Bond yields headed lower towards 2024

-

Bond market outlook remains blurred by high issuance, debt sustainability worries as well as uncertainty over economic outlook and inflation. We continue to forecast lower long-end yields, but less than previously.

-

We see 10y UST yield at 4.20% in 12M horizon (from 3.70%). We also revised up our US GDP forecast to 2.4% for 2023 (from 2.1%) and 1.1% for 2024 (from 0.9%), reflecting stronger realized data but still weak outlook.

10Y UST yields have generally traded in the 4.80-5.00% range over the past weeks but broke below the recent range following the November FOMC Meeting. Yields remain caught in crosswinds stemming from data, market dynamics and monetary policy.

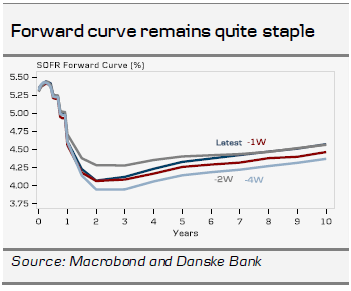

On the latter, Powell struck a rather balanced tone at the press conference following yesterday’s FOM C meeting, emphasising that the committee sees progress on inflation/labour market data but is not yet convinced that financial conditions are sufficiently restrictive. Wage growth remains elevated, excess labour demand is still present and growth continues to surprise to the upside. The ‘high for longer’ narrative has clearly been adopted by markets, which is visible in the noticeable staple pricing of the SOFR forward curve to bottom at a level above 4% in 2025 (see right-hand chart).

Dire deficit outlook justifies a higher-term Premium

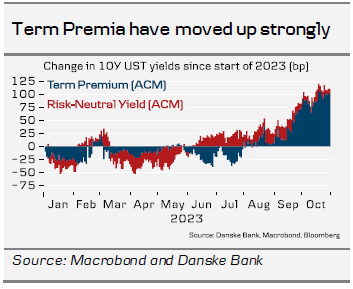

Apart from data and monetary policy, bond markets remain highly impacted by supply/demand dynamics encapsulated in the move up in the Term Premium since the summer (see right-hand chart). The US debt outlook is in centre of these discussions, after the Treasury’s sizeable upward revision of expected issuance in August. However, recent announcements on issuance have brought some calm to markets.

Earlier this week, the Treasury lowered its expected issuance for the remainder of the year, while signalling that the cash buffer (TGA) is now sufficiently refilled after being drained in the lead-up to the debt ceiling resolution in June. According to the Quarterly Refunding Statement out Wednesday, issuance for the remainder of the year will mainly pick up at the belly of curve, while selling in the long end will decline marginally in December and January. A continued high share of T-Bills in the issuance profile indicates, that the short end will continue to bear a significant share of US deficit burden. Markets had clearly feared a more significant amount of duration to accommodate in the short run.

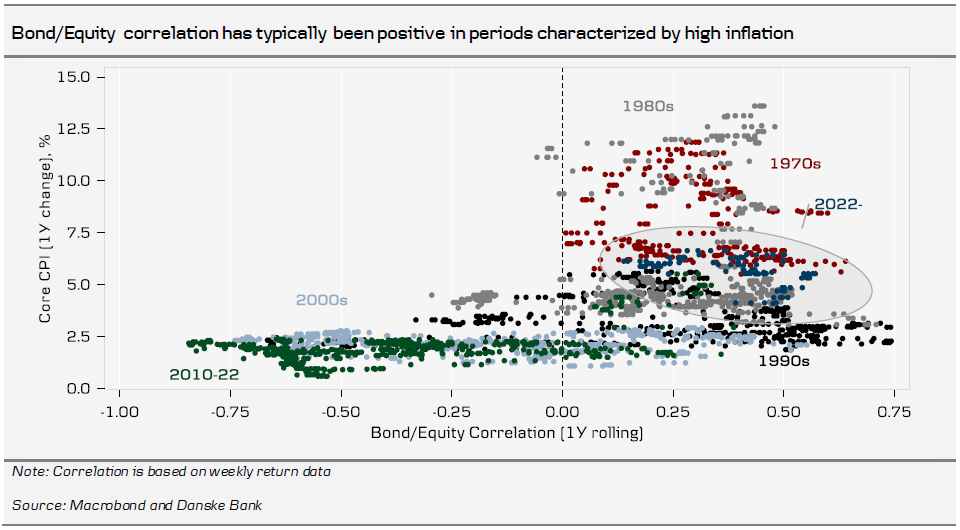

On the demand side, investors still seems cautious to take on more duration risk in the current situation. Powell mentioned in his speech at The Economic Club of New York earlier this month that the FOMC is looking at the current positive bond/equity correlation as a potential driver of Term Premia. Bonds have become less useful for hedging risk. Bonds and equities share a common exposure to inflation, and historically the two have correlated positively in decades characterized by elevated price pressures as the 1970s and 1980s (see chart below on page 2). As economic growth slows and inflationary risks dampen, the positive correlation will likely recede gradually from here.

Author

Danske Research Team

Danske Bank A/S

Research is part of Danske Bank Markets and operate as Danske Bank's research department. The department monitors financial markets and economic trends of relevance to Danske Bank Markets and its clients.