Banking vs recession

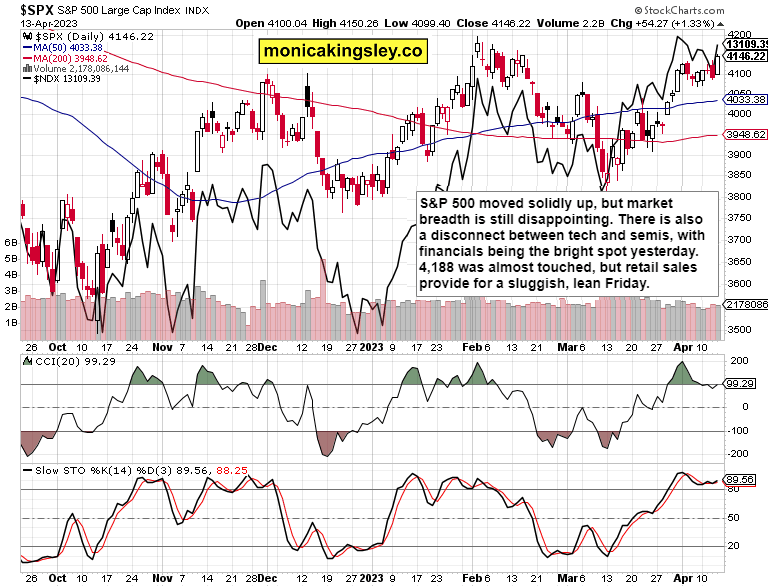

S&P 500 celebrated both the low PPI and CPI headline lately, chose not to focus on core data (key metric for the Fed), and reacted with a temporary downswing only when reminded of recession – be it Fed minutes or today‘s retail sales, with consumer confidence to come still.

More intraday commentary on Twitter and Telegram follows as always – best combined with individual chart sections below.

Keep enjoying the lively Twitter feed via keeping my tab open at all times – on top of getting the key daily analytics right into your mailbox. Combine with Telegram that never misses sending you notification whenever I tweet anything substantial, but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open in a separate tab with notifications on so as to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

Stocks are advancing on still poor market breadth even if financials anticipated good bank earnings today. Bonds though didn‘t stand in the way, but risk taking in junk corporate ones is attracting some second thoughts (is the credit juice freely flowing again?). I‘m looking for stocks to take on 4,188 (with success) rather than breaking below 4,129 really. Whether tech continues doing well, or rotation into value kicks in, is the key factor as regards the next trading days (the latter is constructive for this still ongoing rally – this isn‘t yet time to turn short-term bearish).

Gold, Silver and Miners

Precious metals haven‘t topped, but the hawkish remarks (Fed, ECB) will hit them at one point. For now, it‘s still about carefree upswing driven by dollar woes (reminiscence on my Sunday thoughts).

Crude Oil

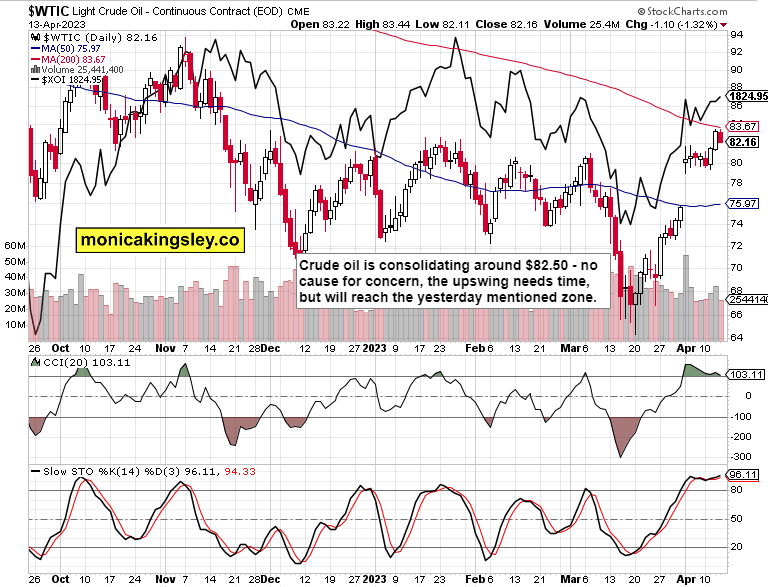

Crude oil is to keep treading water a little before heading higher again – that‘s the function of recession signs popping up. Shallow consolidation ahead at best.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.