Bleeding stocks

S&P 500 was stopped in the 4,180s, and core PCE only a little hotter didn‘t help stock buyers even if yields retreated from intraday highs – they did retreat first thanks to no reassessment of inflation stickiness (it is sticky, and will keep accelerating this year still), and then the Israel move lighting fire under safe haven trades. Yes, I called the gold upswing to happen during Friday on Telegram, and there was another great day in our intraday Telegram channel bringing gainful calls to clients.

But where are we standing in the stock market and real economy prospects? Bond yields haven‘t yet peaked, and their increase is as much a function of still very resilient and (in rear view mirror only) accelerating real economy, and overwhelming supply of new and rolled over Treasuries hitting the market. Clearly, this dynamic has more time to play out as recession arrival isn‘t imminent – and no landing narrative is supportive to high yields and higher for longer theme where the Fed can somehow mop us the excesses without crashing the economy.

By the same token, yield curve steepeing is to continue, and serve as a countdown to recession. Remember the key summer event in central banking – BoJ expanding the permissible yield curve control band – and consider that it had to do unplanned interventions more than once a week in October, and that the yen is still weakening.

Also Q3 are proving not to be disastrous (I didn‘t expect them to be), which bodes well for a rally developing later this quarter – consumer is still strong (strongly spending even if with the help of credit cards as revolving credit is $1.3T now) and manufacturing solidly improving, hinting at better days in stocks – which I would tell clients about as soon as that becomes imminent.

Individual charts analytics have more details – and I hope you‘ve reviewed the extensive Sat video as well.

Let‘s move right into the charts (all courtesy of www.stockcharts.com) – today‘s full scale

article contains 6 of them.

Stocks and Sectors

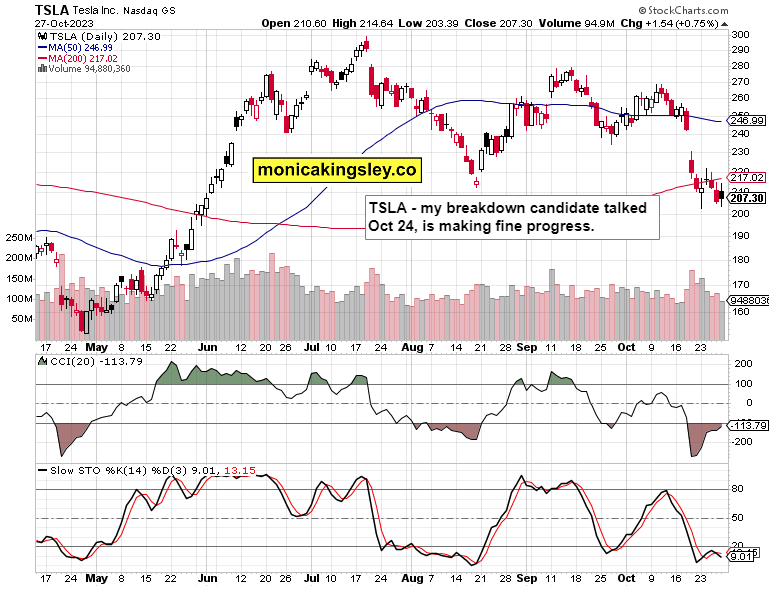

TSLA hasn‘t yet cleared the danger zone, and looks set to visit $180s as I wrote almost a week ago. Fine bearish progress made.

BAC, JPM or WFC, the story is the same – vulnerability and underperformance as talked already.

Gold, Silver and Miners

Even if miners with gold turned up, keeping above $2,020 would prove a short-term feat – gold is likely to move now back and forth within the high ground established, unless escalatory headlines jolt it higher later on.

Copper

$3.55 copper did indeed hold, and next bullish objective as per Friday‘s call, remains $3.68. The red metal is starting to show very short-term resilience, and that‘s as well thanks to consumer one year ahead inflation expectations having gone up.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.