Biden drama continues – Trump delivers final RNC keynote

Asia market update: JP CPI steady; CN 3rd Plenum ends; Biden drama continues; Trump delivers final RNC Keynote.

General trend

- Japan’s National CPI for June came in slightly below expectations, but still equal to or slightly above levels of recent months. The BOJ meets for its rate decision, considered to be live, on July 31st. BOJ also expected to cut monthly JGB purchases by some amount lower than the current ~¥6T per month.

- Late yesterday, the China CCP released the Communique of its 5-yearly Third Plenum. Light on detail and high on rhetoric, it was noted by analysts that more precise reform plans may be unveiled at the upcoming Politburo meeting at the end of July. What was notable for what is traditionally a five-year-plan economic strategy planning meeting was the emphasis placed on factors such as social stability, the need for absolute leadership of the Party over the army and the ‘inevitability’ of Urban-Rural integrated development. While international financial media duly repeated the messaging put out by the CCP, the underlying message was clear; prepare for even tighter control of society and the economy.

- China CCP Central Committee media briefing for Third Plenum notably led by saying Xi Jinping played a decisive role throughout the Plenum. This is notable as there have been widespread, unsubstantiated rumors throughout Chinese social media this week that Pres Xi may have suffered a stroke earlier this week. Photos of Xi purportedly at the event thus far are inconclusive on date, time and location. Chinese media has also been very circumspect during the four-day event, when usually they promote multiple announcements throughout the four days. However, at this Plenum, nothing was released until the event concluded.

- Comments from US Fed's Daly said that while recent data has been really good, there must be focus on core risks when monitoring bank stability.

- This was later followed up by US Fed’s Bowman who gave a a detailed outline on liquidity risks, supervision and potential regulatory reform.

- Former US Pres Trump delivered the final Keynote speech at the 2024 RNC Keynote, emphasizing familiar themes of stopping illegal immigration, bringing inflation down, drilling for more oil, ending all foreign crises that the US is involved in, tough talk on China trade, ending EV mandates. Press noted the overall unifying tone of the speech, softer than a usual Trump speech, where he also gave his own personal experience of the shooting that nearly took his life last week.

- REITS down in Australia on higher yields.

- Taiwan dollar hits 2016 lows as Taiwan Semiconductor also lost a further 2.5%.

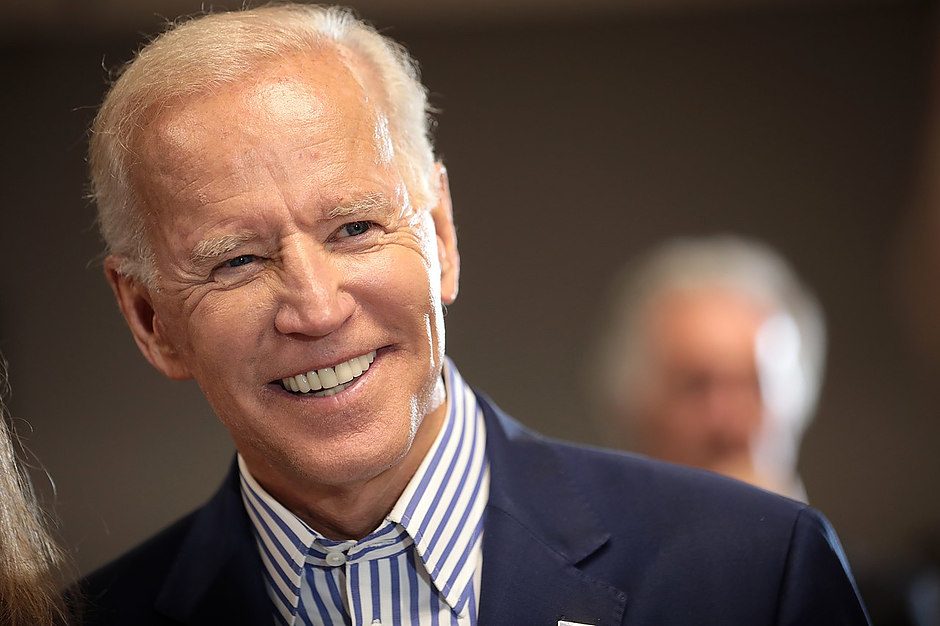

- Continued back-and-forth concerning Pres Biden’s decision to keep running or step down, with conflicting statements from his team versus a chorus of senior Democrats saying they want him to step down.

- US equity FUTs clawed back a portion of overnight losses during Asian trading.

Looking ahead (Asian time zone)

- Fri July 19th (Fri eve GB Retail Sales).

Holidays in Asia this week

- Mon July 15th Japan.

- Wed July 17th India.

Headlines/economic data

Australia/New Zealand

- ASX 200 opens -0.3% at 8,012.

- Australia sells A$700M v A$700M indicated in 2.75% Nov 2027 bonds; Avg Yield: 3.9797% v 3.9644% prior ; bid-to-cover 4.39x v 3.02x prior.

- Australia to issue new Dec 2035 T-bond next week of July 22nd.

China/Hong Kong

- Hang Seng opens -1.0% at 17,603; Shanghai Composite opens -0.5% at 2,963.

- US Trade Official McCartin said to be in Geneva on Friday for WTO China meeting - financial press.

- China MOFCOM: China to impose tariff on US-made Propanoic Acid.

- China Communist Party Central Committee media briefing for Third Plenum.

- China CCP third plenum communique: china to better maintain market order; to build high-level socialist market economic system by 2035; to promote reform in taxation and finance sector - press [**Note: some analysts point out that precise reform plans may be unveiled at upcoming Politburo meeting end-July] [overnight update]asia.

- China state CCTV shows China Pres Xi attending the Third Plenum meeting and delivering a speech - press [**Note: timing of the footage is unclear; There was completely unverified and unconfirmed speculation in social media Xi might have had some health issue] [overnight update].

- China Commerce Min: Selects three companies in EU anti-dumping probe of EU pork - financial press [overnight update].

- China PBOC sets Yuan reference rate: 7.1315 v 7.1285 prior.

- China PBOC Open Market Operation (OMO): Sells CNY59B in 7-day reverse repos; Net injects CNY57B v net injects CNY49B prior.

Japan

- Nikkei 225 opens -0.4% at 39,965.

- Japan Jun national CPI Y/Y: 2.8% V 2.9%E; CPI ex-fresh food (core) Y/Y: 2.6% V 2.7%E.

- Japan releases weekly flows data [period ended July 12th]: Foreign buying of Japan equities: ¥227.6B v ¥603.5B prior; Japan buying of foreign bonds: -¥208.9B v ¥209.7B prior.

- Japan govt cuts FY24 GDP growth forecast to 0.9%, from 1.3% in Jan (as expected).

- Japan PM Kishida: Needs to be cautious about effects of rising prices due to weak Yen - Japanese press.

- (JP) Japan Fin Min Suzuki: To attend G-7 and present Japan's stance on FX and global economy.

- Bank of Japan (BOJ) accounts data suggests no new intervention on July 17th - Press [overnight update].

South Korea

- Kospi opens -1.0% at 2,794.

- Samsung Electronics: Reportedly Samsung union (~30K workers, about 25% of Samsung total) and Samsung management may resume wage talks as its strike enters into 11th day – press [overnight update].

Other Asia

- Taiwan Foreign Minister: We need to rely on ourselves for defense, defense spending continues to rise.

- (IN) India Central Bank (RBI) July Bulletin: Global economic activity appears to be strengthening; Consumer price inflation ticked up in June [overnight update].

- Taiwan Semi: Reports Q2 (NT$) Net 247.8B v 238.8Be, Op 286.6B v 202.0B y/y, Rev 673.5B v 673.5B prelim (v 480.8B y/y) [overnight update].

North America

- (US) Former Pres Trump accepts the GOP Presidential Nomination and gives Keynote Address to conclude the 4-day RNC for 2024.

- (US) Trump campaign releases excerpts of Trump’s RNC speech (in advance of the former President's speech).

- (US) Fed’s Bowman (voter, hawk): Speech on Liquidity, Supervision and Regulatory Reform.

- (US) Fed's Daly (voter): Recent data has been really good; Must focus on core risks when monitoring bank stability - comments at conference hosted by Dallas, Atlanta Feds.

- (US) "Biden for President" campaign calling all-staff-meeting for Friday - US press.

- (US) Biden-Harris Campaign Co-Chair: NYT reporting on Biden is 'wrong'; Biden can 'win'.

- (US) Follow up: Former House of Representatives speaker Pelosi reportedly believes Pres Biden can be convinced soon to drop out - WAPO.

- (US) Reuters citing one Biden campaign official source on Biden candidacy: "Yes, it's over. Just a matter of time"; Another source said "Biden's soul searching is actually happening, I know that for a fact... He's thinking about this very seriously."

- (US) Initial jobless claims: 243K V 229KE (1-year high); continuing claims: 1.867M V 1.856ME (highest since early Mar 2024).

- (US) July Philadelphia Fed business outlook: 13.9 V 2.9E (above all estimates); New Orders: +20.7 v -2.2 prior (highest since March 2022).

- (US) Fed’s Logan (non-voter): Makes case FDIC deposit insurance limit too low; All eligible banks should be prepared for discount window - prepared speech.

- (US) May net long-term TIC flows: -$54.6B V $123.1B prior; total net tic flows: $15.8B V $66.2B prior.

Europe

- (IL) Explosion reported in a Tel-Aviv building, the source of the explosion is not yet known; Security services are checking suspected drone attack - press.

- (UK) July GfK Consumer Confidence: -13 v -12e (highest since Sept 2021).

- UK Chancellor of the Exchequer (Fin Min) Reeves: Difficult decisions ahead to fix UK economy; Want to make it easier for UK firms to sell in EU; New UK fiscal lock to prevent Truss-style turmoil - tv interview.

- (EU) ECB leaves key rates unchanged; as expected.

- (EU) ECB Chief Lagarde: Question of what to do in September 'wide open'; Determined not to have predetermined rate path - press conf comments.

- (ZA) South Africa Central Bank (SARB) leaves interest rates unchanged at 8.25%; as expected.

- (EU) ECB officials reportedly consider if only one additional cut is feasible in 2024 - press.

Levels as of 01:20 ET

- Nikkei 225, -0.2%, ASX 200 -1% , Hang Seng -2.1%; Shanghai Composite -0.2% ; Kospi -1.4%.

- Equity S&P500 Futures: +0.2%; Nasdaq100 +0.3%, Dax flat; FTSE100 -0.4%.

- EUR 1.0901-1.0884 ; JPY 157.73-157.06 ; AUD 0.6708-0.6694 ;NZD 0.6081-0.6021.

- Gold -1.2% at $2,425/oz; Crude Oil -0.7% at $80.74/brl; Copper +0.3% at $4.2763/lb.

Author

TradeTheNews.com Staff

TradeTheNews.com

Trade The News is the active trader’s most trusted source for live, real-time breaking financial news and analysis.