BoC Follows Through with Rate Cut

The Bank of Canada cut interest rates by 50 basis points, following the RBA and the Federal Reserve.

The move comes as markets expect many other central banks to cut rates.

However, at the same time, there is talk of a possible stimulus package being the need of the hour.

Retail Sales in the Eurozone Recovers Slightly

The eurozone’s retail sales for January saw a modest increase. Data showed that retail turnover rose 0.6% on a month over month basis. This reversed part of the 1.1% decline from the month before. The data was broadly in line with estimates.

EUR/USD Maintains Consolidation

The euro continues to trade flat in the medium term. Price action is stuck within the range of the 1.1180 and 1.1100 region. A breakout from this level is imminent. However, the bias remains mixed currently.

Given the current volatility, we could expect to see a possible breakout higher.

Services Sector in the UK slows in February

The services sector in the UK expanded at a slower pace. This was because of the negative impact of sales due to the coronavirus outbreak.

Data from IHS Markit showed that services PMI fell to 53.2 in February, down from 53.9 in January. It was also slightly below the flash estimates of 53.3

GBP/USD Trades Flat Below 1.2858

The GBPUSD currency pair continues to trade flat, with prices trading below the price level of 1.2858. We could expect a modest retracement to this level where resistance is likely to form.

The stochastics oscillator is pointing to the upside and could signal a breakout.

ISM Non-Manufacturing PMI Rises More than Forecast

The US non-manufacturing PMI rose above estimates in February. Data from ISM showed that non-manufacturing PMI rose to 57.3. This was above estimates of 54.9.

The data also improved on January’s reading of 55.5. The markets did not react much to the news.

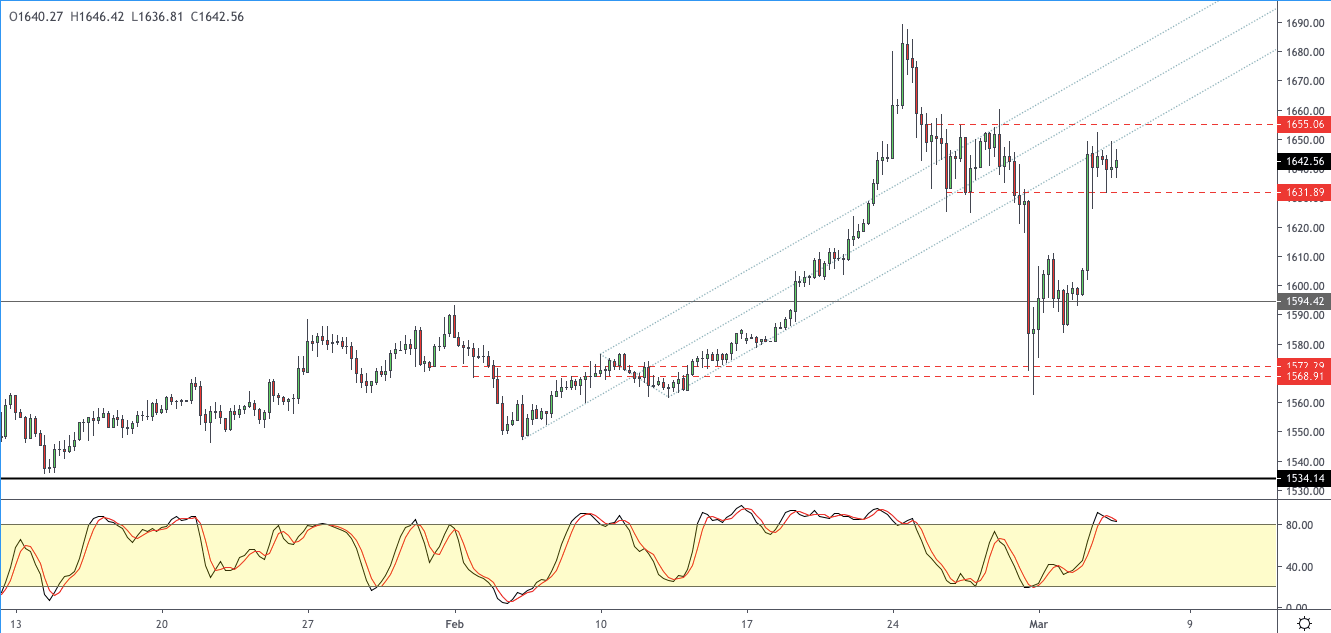

Gold Prices Likely to Move into a Range

The precious metal is consolidating within the range of 1655 – 1632. This sideways range is likely to continue in the near term. The precious metal could, however, see a possible breakout. The bias is shifting to the downside and this could be confirmed on a possible failure at 1655.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.