- BoC on the cards this week, and FX is at stake if RBA was anything to go by.

- Volatility is the name of the game, although the BoC is expected to stay on hold, the devil is in the detail.

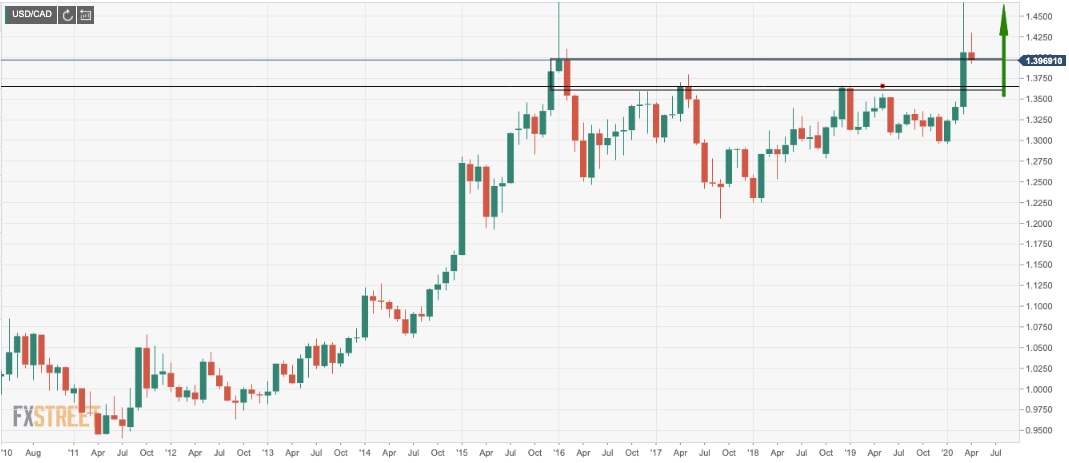

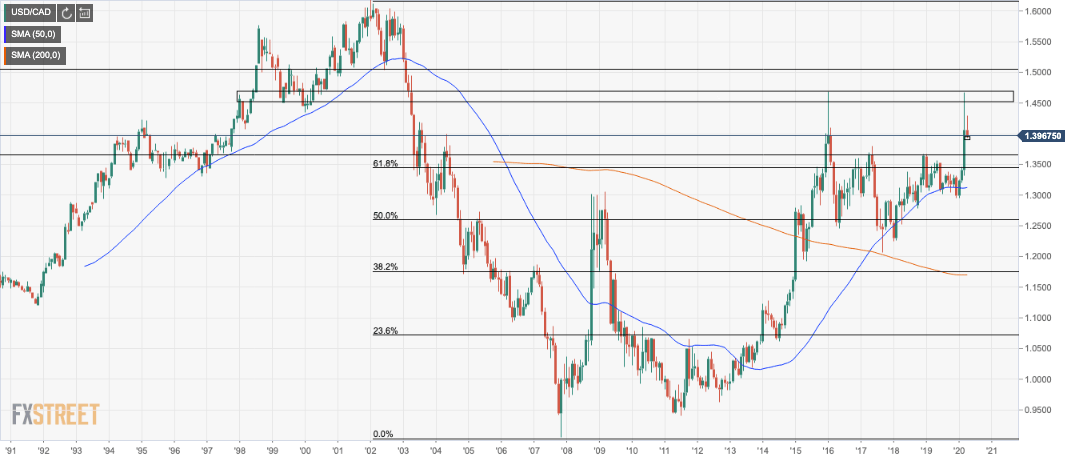

- COVID-19 expected to keep USD underpinned and weigh on commodity-FX, bulls looking for long term game to 1.5050s.

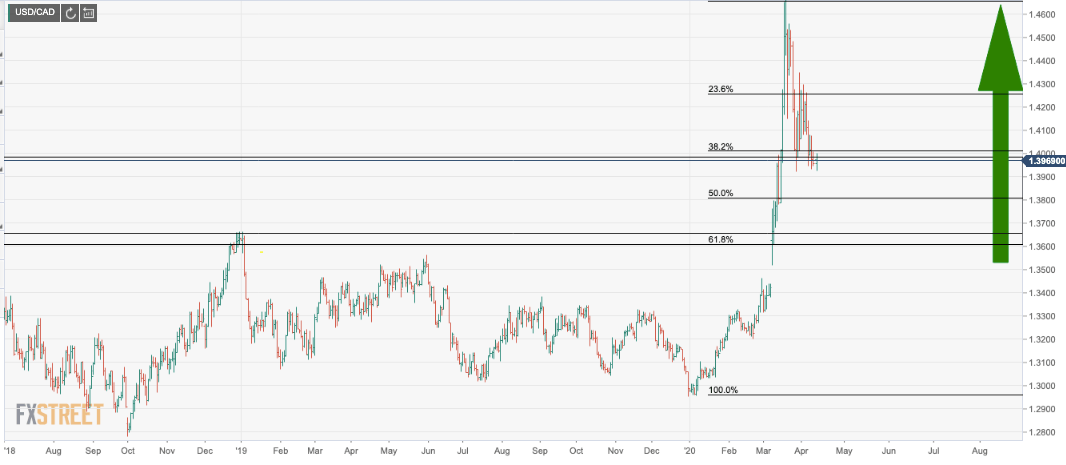

- Downside target comes in at a 61.8% Fibo, bulls seeking to buy the dip, low 1.36's.

The Bank of Canada is scheduled this week on the economic calendar and is expected to keep rates on hold. However, as ever, as w saw with the Reserve Bank of Austalia, markets will be tuned into the rhetoric surrounding the central bank's outlook for the economy and subsequent implications for quantitative easing measures pertaining to COVID-19.

Between now and the last fixed announcement date, the BoC has cut rates by an additional 100bps, launched Large Scale Asset Purchases (LSAP), and announced direct support for BAs, Provincial T-bills, CP, and CMBs. As it stands, the BoC O/N rate is at 0.25% its Large Scale Asset Purchases is at $5bn per week. It is likely that considering how much stimulus has already been pumped, markets are potentially writing off this meeting around.

However, the RBA should be a template that FX strategy may wish to take note of, considering how far the Aussie moved on the hint of a taper. At this point though, it would be widely expected for the BoC to keep its powder dry and remain on the cautious side, signalling its uncertainty towards the economic outlook and the impact of COVID-19, ready to act further should the situation deteriorate. In Canada, more than 650 people have died as of April 12 and overall death projections for the country are between 11,000 and 22,000, according to the Public Health Agency of Canada last week.

The COVID-19 crisis has lead to a shutdown in economic activity, so growth forecasts are expected to be highly negative for the first half of 2020. If there are any optimistic points of view for further out, and leading into 2021 even, then presumably the markets will see that as a signal that tapering will be on the minds of the central bank. "If the BoC forecast errs on the optimistic side (-3.0% or higher on 2020 GDP) then it would imply a lower bar to additional asset purchases or rate cuts. Conversely, if the BoC takes a more pessimistic path (-5.0% GDP growth or below), it would suggest that they believe their announced policy stance is appropriate," analysts at TD Securities explained.

"Economic projections should show a sharp contraction in H1 while full-year forecasts will provide more insight towards the path forward. We do not think the Bank is finished yet, but we expect further policy support will come from the next Governor," analysts at TD Securities argued.

While rates are expected to be on hold, the Large Scale Asset Purchases will be under scrutiny and possibly subject to an adjustment via the QE programme. The purchases at the mont are spread across the curve and given that it has only just been implemented, the bar is relatively high for an adjustment so soon and purchases are more likely to remain at a minimum of $5bn per week. CMB purchases, on the other hand, could be more subject to a tweak, currently limited to just $500mn per week.

FX implications

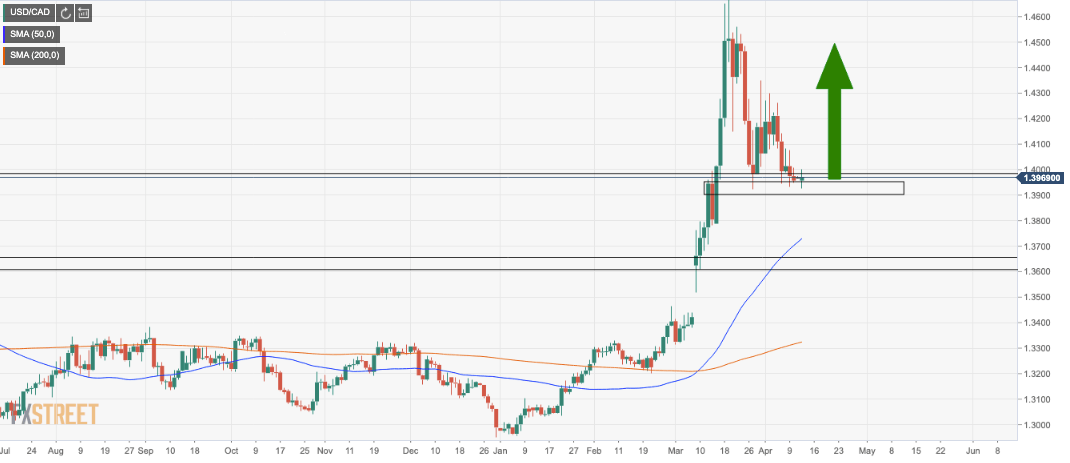

USD/CAD is at the mercy of COVID-19 and oil markets. On Sunday, 12th April, there was a decision made by OPEC+ to cut daily production by 9.7m bbls per day. More on that here, but that can help to unwind some pressure off the loonie due to its positive correlation to oil prices. However, the stark reality is that Canada’s traditionally strong oil and gas sector is confronted with both cyclical and structural change and there is still no getting away from the uncertainty and demand shock to the market with inventories sky high and still plenty of time for sellers to flood the market until the production cuts to kick in next month. Instead, the CAD will trade as a commodity complex-currency and risks remain tilted to the downside, with dips in USD/CAD a potential buy which brings us nicely to the longer-term charts, looking for structural support points.

We have support structure into the 1.3600/50s for downside potential taking the funds nicely into a 61.8% golden ratio retracement target on the daily outlook:

On the other hands, should the recent price action's structure be respected, then we have a bullish scenario:

In conclusion, in the absence of a V-shaped recovery sentiment, the risk sentiment is likely to keep the US dollar underpinned and a high volatility environment and the commodity-complex well anchored for the foreseeable future. 1.5050 could be on the cards on a break and hold above the long term resistance in this latter phase of accumulation back towards the 2002 highs:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats from fresh multi-year highs, holds above 1.1000

EUR/USD neared 1.1150 in the European session on Thursday, shedding roughly 100 pips afterwards. The Euro holds on to solid gains amid broad US Dollar weakness, after US President Trump unveiled aggressive tariffs on the "Liberation Day." Markets await mid-tier US data releases.

GBP/USD surges to multi-month tops near 1.3200 ahead of US data

GBP/USD paused its rally after briefly surpassing the 1.3200 mark, yet holds on to most of its intraday gains. The US Dollar plunged to a fresh YTD low amid worries about a tariff-driven US economic slowdown, lifting Fed rate cut bets and weighing on the Greenback. The focus now remains on the US data for further impetus.

Gold retreats below $3,100 from all-time peak

Gold price extends its steady intraday pullback from the all-time peak touched this Thursday, and pierces the $3,100 mark in the European session. Bullish traders opt to take some profits off the table and lighten their bets around the commodity amid slightly overbought conditions.

SOL is the winner as Solana chain turns into battleground for meme coin launchpad and DEX

Solana (SOL) gains nearly 2% in the last 24 hours and trades at 118.28 at the time of writing on Thursday. A Decentralized Exchange (DEX) and a meme coin launchpad built on the Solana blockchain have waged a war for users and compete for the trade volume on the chain.

Trump’s “Liberation Day” tariffs on the way

United States (US) President Donald Trump’s self-styled “Liberation Day” has finally arrived. After four straight failures to kick off Donald Trump’s “day one” tariffs that were supposed to be implemented when President Trump assumed office 72 days ago, Trump’s team is slated to finally unveil a sweeping, lopsided package of “reciprocal” tariffs.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.