Big move coming for S&P 500 according to this market breadth indicator [Video]

![Big move coming for S&P 500 according to this market breadth indicator [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse3-637299021683820849_XtraLarge.jpg)

Original content: Big move coming for S&P 500 according to this market breadth indicator [Video]

The bullish divergence in the stock market breadth and the price volume analysis of S&P 500 using the Wyckoff method suggest a potential big move ahead.

Click and watch the video below on YouTube (Pro Tip: adjust the speed to 1.5–2X). Pay attention to the analogue comparison using the Wyckoff trading method to spot the clues and tell-tale signs for the next big move.

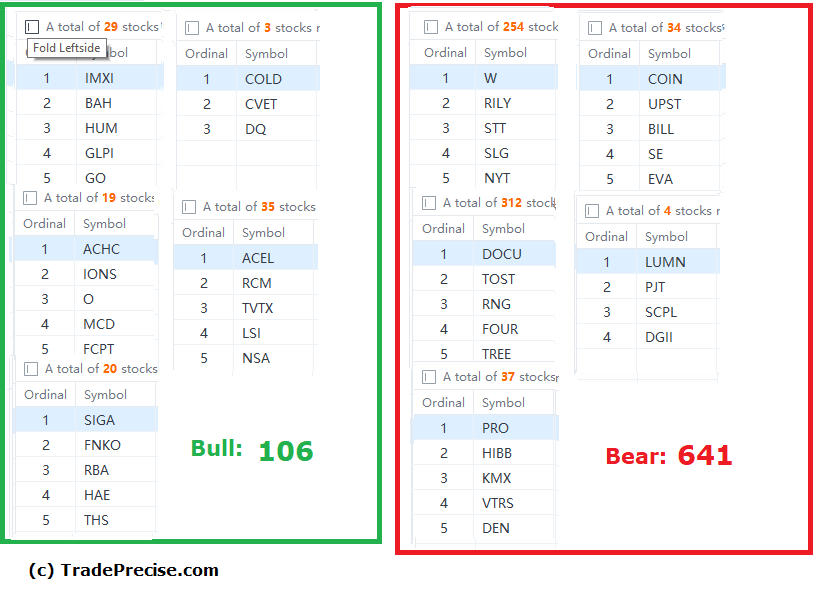

The bullish setup vs. the bearish setup is 106 to 641 from the screenshot of my stock screener below. The bearish setup has spiked from 80 to 641, as the market dropped from 2–4% last week. Yet, the bullish setup has increased from 24 to 106, which was a constructive sign for the bullish scenario despite the bearish market.

Another encouraging sign is the addition of 1 more industry group that outperforms the market on top of the China stocks theme and the Biotech group.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.