Bond market moves explained

Bonds are no longer a safe haven in the current market sell off. Longer dated bonds are lower across the board today, however, the moves have been most pronounced in the UK. 10-year Gilt yields have surged by 16bps and are selling off at a faster pace than 10-year US Treasury yields, in 30-year Gilts, the sell off is even more extreme and the 30-year yield was higher by 30bps at one point today, its highest level since 1998. But why are UK Gilts getting sold off if the UK got off relatively lightly with US reciprocal tariffs?

Why the sell off is not just about tariffs

The reason is that the sell off is now about more than just US trade policy. The announcement of reciprocal tariffs caused a major sell off in equity markets and other risky asset prices last week. When a few asset classes come under pressure, losses can pile up for investors and traders who are then forced to sell other investments including haven assets like government bonds.

Liquidity risks mount

The problem now for the UK bond market is one of liquidity and positioning. The Bank of England came out today to warn about the extent of leveraged bets in the UK Gilt market that have surged to more than £65bn in recent years. These bets are often held by hedge funds, which have racked up some huge losses since the tariff-induced sell off. The BOE noted that the risk of corrections in the bond market is high, since hedge funds are facing significant margin calls on their positions, which will exacerbate the sell off. It is also a sign that the market sell off, especially the bond market sell off, is now disassociated from fundamentals.

BOE to the rescue?

The good news, if there is any, is that the BOE has been banging the drum about hedge funds’ leveraged positions in UK bonds for months. No doubt hedge funds were enticed into the UK bond market by surging levels of volatility in the Liz Truss Budget crisis. Back then they could pick up UK debt at bargain basement prices, however, now a politician of a similar ilk across the Atlantic is causing havoc across financial markets, and hedge funds will pay the price.

Not all will, but we are now in the space where something could ‘break’. As Warren Buffet said, this is time when we see who has been swimming naked. The BOE is likely to be ready for this crisis. If the sell off continues in the coming hours and days, then expect more liquidity instruments to be offered to ensure that the UK’s financial system is well oiled. If central banks do step in then this could boost overall risk sentiment in financial markets.

US equity futures are pointing to another sharply lower open at 1430 BST, and the dollar is weaker across the board, as higher Treasury yields cannot protect the greenback against a political risk premium caused by President Trump’s tariff plan. Optimism is hard to find on Wednesday, the outcome of today’s US session will be critical for the future direction of financial markets, and potentially for President Trump’s political future.

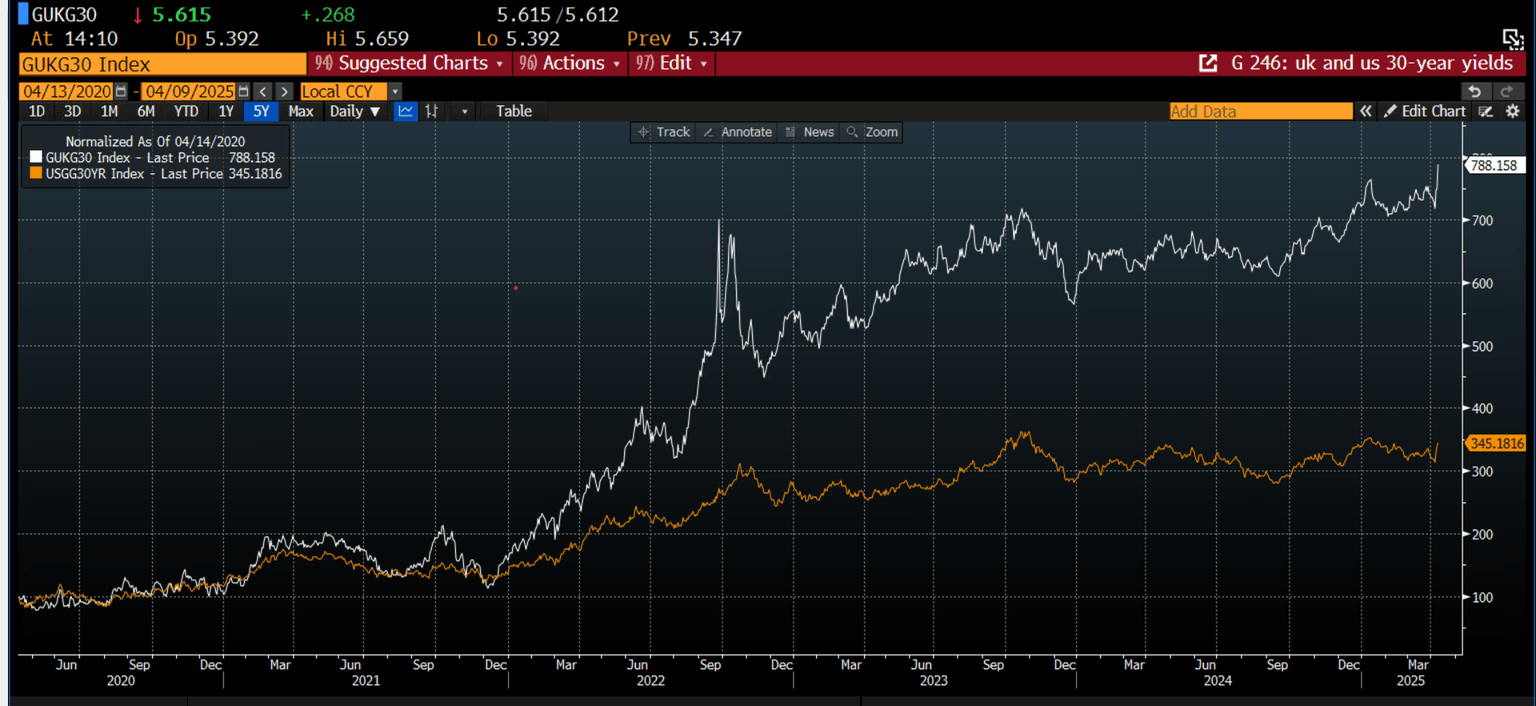

UK 30-year bond yields are rising at a faster pace than US yields, as hedge fund bets on UK Gilts get rapidly unwound

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.