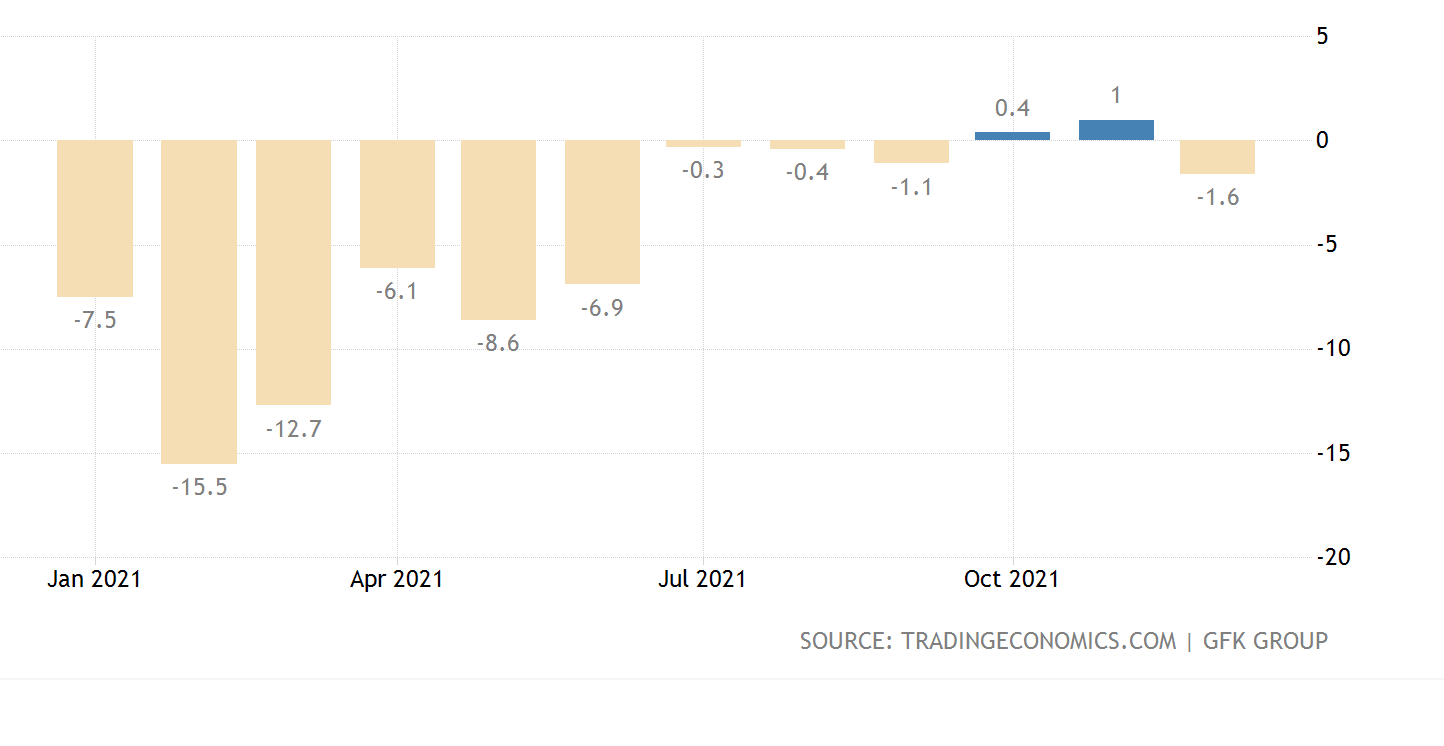

German Consumer Morale turned negative again, after only just managing a small gasp of positivity the previous month or two. That didn't last long, and I know you don't like it when I keep saying, this 'thing' isn't over yet. But it really ain't.

There are two separate processes, and both have serious consequences for any economy.

The virus itself, and now there is a new "clearly different" from previous mutations variant in South Africa that may have come from a long period of chronic illness in an Aids patient is the breaking news from the WHO, and so freewheeling global travel is still a distant horizon thing. Not, an over the next hill thing. Travel with care.

This new "clearly different" variant story has the potential to develop significantly and could add a straw to the back of already strained equity markets through the weekend. A small chance, but it is something to keep an eye on, and that is why I have provided a link to the Wall Street Journal article above.

The second process is what governments do in response to relentless new surges. They are and will all attempt to remain open as long as possible. When hospitals reach pressures too great however, lockdowns come back regardless of vaccination rates. Natural herd immunity is the only true light at the end of the tunnel.

Vaccinations will continue to lessen the load, sorry about the pun as it is the nasal load that determines contagion, while herd immunity builds naturally to some degree at the same time. To focus on the un-vaccinated is a mistake. As absolutely every study has confirmed that a vaccinated person with Covid has exactly the same high probability of transferring the disease to other members of their household as the vaccinated.

We should be wary of simplistic solutions and would be better served to understand we all have to push on regardless, but be personally careful in doing so, as there will inevitably be a price to pay for resuming open society life as vaccinations wear off.

All of this, as dreary and un-popular to think about as it is, will utterly determine economic outcomes everywhere. Still, for the foreseeable future.

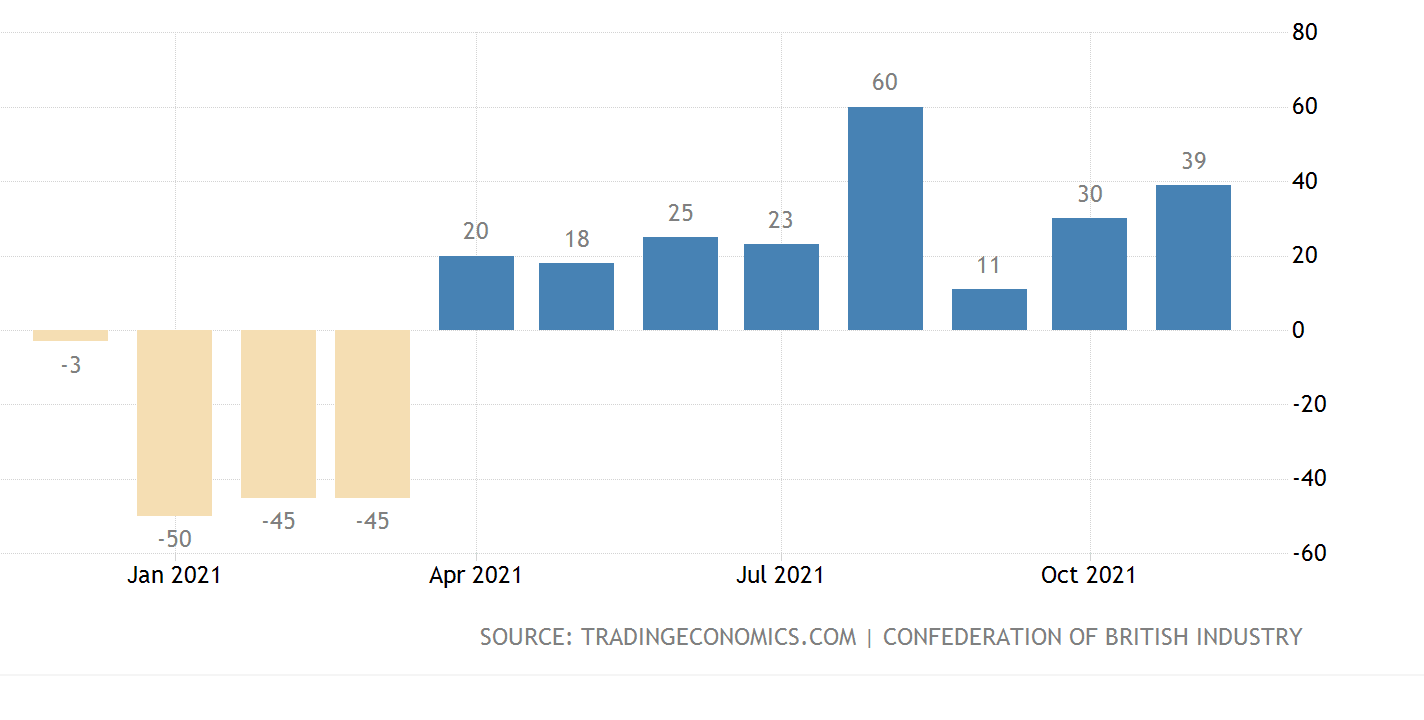

UK Retail Sales were very strong. This reflects, oh my goodness, I walked into the store, and they actually had stock on the shelves? Well done, congratulations to the UK for achieving a functioning trucking industry again.

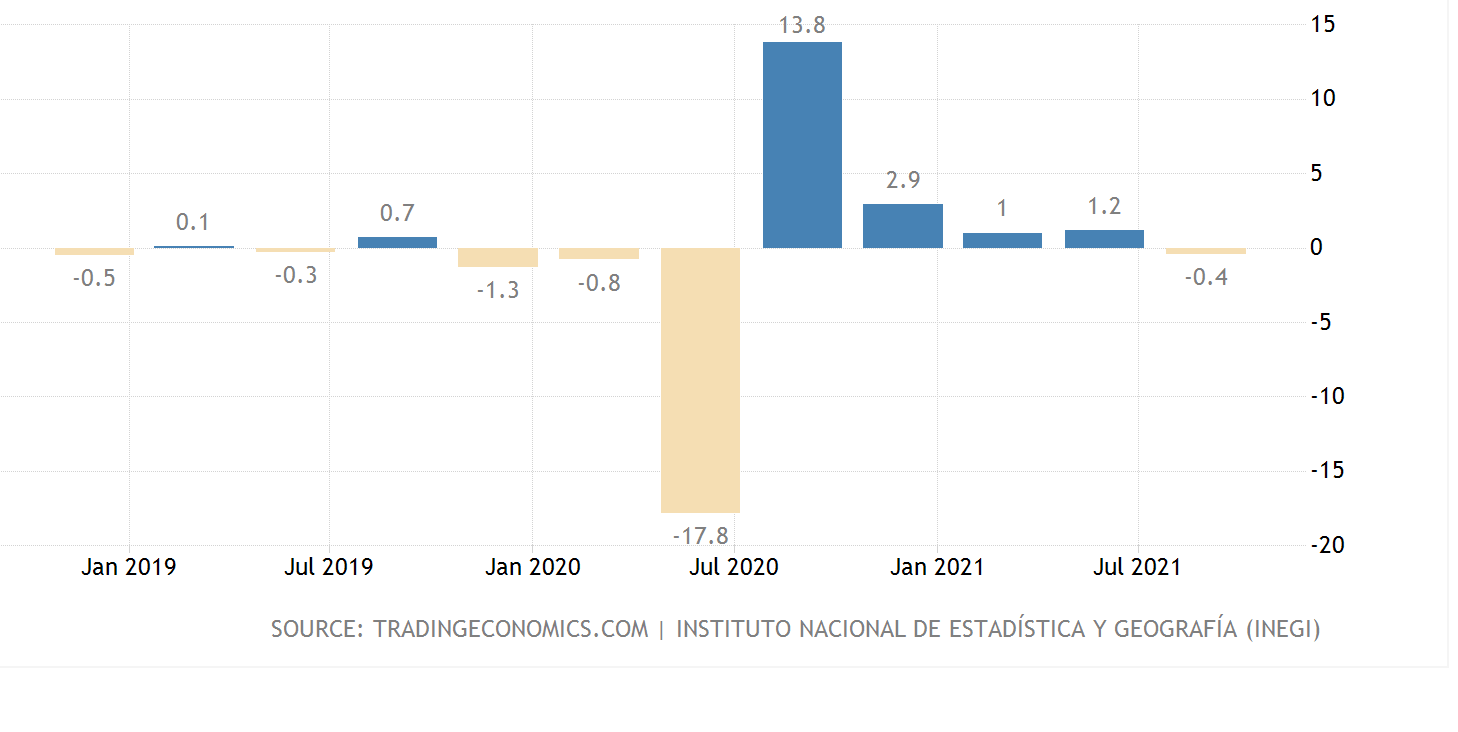

Mexico's economy just went negative again. No small thing.

The big developing trend opportunities remain basically selling Australia, I mean hedging your Australian currency and equity exposures.

After that, the US dollar will be strong for quite some time, Gold should begin to re-catch up, Oil is a story once told, and the US stock market looks simply alarming.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a