Big moves ahead: ECB’s interest rate cut and the future of EUR/USD

The European Central Bank is set for a major move: an interest rate cut in June. This decision, backed by top officials like ECB Vice President Luis de Guindos and French central bank chief Francois Villeroy de Galhau, even has hawks like Klaas Knot and Joachim Nagel on board. What does this mean for the euro? Expect EUR/USD to face a downward slide in the second half of 2024?

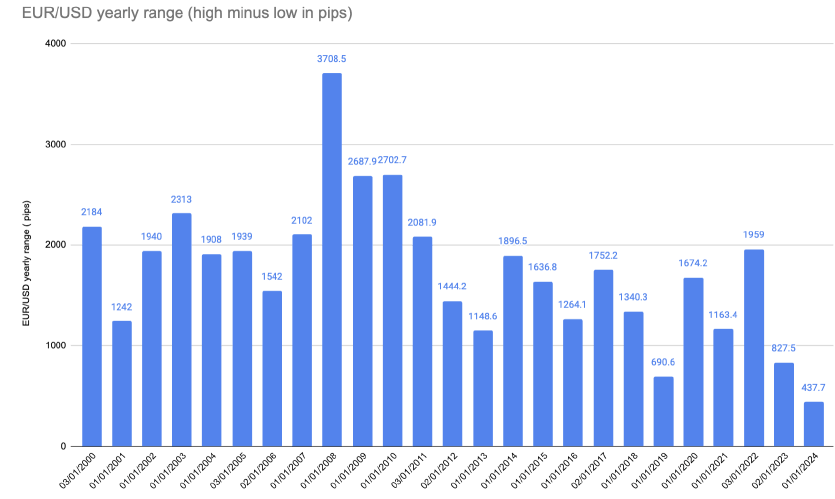

Since 2000, the yearly range (high minus low) of EUR/USD has typically exceeded 1100 pips, except in 2019 and 2023, when it was below 1000 pips. Since 2012, the range has not surpassed 2000 pips.

Source: Adopted from Reuters

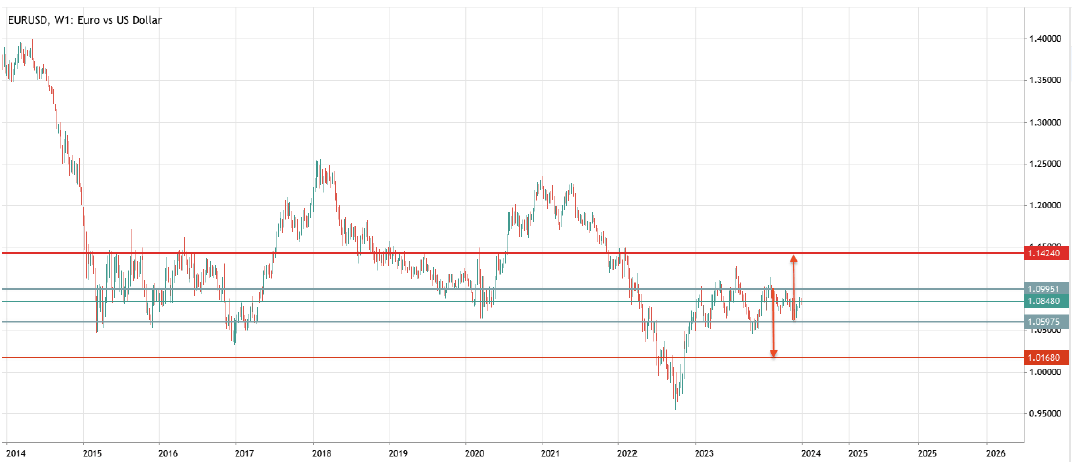

In 2024, the year high is 1.0995 and the year low is 1.0597, resulting in a current range of 437 pips. If 1.0995 remains the high and the range reaches 1100 pips, the low would be 0.9895. If the range is similar to last year's 827 pips, the expected low would be 1.0168 or the high would be 1.1424.

Source: Deriv MT5

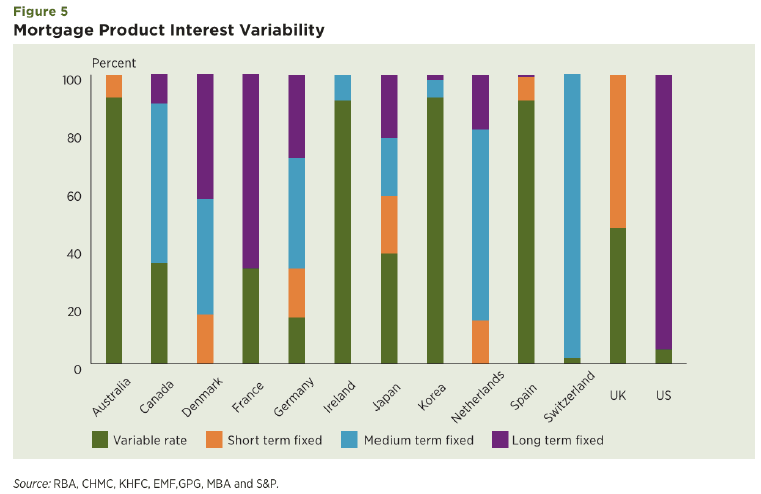

The variation in mortgage scheme patterns will influence the central bank's decision on rate cuts. The type of mortgage affects how interest rates impact the property market. In the US, most homeowners have long-term mortgages, so high interest rates have little effect on them. In the UK and Eurozone countries like Germany, Ireland, the Netherlands, and Spain, long-term fixed mortgages are rare. As short-term and medium-term mortgages mature, they need new terms. This makes high interest rates in Europe more likely to impact the housing market and bank asset quality.

Interest rate paths should differ between the US and Europe. As ECB President Christine Lagarde stated, "We are not Fed-dependent."

Source: mba.org

The Fed is expected to delay rate cuts, and the market no longer anticipates a cut in July. This could widen the rate differential between the US and Europe, potentially causing funds to flow to the US and weakening the euro.

The Eurozone Manufacturing PMI rose to 47.4 in May 2024, a 15-month high, signalling a positive trend for the EU economy. An ECB rate cut is expected to boost the PMI further. With low business inventory levels, the manufacturing sector is poised for recovery, reducing the immediate risk of recession.

Unless Ukraine and Russian war elevated, but both parties is running out of steam now, both countries have financial constrain for them so a designsive victory of either side is not expected.

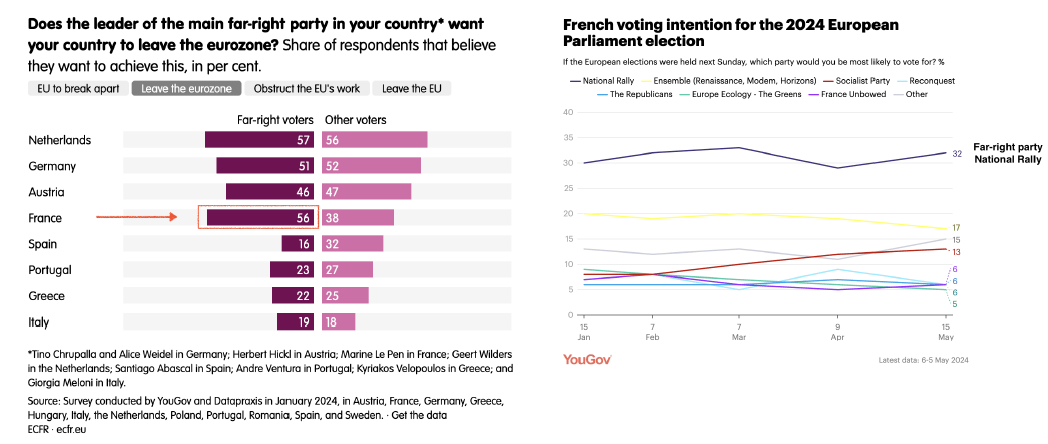

The EU Parliament election is crucial, particularly for French MEPs. YouGov’s latest poll (6-15 May) shows the right-wing 'Rassemblement National' led by Jordan Bardella leading with 32% of the French vote. This could lead to a discussion of Frexit or complicate EU reforms, potentially depreciating EUR/USD if the political climate deteriorates.

Source: European Council on Foreign Relation Source :YouGov

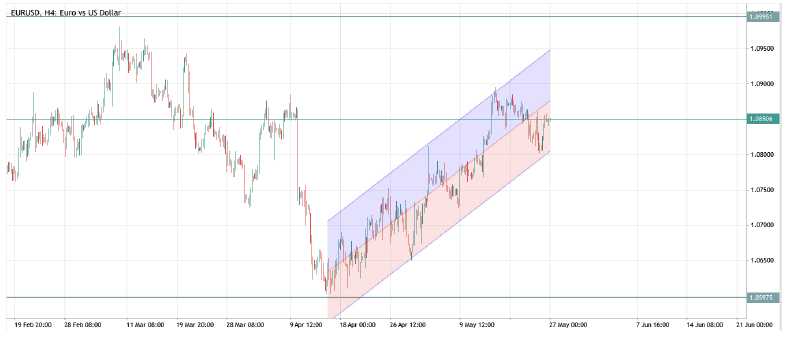

Technical analysis in short term

Source: Deriv MT5

The four hour chart show the EUR/USD is short term uptrend with support at 1.0806. Unless 1.0806 break down, the EUR/USD still have chance to testing 1.0950 resistance of the channel.

Conclusion

EUR/USD is likely to depreciate in the second half of the year due to rate differentials, slower EU economic growth, and political instability from the EU Parliament election, driving funds to the US dollar. Inflation data and the Fed's rate cut timetable will be key drivers of EUR/USD direction.

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.