Bitcoin and Gold: Two assets that can't afford to ignore

Given the fact that inflation is high in the United States, the precious metal is in a great situation. In reality, every single central bank is concerned about inflation. This is why the Fed's aggressive monetary policy isn't driving gold prices off a cliff. In general, the dollar index rises in response to the Fed's hawkish posture, which is bad news for gold prices. Yesterday's inflation data brought more bids to the market then many expected, and this pattern is likely to continue if inflation situation continues to go out of control.

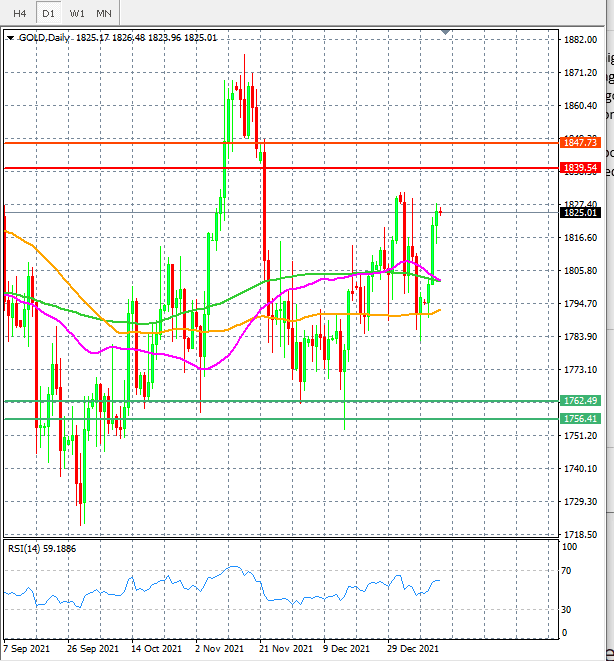

The gold price is now trading above the 1,800 support level, which is actively monitored by traders and is also seen as a key support level. In the following days, the gold price is anticipated to reach the 1850 handle.

Bitcoin

Bitcoin, which is naturally recognized as an inflation hedge, has seen some bids over the last few days. There is, however, more to the tale than that. According to exchange statistics, whales are tampering with the bitcoin supply. This indicates a large increase in bitcoin outflow from crypto exchanges to personal wallets. This is causing a lack of bitcoin supply, which is pushing the bitcoin price upward.

In terms of price action, the greatest and most crucial figure for bitcoin is the support of 40K, and as long as this remains intact, which is unlikely, we may expect bigger moves for the Bitcoin price.

Author

Naeem Aslam

Zaye Capital Markets

Based in London, Naeem Aslam is the co-founder of CompareBroker.io and is well-known on financial TV with regular contributions on Bloomberg, CNBC, BBC, Fox Business, France24, Sky News, Al Jazeera and many other tier-one media across the globe.