Bitcoin and Ethereum prices retreat after disappointing Coinbase earnings

Cryptocurrency prices retreated on Wednesday as investors reflected on the relatively weak earnings by Coinbase. The company, which is the second-biggest exchange in the world, made more than $1.2 billion in revenue in the second quarter. This was about $200 million lower than what analysts were expecting. It also lost users during the quarter as cryptocurrency prices retreated. Other companies that have exposure to cryptocurrencies like Robinhood and Square also reported weaker earnings. Still, cryptocurrencies like Bitcoin, Solana, and Ethereum are all a few points below their all-time high.

Global stocks were relatively mixed as investors reflected on the latest China, Germany, and US inflation data. In China, the headline consumer price index (CPI) rose by 1.5% in October, a significant jump from the previous 1.4%. In the same period, the producer price index rose by 13.5% as energy prices rose. These are important numbers since they will be passed to consumers. As such, there is a likelihood that global inflation will continue for a while. Meanwhile, in Germany, the headline inflation rose to 4.5% while the harmonised CPI rose by 4.6%. In the United States, the headline CPI rose by 6.2% while core CPI rose by 4.6%. These were the highest levels in decades.

In Europe, the DAX, FTSE 100, and CAC 40 indices were relatively unchanged. In the United States, futures tied to the Dow Jones and Nasdaq 100 index declined by more than 0.25%. There will be several companies in the spotlight today. First, Coinbase stock has dropped by more than 12% in premarket trading after weak earnings. While Unity Software delivered strong results, its stock dropped by more than 6% after it made a $1.7 billion acquisition. The biggest stock to watch will be Rivian, which is set to go public at a $77 billion valuation.

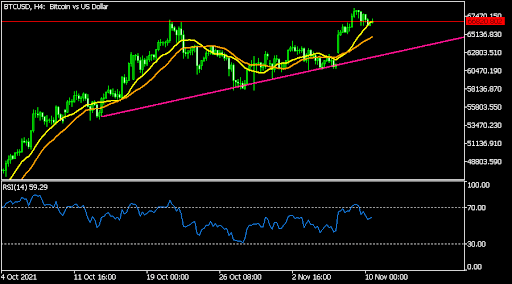

BTCUSD

The BTCUSD pair declined to a key support level at 66,820, which was the previous all-time high. The pair has formed a break and retest pattern, which is usually a bullish sign. It is also at the upper part of the cup and handles pattern. The pair has also risen above the 25-day and 50-day moving averages. It is also above the ascending trendline that is shown in pink. Therefore, the pair will likely break out higher in the coming days.

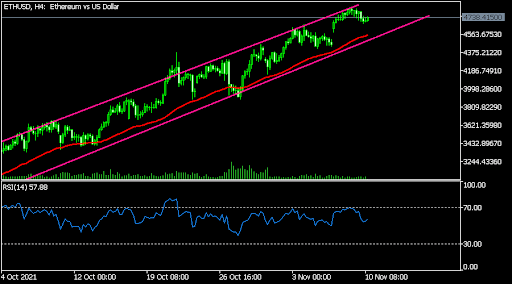

ETHUSD

Like the BTCUSD, the ETHUSD pair retreated slightly on Wednesday. The pair is trading at 4,745, which was slightly below the all-time high of 4,830. On the four-hour chart, the pair has moved above the 25-day and 50-day moving averages. It is also between the ascending channel while the Relative Strength Index (RSI) is slightly below the overbought level. Therefore, the pair will likely keep rising as bulls target the key resistance at 5,000.

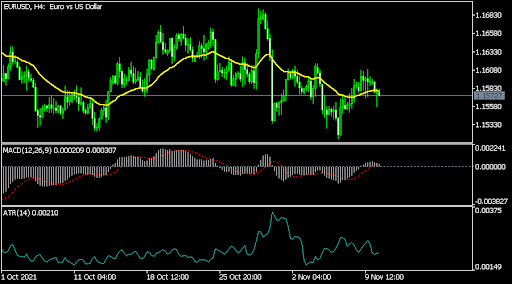

EURUSD

The EURUSD was unchanged immediately after the US published its inflation data. The pair is trading at 1.1573, where it has been in the past few days. It is also along with the 25-day moving average while the average true range (ATR) and the MACD have remained unchanged. Therefore, the pair will likely remain in this range during the American session.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.