BoJ preview: Focus is on Governor Ueda

At approximately 3:00 am GMT tomorrow, markets will welcome the Bank of Japan’s (BoJ) rate decision. No change is expected in the central bank’s ultra-loose Overnight Policy Rate. Alongside BoJ Governor Ueda’s dovish forward guidance in December and the earthquake on New Year’s Day—a magnitude 7.6 earthquake that has sadly killed 100s of people and displaced 1000s— together with easing inflation and a slowdown in wage growth, polled economists from Bloomberg unanimously anticipate the central bank to hold its negative policy setting at -0.1% tomorrow and maintain its YCC ceiling at 1.0%. Importantly, also accompanying the rate decision is the BoJ’s Outlook Report, a detailed release published on a quarterly basis that delivers the central bank’s view of economic activity and inflation.

Eyes on Governor Ueda

The majority of the market’s attention, however, is going to be directed towards the BoJ Governor Ueda, seeking information/hints on a timeline for exiting negative interest-rate policy. It is now simply a question of when the central bank will lift its Policy Rate out of negative territory, not if.

Where is the USD/JPY trading?

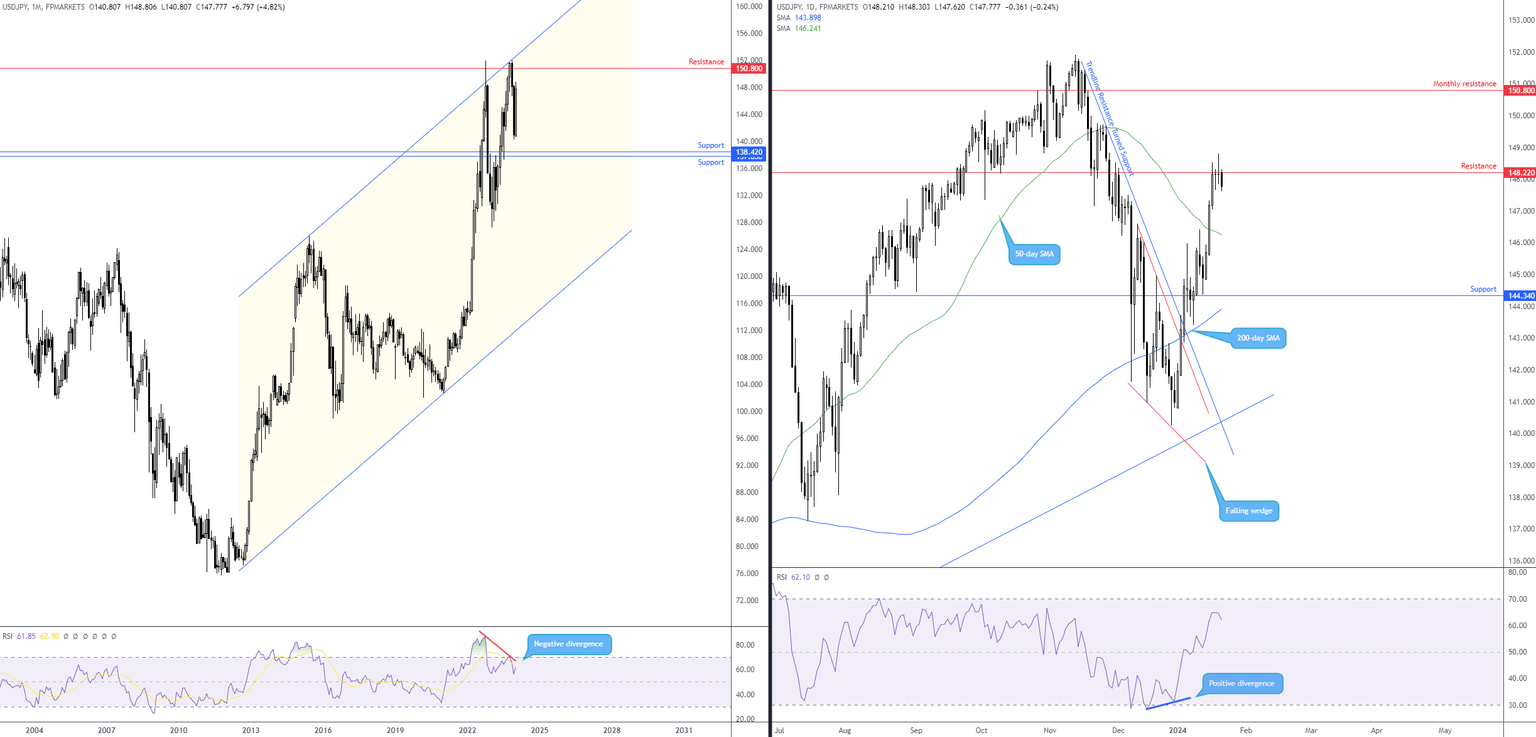

January is poised to end on the front foot; MTD, the USD/JPY is up 5.0% and has reclaimed all of December’s downside move and is nibbling away at the lower range of November’s losses, as of writing.

First and foremost, the longer-term trend is unequivocally clear. Since 2011, we have seen an upside bias unfold on the monthly chart, and (albeit leaving monthly support around ¥138.42 unchallenged) January’s spirited advance has thrown light on potentially refreshing multi-year highs in the coming months. Indeed, for such a move to materialise, offers would need to be engulfed around monthly resistance from ¥150.80; this is a level that needs little introduction as it has withstood two upside attempts (one in 2022 and the other in 2023).

Meanwhile, over on the daily chart, resistance at ¥148.22 is the dominant level for the time being, shaking hands with price action last week. Rupturing the aforementioned resistance level would, aside from possible resistance emerging from the ¥149.75 22 November (2023) high, help pave the way northbound toward the monthly timeframe’s resistance mentioned above at ¥150.80. Therefore, a daily close forming above ¥148.22 could be viewed as a bullish breakout signal, whereas defending the noted resistance may lead the pair back to the 50-day simple moving average (SMA) at ¥146.24.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,