- The BOE is widely expected to raise the key rate by 50 bps to 1.75% on ‘Super Thursday’.

- Voting pattern on rate hike and Bailey’s policy path will be closely examined.

- GBP/USD is at a make-or-break point following the recent recovery rally.

GBP/USD is holding at a critical juncture heading into the Bank of England’s (BOE) ‘Super Thursday’ announcements. The central bank is widely expected to hike the key rate by 50 bps to 1.75% at 11:00 GMT while Governor Andrew Bailey’s press conference will follow at 11:30 GMT.

BOE’s policy path and growth fears

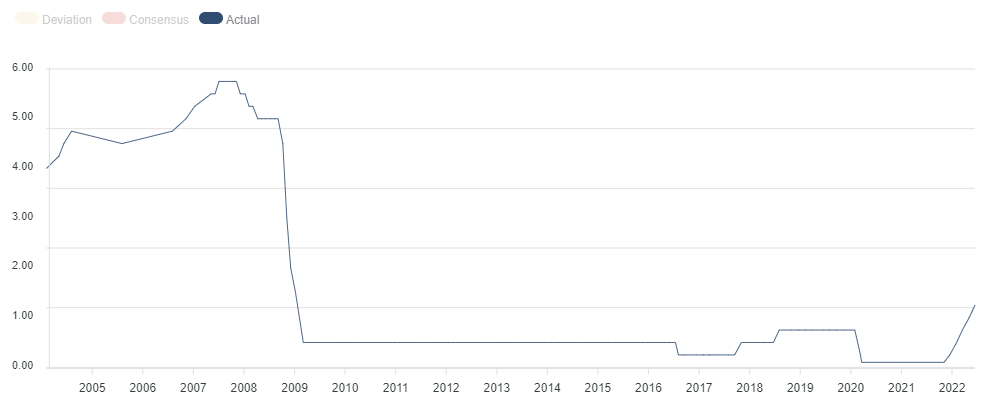

The BOE is set to tighten its monetary policy for the sixth straight meeting. The 50 bps lift-off would be the largest since 1995, which will take the rates to the highest since late 2008 at 1.75%. Money markets are currently pricing an 82% chance of a 50bps hike and only an 18% probability of a 25bps hike this Thursday.

Source: FXStreet

However, the central bank could strike a dovish tone, following the footsteps of the US Federal Reserve (Fed) and the Reserve Bank of Australia (RBA), as they acknowledged slowing economic activity.

The US Fed raised rates by 75 bps last week but abandoned the forward guidance while adopting a meeting-by-meeting approach. Meanwhile, the RBA delivered a 50 bps hike this week but said that the bank is not on a pre-set tightening path.

The BOE stands firm in its fight to control inflation, which is at a 40-year high of 9.4% YoY for June, despite the risks of an economic slowdown or recession. Growth fears could, however, overwhelm and prompt Bailey and company to hint at a probable slowdown in its rate-hike track.

Supporting the case for a less hawkish policy outlook by the BOE, measures of inflation expectations and prices charged by companies have slowed recently. A survey by US Citibank and pollsters YouGov published on Monday showed expectations among the public for inflation in five to 10 years fell in July for the third time in four months.

The pace of increases in prices charged by firms, as measured by the S&P Global/CIPS Purchasing Managers Index, slowed a bit in May and June and cooled more significantly in July.

Meanwhile, the Office for National Statistics (ONS) said in its latest report that 26% of companies surveyed over the past two weeks intended to raise prices in August. This was down from 31% in April when the question about price changes for the following month was first asked.

On the other hand, the BOE’s 11% peak inflation forecast made in May will likely be revised upwards at the August meeting. The economic uncertainty, courtesy of the European gas crisis and China’s covid lockdowns, could lead the central bank to downgrade its growth forecasts. These considerations give a reason for the central bank to slow down or even bring to a pause its tightening cycle.

Markets are also aware of the looming political uncertainty in the United Kingdom, with candidates Liz Truss and Rishi Sunak leading the Tory leadership – and PM – race. The new UK prime minister to replace the outgoing Boris Johnson will be announced on September 5.

Trading GBP/USD with the BOE

That said, the voting pattern on the rate hike and Bailey’s hints on the future policy path will hold the key, as a 50 bps rate hike is fully baked in. At the June meeting, the Monetary Policy Committee voted 6-3 for the 25 bps hike to 1.25%, with the minority voting for a 50 bps increase.

GBP/USD could take a huge hit on changes to the voting pattern on the dovish side or any hints of a potential slowdown in rate hikes going forward. The pound could also suffer on ‘sell the fact’ trading, in an immediate reaction to the 50 bps rate rise announcement. In that case, the cable currency pair could drop towards the 21-Daily Moving Average (DMA), just above the 1.2000 mark.

Cable could resume its recovery momentum towards 1.2500 if the BOE signals aggressive tightening in the coming meetings, prioritizing inflation over growth concerns. Markets continue to anticipate further rate hikes after this week, as Sterling Overnight Index Average (SONIA) is placed above the 2% mark in September and close to 2.5% in November.

At the time of writing, the GBP/USD spot is at a critical juncture, challenging the critical daily support line at 1.2130 while capped by the bearish 50 DMA at 1.2200. The 14-day Relative Strength Index (RSI) is holding within the positive territory, keeping buyers hopeful.

GBP/USD: Daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.