BoE Interest Rate Decision Preview: A close call between 50 bps and 75 bps, GBP/USD set to suffer

- The BoE is widely expected to hike rates by 75 bps to 3.0% on ‘Super Thursday’.

- Governor Bailey could surprise with a 50 bps raise or deliver a 75 bps hike dovish variant.

- GBP/USD remains in a lose-lose situation, bracing for massive volatility.

The Bank of England (BoE) is widely known for its brutal honesty and conservative approach, which raises a big question of whether a 75 bps rate really is on the table this ‘Super Thursday’. A 50 bps rate hike or hints of smaller increases following a super-sized hike may be no surprise, with risks tilted to the downside for the GBP/USD pair.

BoE to walk a fine line

Markets are convinced that the UK central bank will announce its first 75 bps rate hike in 33 years at 12:00 GMT, accompanied by the Minutes of the meeting and the Monetary Policy Report (MPR), making it a ‘Super Thursday’. The BoE is set to raise the policy rate from 2.25% to 3.0%. Economic projections and Governor Andrew Bailey’s press conference will be also eagerly awaited.

In doing so, the BoE will take the lead from the US Federal Reserve (Fed) and the European Central Bank (ECB), in a show of its commitment to fight stubbornly-high inflation head-on. But what about the looming risks of a recession deepening and uncertainty over the country’s new fiscal framework?

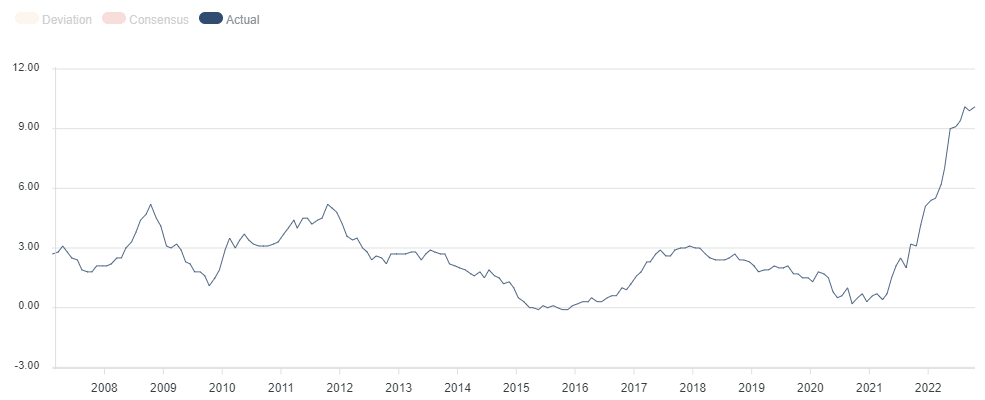

There are enough reasons to justify an outsized move by the Old Lady this ‘Super Thursday’, especially with tight labor market conditions allowing the bank the leeway to go big to bring down raging inflation. The UK annualized Consumer Prices Index (CPI) surged by 10.1% in September when compared to August’s 9.9% while outpacing estimates of a 10.0% print, according to the Office for National Statistics (ONS). The index surged to its highest level since 1982.

Source: FXStreet

In my view, the central bank will stick with its cautious approach and go for a 50 bps increase, as Bailey and company face a close call between 50 bps and 75 bps while targetting inflation control amid recession worries. The UK retail spending dropped by 1.4% in September while industrial production also declined by 1.8% MoM in August. Meanwhile, falling house prices and a 0.3% contraction in the September GDP suggest deteriorating economic performance. Note that GDP has missed forecasts in the previous two months. Most economists and industry experts believe that the UK economy is in recession. A super-sized rate hike could sink the ship deeper into murky waters.

Further, with a renewed sense of stability in UK politics, the BoE may not need to be as aggressive with tightening. The new UK Prime Minister Rishi Sunak and Chancellor Jeremy Hunt pushed back its fiscal plan to November 17 and, therefore, the BoE will have no idea about the new government’s spending plans. The central bank’s forecasts on growth and inflation outlook may not hold much relevance. Against this backdrop, a 75 bps rate hike announcement at this meeting will be seen as Bailey flying blind when stakes are higher than ever.

Another factor supporting the case for a half percentage point BoE rate hike is that some of the major global central banks have already embarked on slowing down their pace of tightening. The Reserve Bank of Australia (RBA) and the Bank of Canada (BOC) hiked their policy rates by 25 bps and 50 bps respectively, lifting their foot off the gas pedal. The Fed is also likely to hint at smaller rate increases in the coming months after hiking rates by the expected 75 bps on Wednesday.

The turmoil in the UK gilts market last month, fuelled by the previous leadership’s min-budget fiasco, has settled. Consequently, the Pound Sterling has recovered sharply against the US Dollar. The swift recovery in the GBP/USD pair from multi-decade troughs on 1.0300 has alleviated the inflationary pressures emanating from a weaker exchange rate. This could also be considered a reason behind the central bank’s likely moderated rate hike.

Trading GBP/USD with the BoE

The GBP/USD pair has managed to regain the 1.1500 level heading toward the critical Fed and BoE interest rate decisions. The Fed will announce its super-size rate hike later this Wednesday, which will set the tone for markets in the coming weeks. The US Dollar’s direction and risk sentiment will be closely watched once the Fed decision is out of the way and traders gear up for the BoE rate hike verdict.

A 75 rate hike by the English central bank accompanied by dovish wording, with downbeat growth forecasts or Bailey’s comments hinting at smaller increases in the coming meetings will take the wind out of cable’s recovery rally. Further, a split in the rate hike voting composition, with more MPC members leaning towards a 50 bps hike than the previous meeting, will be viewed as dovish.

Should the BoE announce an unexpected 50 bps rate lift-off, it would be an outright dovish outcome, leaving no stones unturned for GBP bears to take over command.

To conclude, there are a lot of moving parts to be closely examined in the BoE announcements while risk trends will also play a pivotal role. The outcome is likely to trigger massive volatility for GBP/USD, with the Pound Sterling poised to suffer under any circumstances.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.