Bear over quad witching

Friday brought a much awaited reversal of all the CPI and PPI stock market gains, raising the Nov rate hike odds finally above 50%, with more tech-led selling as 10y yield finally took on 4.33% again, and it‘s not done yet. Nasdaq succumbing, accompanied by discretionaries with communications – more so than cyclicals with value – is the proper constellation of what markets would see more often as we approach early Oct.

Simply put, relatively good economic figures in the States raise both the hike odds and duration of Fed pause expectations (which is what markets ignored through Thursday), bringing up rates differential vs. Europe and Japan, resulting in rising dollar. Add in the slowly recovering China, and not finished rising oil prices, and you have more evidence and reasoning for return of inflation I timed to return with Aug CPI data and reaching at least 4.4% in Dec 2023, and also for its stickiness with headline reverting back towards core rather than the other way round.

Couple with tight job market, wage pressures, still tame unemployment claims, depleted excess savings and nominal retail sales still well below spring 2021 peak – all in times of no recession yet, then add in sizable fiscal deficits rivaling truly recessionary ones, with refinancing needs at much higher rates, and it‘s little wonder that default rates approach the GFC levels while unemployment is below 4% still. Just imagine what merely 1% rise would do in the future.

The outlook in stocks, chiefly the Top 7 ones, remains to underperform the rest, and for more than a couple of days this month still. It means tech would be again leading the downswings, bringing up fine Friday gains in Intraday Signals, and of course benefiting you, the daily publications subscribers as well, just like today. The bear is slowly waking up from hibernation, and premarket doesn‘t surprise.

Let‘s move right into the charts – today‘s full scale article contains 3 of them.

Gold, Silver and miners

Buying interest remained with gold, with delay as inflation positioning kicked in on not too bad latest data. Goldilocks economy for the moment still rules, and expectations of little in the way of more Fed tightening is still on. It‘s unlikely the Fed would convincingly jawbone the markets into Nov rate hike certainty Wednesday, meaning that copper also remains well bid above $3.75.

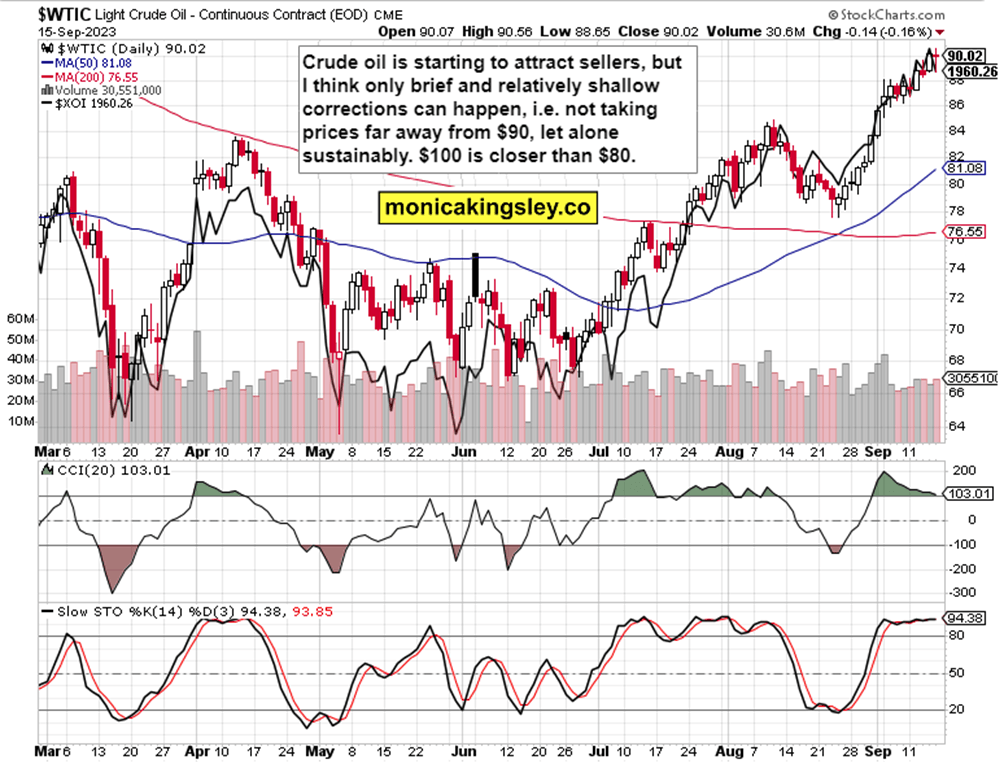

Crude Oil

Crude oil fulfilled the consolidation expectations, and more of the same can be expected in the following days. Still before recession becomes apparent, $100 would be approached, with all the inflation and Fed tightening consequences.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.