- The Bank of England is set to leave its policy unchanged in its last meeting of 2020.

- Vaccine hopes and satisfactory economic data will likely result in a pound-positive message.

- Only a substantial message of upcoming negative rates could sink sterling.

Will the Bank of England rest in London while negotiators frantically discuss Brexit in Brussels? There is little the BOE can do – especially after it boosted its bond-buying scheme by £150 billion in its last meeting. Will BOE Governor Andrew Bailey end a turbulent year with a whimper? Not so fast.

While the "Old Lady" is set to leave its policy unchanged and does not release its quarterly report at this juncture, its updated views of the economy and hints about the next steps matter. The BOE's perspective is critical as recent figures project a murky picture and amid Brexit uncertainty.

Murky pictures

The labor market report is a fine example of sending mixed messages. On one hand, Britain's Unemployment rate remains depressed at 4.9% as of October, barely rising from the historic lows despite the coronavirus crisis. On the other hand, jobless claims jumped by 64,300 in November, worse than projected.

Source: FXStreet

The main theme of 2020 has been coronavirus and there is light at the end of the tunnel. The BOE convenes in the second week of Britain's vaccination campaign using the Pfizer/BioNTech jab – and additional immunization schemes are on the verge of approval.

However, Bailey and his colleagues announce their decision one day after London, where its headquarters are based, enters severe Tier 3 restrictions which are set to hit the economy.

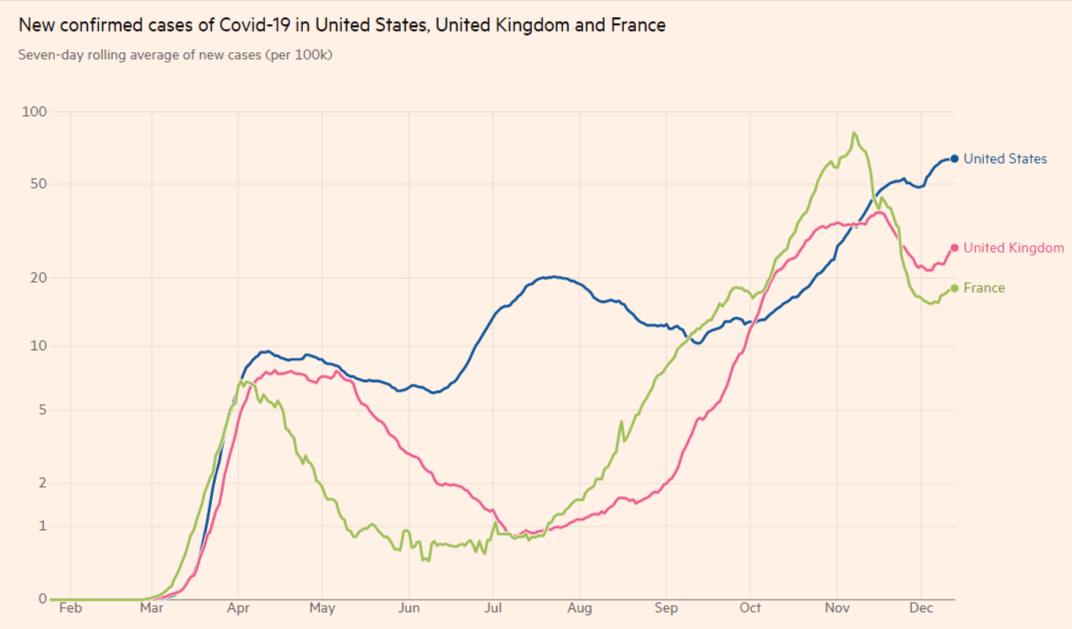

Source: FT

For the pound, the primary driver in recent days has been Brexit with growing uncertainty and precious time to reach an accord. A no-deal exit would subtract an additional 2% of Gross Domestic Product – in addition to 4% that the upcoming departure will cost the UK, according to the Office of Budget Responsibility (OBR). However, the ongoing talks promise higher chances of a deal.

Will the BOE see the glass half-full or half-empty on the economy, the virus and Brexit? There is a good chance that Bailey and co will opt for a rosier view – vaccines show the light at the end of the tunnel and negotiators continue deliberating. The bank is unlikely to go out of its way, but will likely convey a message of cautious optimism – boosting the pound.

Negative rates specter

Officials at the London-based institution have been flirting with the idea of setting negative interest rates since the spring, and even said that they are examining its implementation. Governor Bailey recently stated that work on the topic is ongoing. Each time sub-zero borrowing costs were mentioned, sterling shivered. While such a move would do little to support lending and the economy, it is undoubtedly adverse for the currency.

However, as time passes by, the BOE sounds like the boy who cried wolf – seemingly making toothless threats. Nevertheless, the bank could weigh on the pound by introducing fresh language that would signal setting negative rates in its next meeting – one which includes new economic forecasts. The changes for such a move seem low amid optimism, but that is probably the only risk facing sterling.

Conclusion

The BOE is set to leave its policy unchanged amid growing uncertainties and potentially lean toward pound-positive optimism – at least as long as there is no credible threat of an imminent rate cut.

More: GBP/USD Forecast: Three reasons to expect a sustained Santa rally for sterling

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0450 after German sentiment data

EUR/USD stays in positive territory above 1.0450 after retracing a portion of its bullish opening gap. The data from Germany showed that the IFO - Current Assessment Index declined to 84.3 in November from 85.7, while the Expectations Index edged lower to 87.2 from 87.3.

GBP/USD pulls back toward 1.2550 as US Dollar sell-off pauses

GBP/USD is falling back toward 1.2550 in the European session on Monday after opening with a bullish gap at the start of a new week. A pause in the US Dollar decline alongside the US Treasury bond yields weighs down on the pair. Speeches from BoE policymakers are eyed.

Gold price manages to hold above $2,650 amid sliding US bond yields

Gold price maintains its heavily offered tone through the early European session on Monday, albeit manages to hold above the $2,650 level and defend the 100-period Simple Moving Average (SMA) on the 4-hour chart. Scott Bessent's nomination as US Treasury Secretary clears a major point of uncertainty for markets.

Bitcoin consolidates after a new all-time high of $99,500

Bitcoin remains strong above $97,700 after reaching a record high of $99,588. At the same time, Ethereum edges closer to breaking its weekly resistance, signaling potential gains. Ripple holds steady at a critical support level, hinting at continued upward momentum.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.