Basking in BTC glory

S&P 500 offered a great intraday reversal yesterday, and now I‘ll present analysis I sent to clients before the opening bell – this will cast best light on how I was able to capture in intraday terms fine gains for them. Quoting yesterday‘s daily premium analytics alongside the chart given:

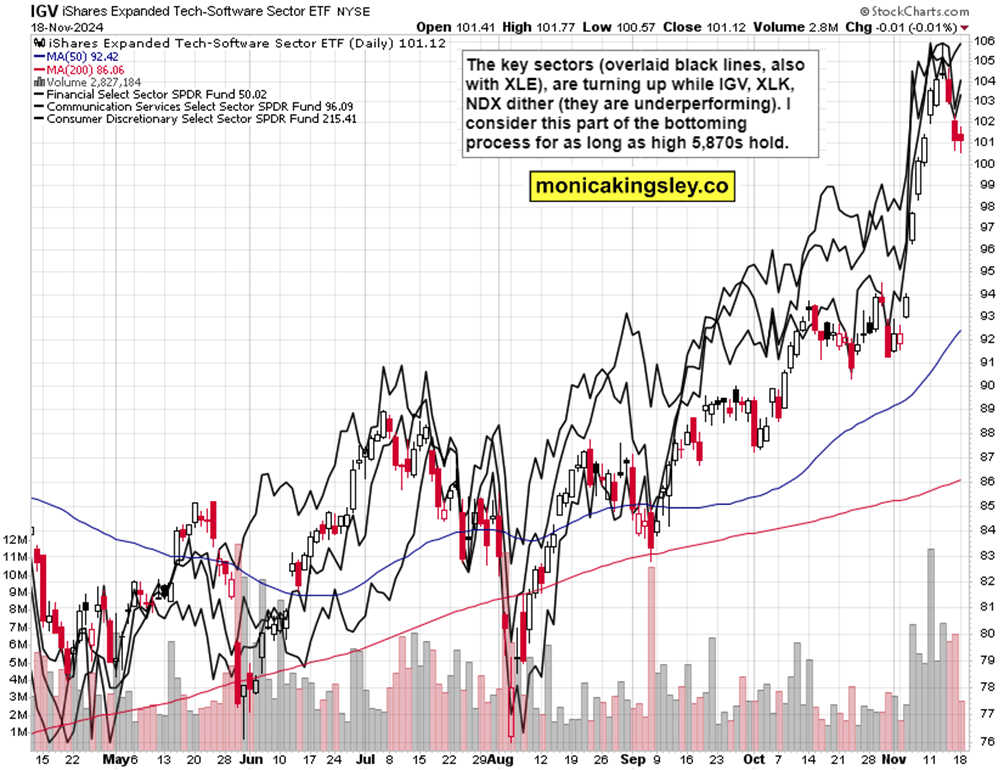

(…) Sectorally, the encouraging bottoming signs are there, whether tech kicks in or not yet. The key demarcation line is in the mid 5,870s – with breaking below (or conversely remaining above) the largest hourly green candle during yesterday‘s regular session providing the key sign as regards the daily outlook. Thus far, I don‘t have bullish conviction that the bottom is truly in (trappy session ahead) – the index looks forming a bear flag/pennant.

The fact of still elusive Bitcoin correction coupled with flows into my key sectors on that day‘s watch, is what drove the switch to long bias almost into the closing bell.

Let‘s mve right into the charts – today‘s full scale article contains 3 more of them, with commentaries.

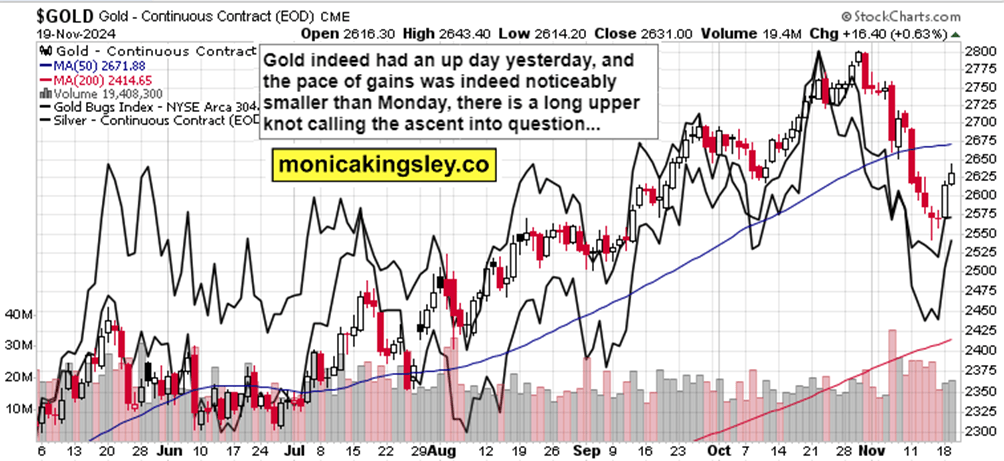

Gold, Silver and Miners

Sideways, at best sideways day ahead in gold, and I‘m looking for the risk-off echo of yesterday to catch up with silver, and keep a lid on copper (the red metal will be inspired to move more alongside oil today).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.