Basis trade

S2N spotlight

Today is a very happy day for the Bermans. My son, who lives in Israel, is back for 2 weeks. My writing may be a little limited as I spend time with the family and also the Passover holiday starting on the weekend. The markets are action-packed at the moment, and while I am writing, the S&P 500 futures are close to putting in new lows for the year.

I wanted to share something that many might not be aware of but is important, as it is all part of the machine that greases the financial system. The spotlight was inspired by Dr. Torsten Slok, the chief economist of Apollo.

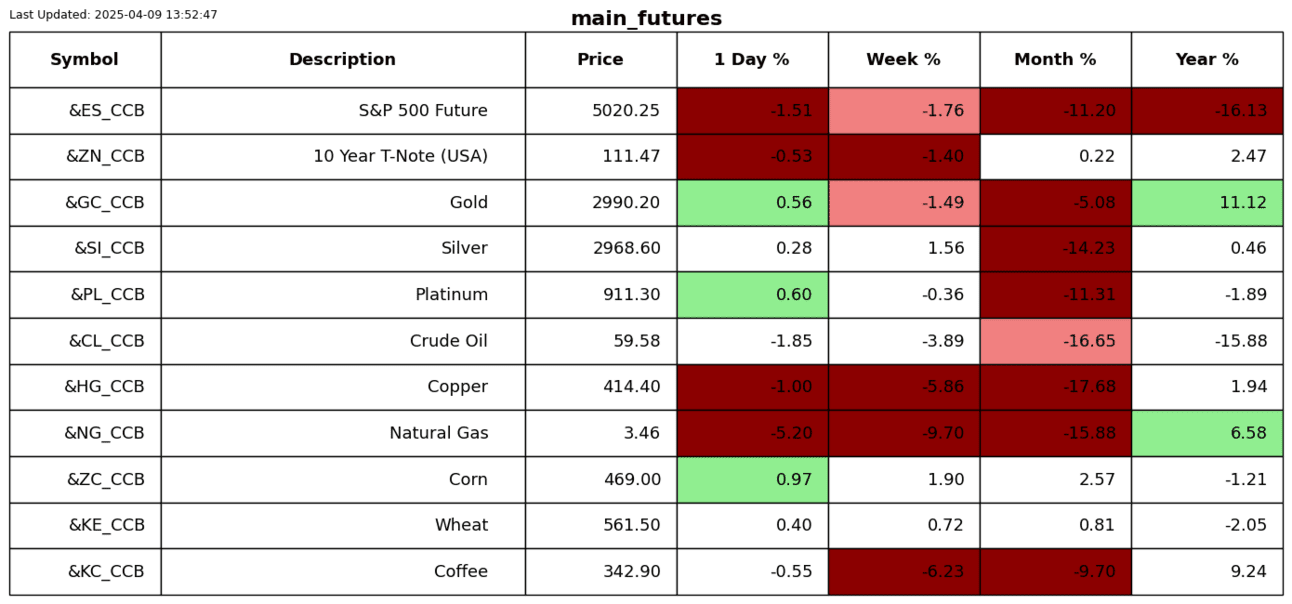

The basis trade in the bond market is when participants trade the convergence of Treasury security prices with Treasury futures contracts. Supply and demand dynamics cause these 2 instruments to occasionally diverge a little. Hedge funds and the big end of town use leverage (100x) to take advantage of these small statistical deviations. How big is this business? Around $800 million and growing as the US government debt level continues to grow.

Why am I bringing this up? Because with high leverage, everything works smoothly—until it doesn’t. The risk profile has nonlinear (concavity) properties, meaning the system becomes increasingly fragile as it grows. In other words, the downside can escalate rapidly once those small cracks appear, precisely because of the heavy leverage involved. The brokers who are facilitating these deals are themselves capital constrained, so if there is a sudden unwind of one of these legs in the basis trade, there can be a shock to the plumbing of the financial system, which can have cascading effects.

The size of the prime broker borrowing enterprise for decent-sized hedge funds is around $2 trillion. This can become a serious shockwave to the broader financial markets.

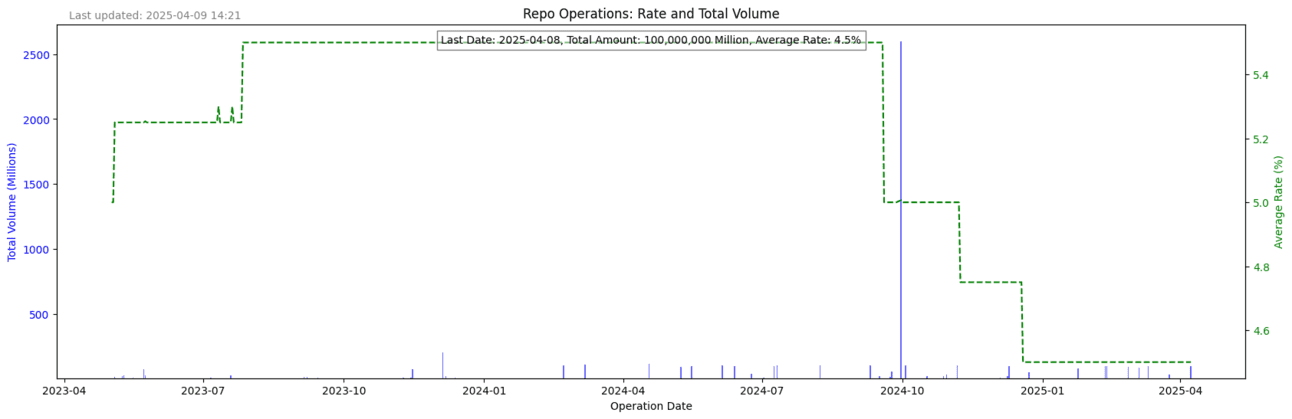

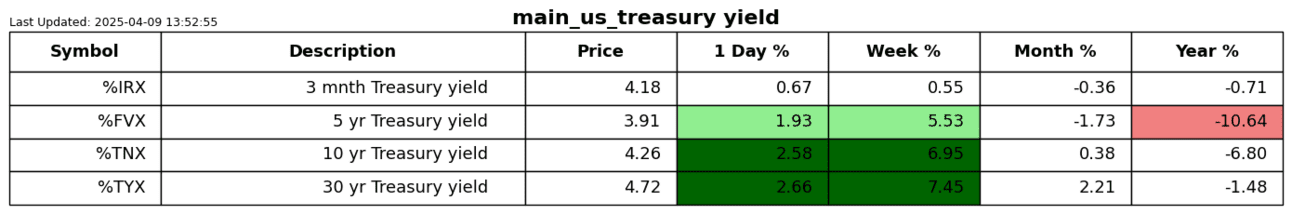

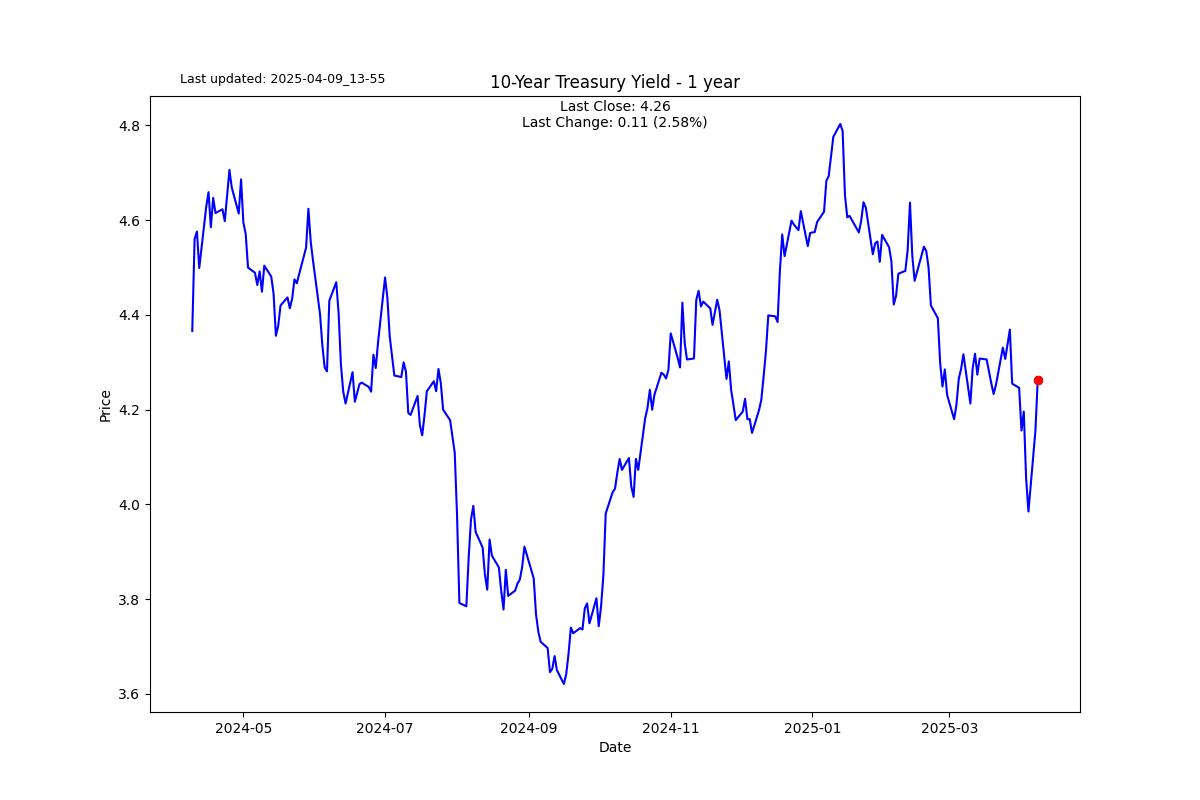

Jerome Powell could still reclaim the mantle as the most powerful man in the world if the Fed is forced to provide liquidity to a dehydrated financial system. I am keeping an eye on the repo market should we see one of these brokers coming to the Fed window begging for a loan. So far we see only small blue blips on the chart.

S2N observations

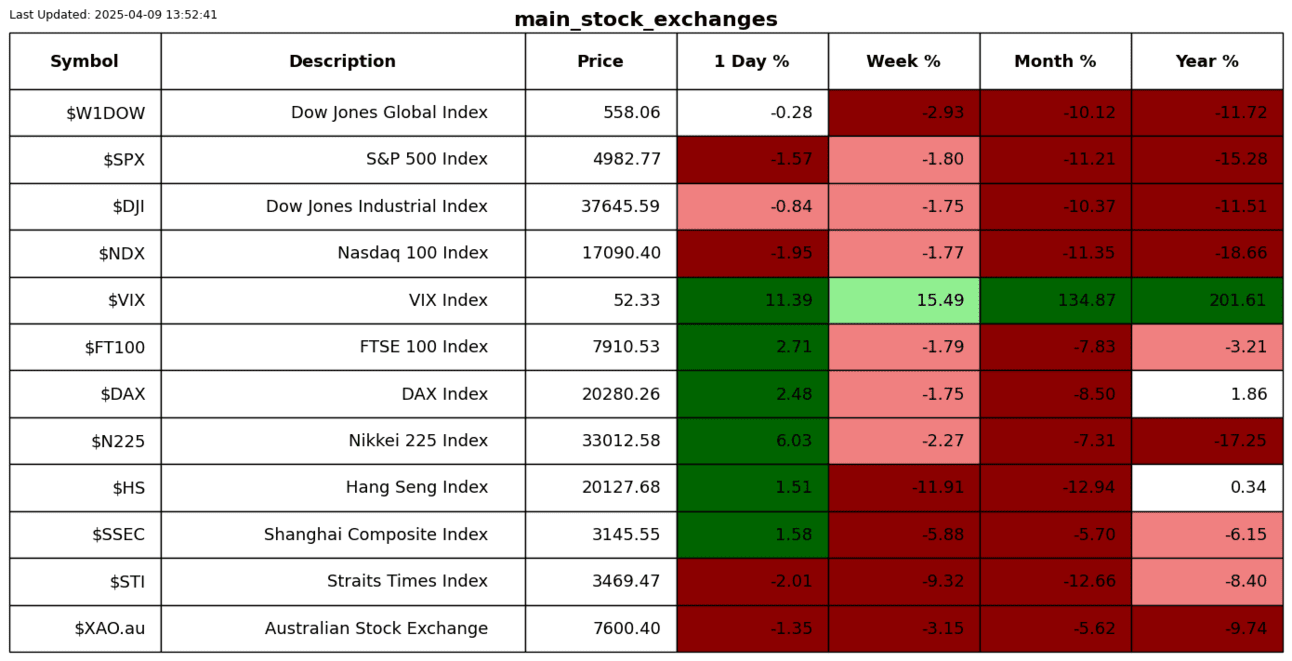

I still cannot believe the US went a step further to punish the Chinese for retaliating with a 104% tariff starting from midnight, which means it has started. Americans purchasing goods from China will pay double what they were paying a short while ago. I cannot get my head around this, so I am not even going to try.

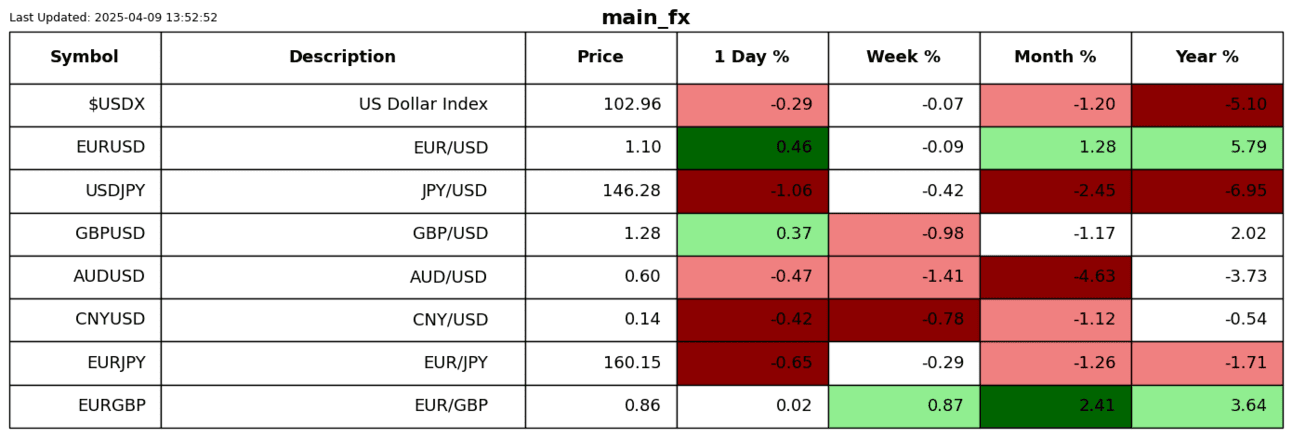

What I have not been watching that closely is the Chinese renminbi. The PBoC has a “daily fix” that is often called a “managed float” whereby the Chinese currency is “manipulated,” according to many. I think every country manipulates their currency to some degree, so I will step aside from that debate for now, as it is just semantics.

What you can see from a technical chart point of view is that the renminbi is on the verge of collapsing. This will help exporters, at least in the short term, and, I suppose, will also increase the value of China’s US bonds in local currency. However, this is a very dangerous game to play and will have consequences that will cost China in the long run.

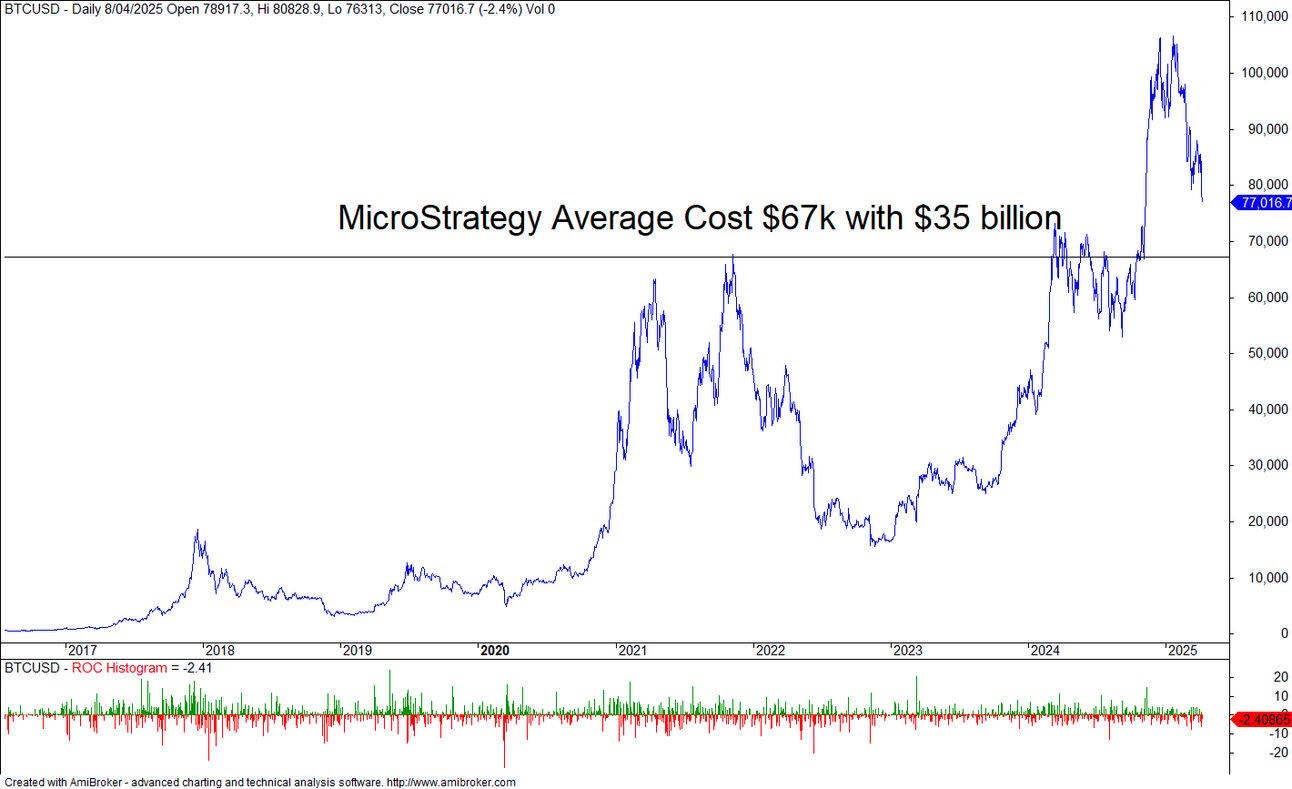

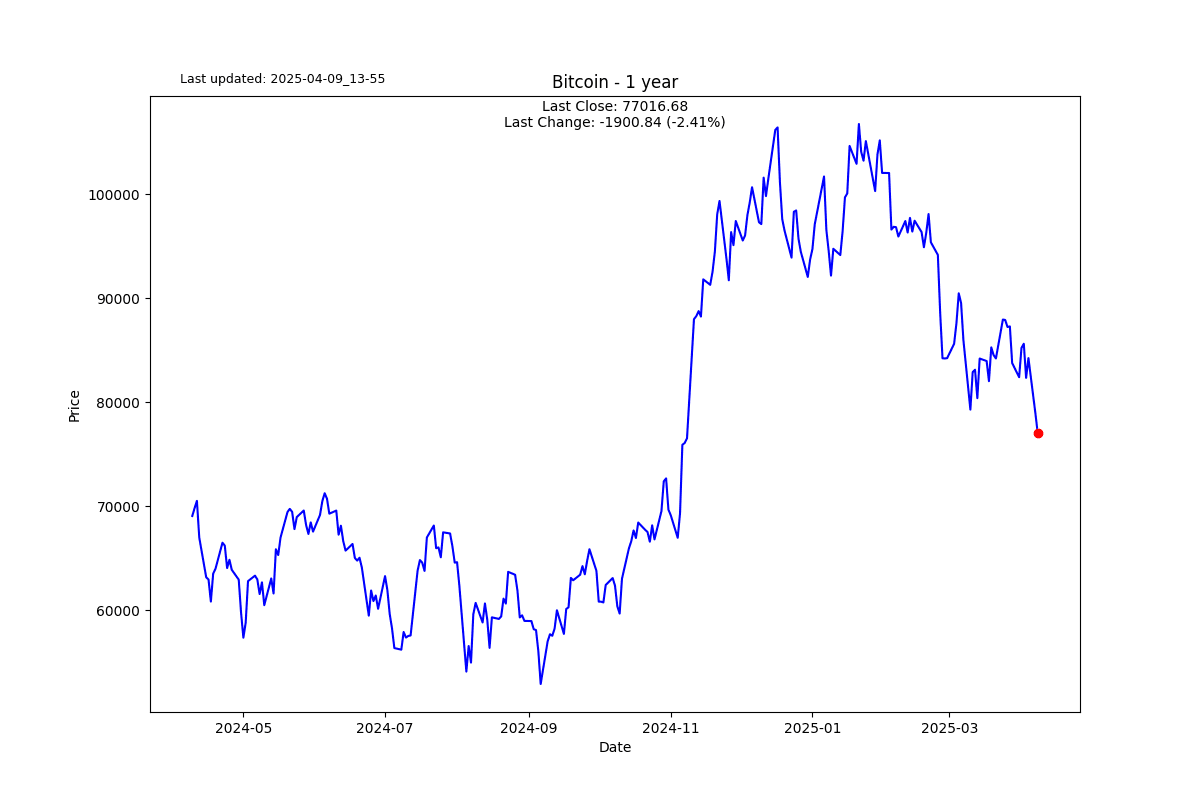

MicroStrategy just bought another sh!t tonne on the 31st of March and has spent $35 billion at an average cost of $67k. I really need to stop with the schadenfreude, but I can’t help myself. Michael Saylor was told by his board to stop buying bitcoin after reporting a $5 billion loss for the quarter. I have always been a fan of Bitcoin, but I also accept some of its weaknesses. I dislike the religious fervour and irresponsibility of personalities like Saylor. There are no guarantees in life and even fewer in finance, so preaching that Bitcoin going up is a dead certainty is, for me, a death sentence. See you in the afterlife, Mr. Saylor.

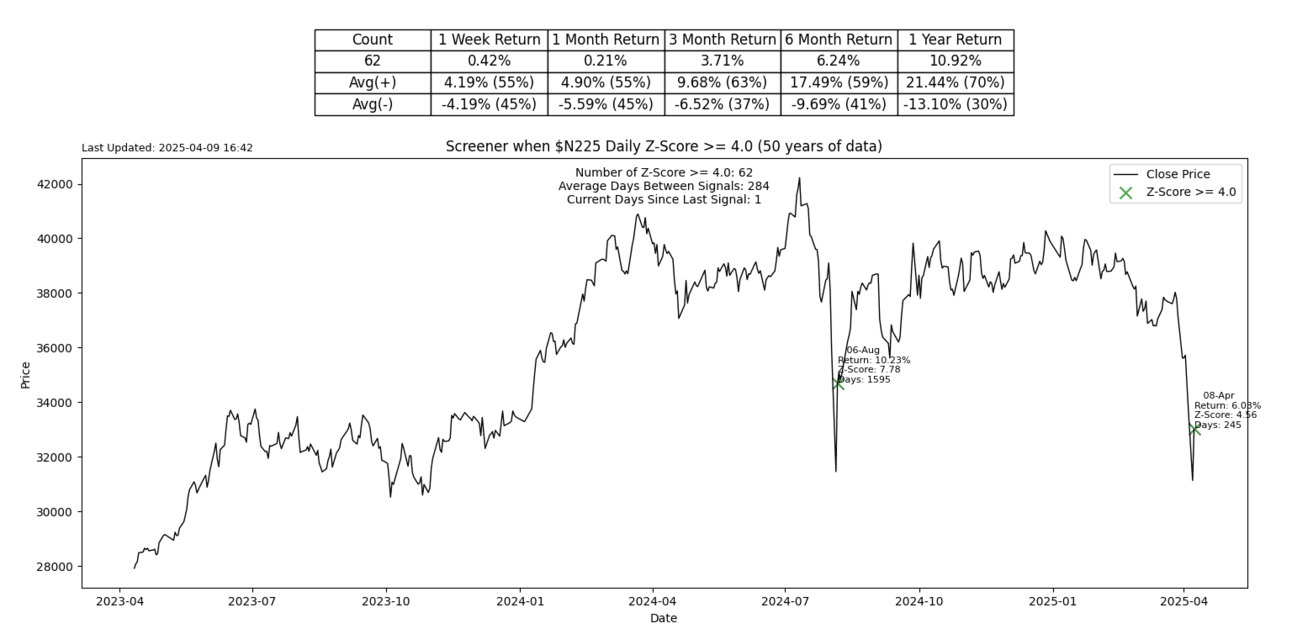

S2N screener alert

The Nikkei was one of the stars of yesterday’s pop. It is hard to see the 6% return and 4.5 Z-Score on this sick chart.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.