- The Bank of Canada is set to raise interest rates despite a perceived GDP miss.

- High Canadian inflation expectations and growingly hawkish Fed rhetoric would likely trigger the same from BOC.

- Potentially weak US data released in parallel could exacerbate USD/CAD falls.

Last storm ahead of the summer – that seems to be the case for USD/CAD as it faces an imminent 50 bps rate hike by the Bank of Canada. While raising the Overnight Rate to 1.50% is in the price, a pledge to ferociously fight inflation has room to lift the loonie. Moreover, other factors also provide a backdrop for a bearish bias on USD/CAD.

Hawkish hike

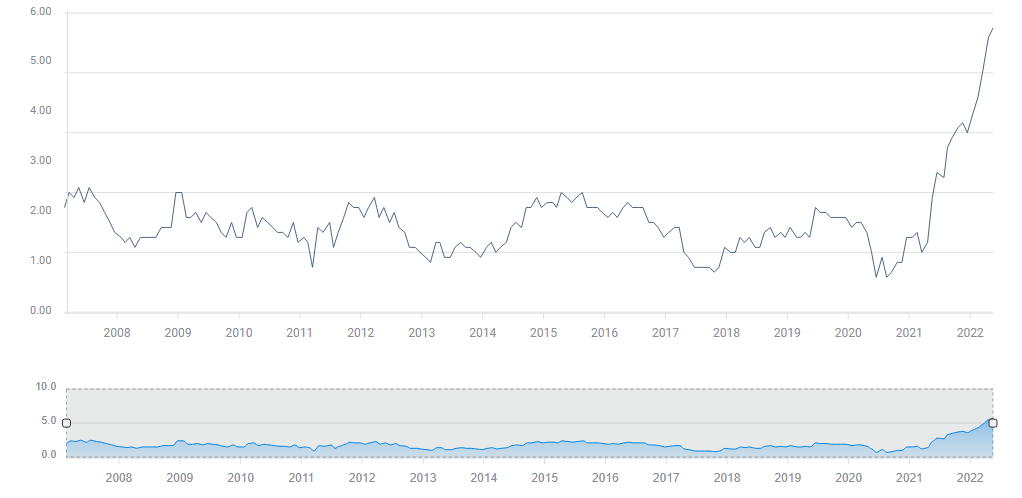

As elsewhere in the world, inflation is rising in Canada. However, the northern nation is similar only to the US in suffering rapid rises in underlying prices. The Core Consumer Price Index (Core CPI) jumped by 5.7% YoY in April. That is just below 6.3% in America – yet at least it is trending down south of the border.

Canadian core inflation:

Source: FXStreet

Increases in energy and food prices are impacted by global factors which central banks cannot control. However, when inflation is widespread, the BOC can cool lending and encourage saving by raising interest rates.

As mentioned earlier, markets know that BOC Governor Tiff Macklem and his colleagues are set to fight deep inflation with a 50 bps rate hike. But, what will they signal about the future?

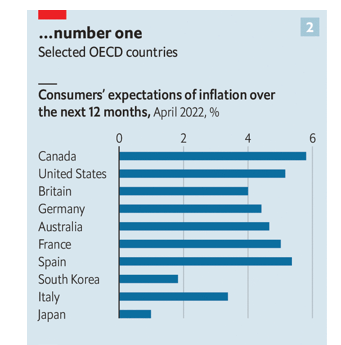

Inflation can become a self-fulfilling prophecy if consumers expect prices to rise and increase purchases now to get ahead of rising prices. In that, Canada already exceeds the US and many other developed economies.

Source: The Economist

Macklem needs to signal more rapid rate hikes are coming, perhaps indicating a move to tight monetary policy – raising interest rates above the level of inflation in order to choke off rising prices. Such a stance would boost the loonie.

Domestic inflation is not the only consideration for Macklem, but also the work of his peer in the US, Federal Reserve Chair Jerome Powell. The Canadian economy is highly dependent on US demand and the BOC is watching the Fed closely. The recent hawkish stance from Powell and his colleagues – Governor Waller hinted at non-stop 50 bps hikes – may also force policymakers in Ottawa to act more aggressively.

USD/CAD vulnerabilities

As I have explained, the Bank of Canada is ready for a hawkish hike, but how is USD/CAD positioned? The latest significant release from Ottawa was quarterly Gross Domestic Product (GDP) which came out at 3.1% vs. 5.4% projected. The substantial miss weakened the Canadian dollar.

On the other hand, it is essential to remember that the BOC foresaw an expansion of 3% in the first quarter – which means growth exceeded expectations. The softer loonie is ripe for strengthening.

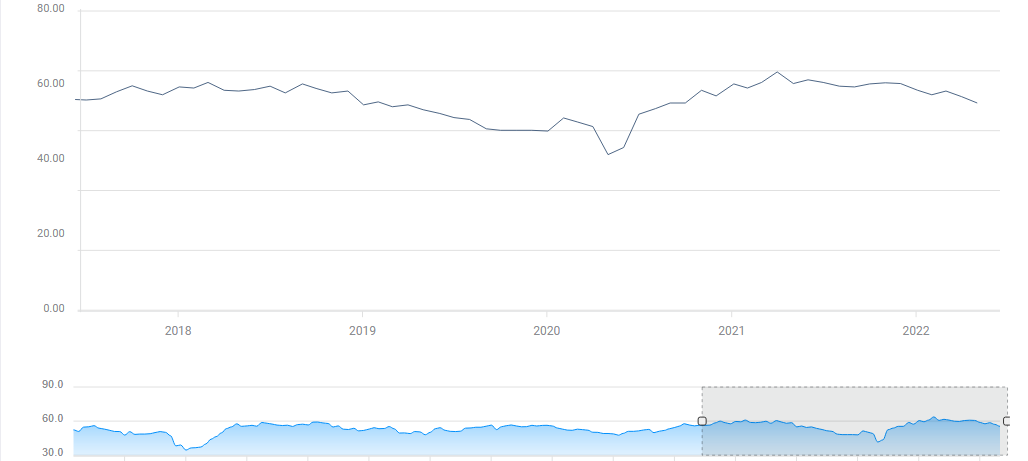

Just as the BOC releases its rate decision on June 1 at 14:00 GMT, the US ISM Manufacturing Purchasing Managers' Index comes out. Recent US figures have mostly missed expectations, and there is room for another weak figure that would hit the dollar.

The forward-looking ISM Manufacturing PMI is trending down:

Source: FXStreet

All in all, it seems like the perfect storm for USD/CAD to resume its falls.

Final Thoughts

It is hard to see the Bank of Canada stray away from the hawkish tones of the Fed and also the European Central Bank, the Reserve Bank of New Zealand and others. The Canadian real estate market may take a hit, but the BOC may "do whatever it takes" to bring inflation to its knees.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trims losses and approaches 1.1380

The US Dollar now succumbs to the re-emergence of the selling pressure and allows EUR/USD to recoup part of the ground lost and approach to the 1.1380 zone on Thursday. Earlier on Thursday, the ECB matched estimates and lowered its rates by 25 bps.

GBP/USD extends the daily recovery, looks at 1.3300

The upside impulse in the British pound remains everything but abated and now propels GBP/USD to the upper end of the range, shifting its attention to recent yearly peaks near 1.3300 the figure.

Gold breaks below $3,300, daily troughs

Further improvement in the sentiment surrounding the risk-associated universe put Gold prices to the test on Thursday. Indeed, the troy ounce of the precious metal faces increasing downside pressure and breaches the key $3,300 mark to hit new daily lows.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.