BOE Preview: Guide to trading critical Super Thursday with GBP/USD, in three stages

- The BOE is set to refrain from a rate hike, yet a close call would shake the pound.

- Meeting minutes from the decision are set to show the divisions, providing insights on what's next.

- BOE Governor Bailey's leanings in the press conference will have the final say.

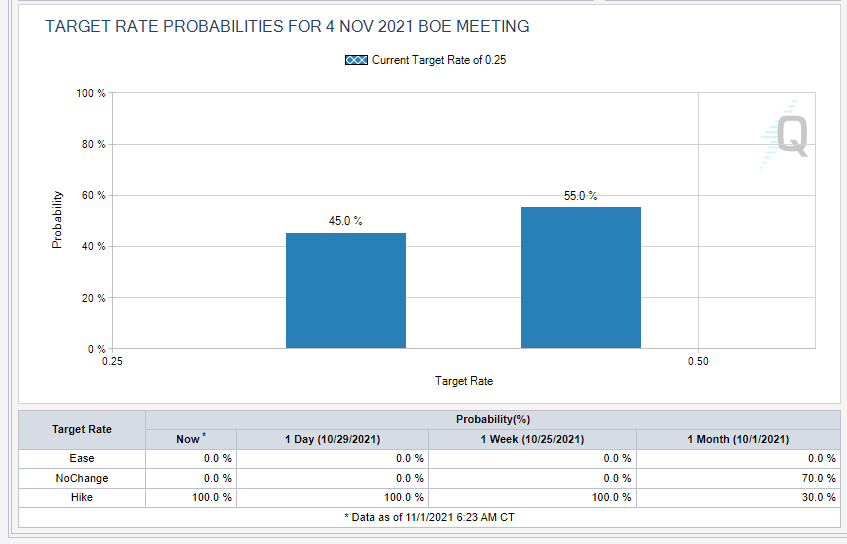

To hike or not to hike? In a rarity for markets, bonds are pricing a near coin-toss on the Bank of England's November decision. There are contrasting factors to consider, with a marginally higher chance that doves win this battle. Nevertheless, uncertainty is high and there are other two market-rocking events.

1) Time to act?

Less than 24 hours after the Federal Reserve's decision, traders will see a stark difference. While American policymakers clearly indicated their intention to announce tapering, the BOE's plans remain up in the air. At writing, bond markets are pricing a 55% chance of a hike, up from above 40% several days beforehand.

Why is uncertainty so high? While BOE Governor Andrew Bailey said the bank has to act, he did not specify when. Chief Economists Phil Huw seems keen to raise rates, but Silvana Terenyero – the last BOE member to talk about rates – sent a dovish message.

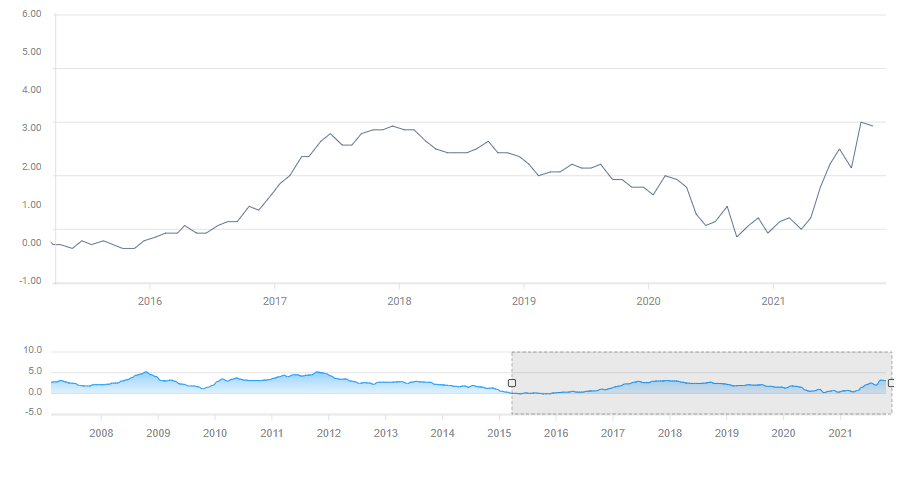

The lack of a clear direction cannot be solely blamed on communications as it is hard for the "Old Lady" – to assess how sticky inflation is. The headline Consumer Price Index (CPI) rose by 3.1% YoY in September, significantly above the BOE's 2% target. Global supply-chain issues have been compounded by Brexit-related shortages of lorry drivers and several goods on shelves, pushing prices higher.

Source: FXStreet

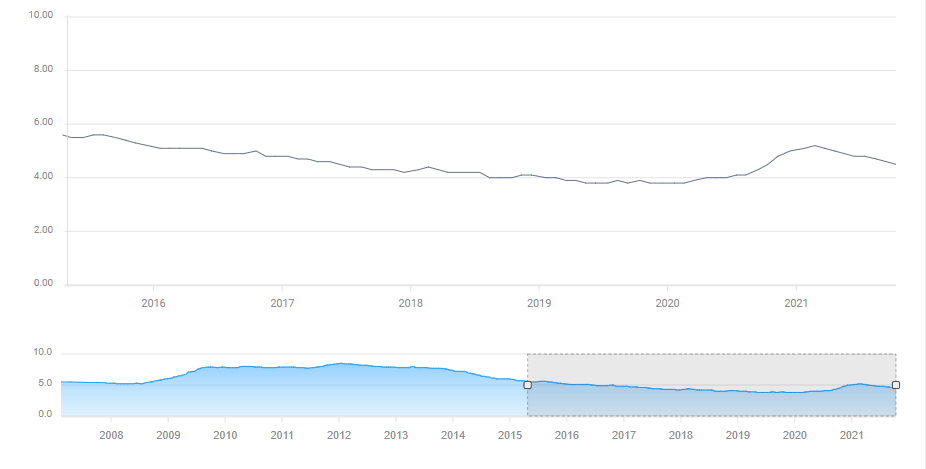

Developments in the labor market also cause some head-scratching. While the unemployment rate is down to 4.6% and wages are up, the expiry of the furlough scheme has yet to materialize fully.

Will job seekers that are left without support push salaries lower? Or are shortages of skilled workers in specific areas continue pushing costs higher?

Source: FXStreet

Another source of uncertainty comes from COVID-19. While most Brits are vaccinated, Britain lags behind some of its European peers and suffers from persistently high cases. The government's denial of considering restrictions only caused investors to fear that they would come. Even without official limits, the spread of the disease could cause people to shy away from public places, weighing on the economy and eventually pushing prices lower.

Will the BOE raise rates to fight inflation or wait longer? When in doubt, stay out, goes the adage relevant for traders. Central banks have been fighting to prevent deflation for years and waiting another month to hike borrowing costs from 0.10% to 0.25% seems to be the more cautious approach.

For the pound, the scenario is straightforward – jumping on a rate increase and tumbling otherwise.

2) How did members vote?

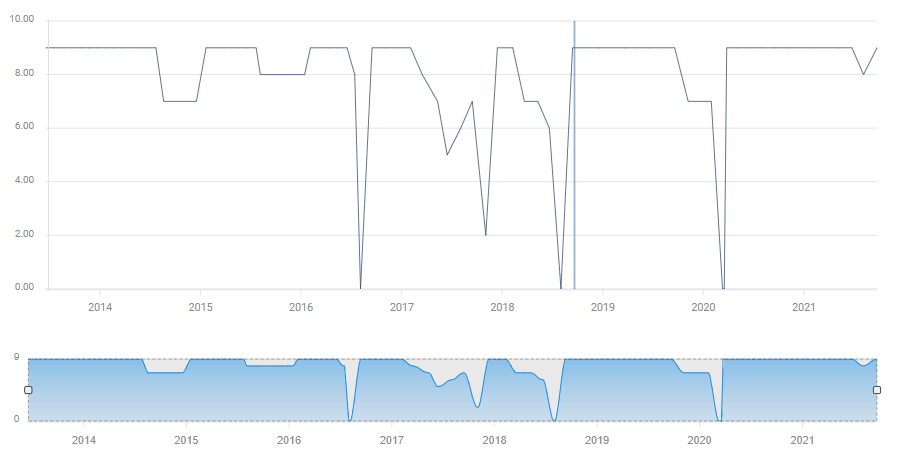

The BOE's Monetary Policy Committee (MPC) is a nine-member body with independently-minded participants. Contrary to the US Fed, the British institution also witnessed its Governor being outvoted by other members in the past.

Uninamity is common but dissent is not rare:

Source: FXStreet

If there is a large minority voting against the decision, it could either smooth the immediate reaction – minutes of the meeting are released alongside the decision – or trigger a rapid countertrend. That could cause some confusion in the immediate aftermath.

If the assessment presented here is correct and the BOE refrains from raising rates, a 6:3 or 5:4 vote would mean the BOE is itching to hike borrowing costs. It would trigger a bounce in the pound, especially if Bailey is within the minority.

In the opposite scenario of a decision to raise rates to 0.25%, a significant dovish opposition of three or four members would imply the decision was a closer call than earlier thought – suggesting additional moves may wait for longer. It could even cause investors to think the rate hike is a "one and done."

What happens if there is a large or even unanimous decision? An 8:1 and especially a 9:0 vote either to raise rates or hold back – something which seems unlikely given the public divisions – could trigger a stronger move in GBP/USD. In case of a hike, it could result in larger gains, while in case of a no-change decision, sterling could suffer even more. Investors are expecting a divided vote.

3) What does Bailey say about the future

The BOE publishes its decision, the minutes and the MPR at 12:00 GMT. The latter document includes inflation and growth forecasts, as well as broad commentary about the economy. However, with the focus on the future of interest rates, markets may be forgiven for ignoring the data and waiting for the governor to open his mouth at 12:30 GMT.

In case of a rate hike, will Bailey signal that more will come to battle rising inflation? Or will he stick indicate a "wait and see" approach after one move. In the former scenario, sterling shines, while in the latter, it sinks.

The same logic applies for a no-hike scenario. If Bailey says such a decision to wait was a close call and hints at a December hike, the pound would bounce. If he focuses on the weaker sides of the economy, it would plunge.

Conclusion

The BOE's rate decision is a rare coin-toss, and so are the voting patterns and the messages conveyed by the bank.

More: Fed Preview: Five dollar-moving things to watch out for on the historic tapering announcement

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.