Sluggish South Korean growth, as evidenced by a weaker-than-expected jobs report, ups the odds of an April rate cut. Yet the won falling to the lowest level since 2009 complicates the Bank of Korea’s decision next week.

Private sector hiring remained weak in March

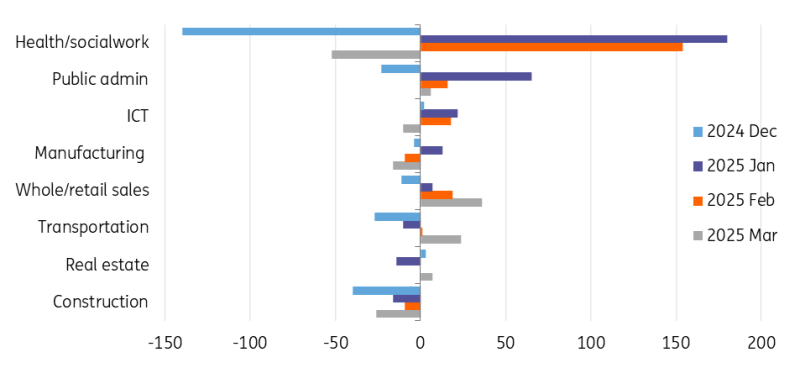

South Korea’s jobless rate rose to 2.9% in March (vs 2.7% in February, 2.8% market consensus). Clearly, the boost from the government job programmes faded, while private hiring remains sluggish. The health and social work sectors lost 52k jobs in March, partially reversing the 334k of combined jobs added in the first two months of the year.

Meanwhile, manufacturing and construction employment was particularly weak, down 16k and 26k, respectively. A silver lining of today’s report was wholesale and retail sales, which rose for a third consecutive month. Though domestic political uncertainty was removed in early April, the negative impacts from tariffs and wildfires in the southern provinces are likely to weigh on labour markets going forward. We don’t expect a sudden deterioration ahead. Rather, we see a gradual rise of the jobless rate in the coming months.

The boost from the public work programmes cannot sustain the job market

Source: CEIC

Market expectations on the tariff negotiations are quite pessimistic

Overnight, Korea began trade negotiations with the US. It’s heartening that Korea secured a seat at the negotiating table. Yet, expectations for good results are quite low. In fact, it’s quite surprising that Trump agreed to talk to the acting president, Han Duk Soo, at all. Working-level discussions will follow soon. The US wants a package deal on tariffs and military spending. It might include larger direct investments in the US, including a commitment to the Alaska LNG pipeline project and increased imports of energy products like LNG and agricultural goods. Talks also might focus on a significant increase in military spending. Given Trump’s desire for a tenfold rise in Korea’s current spending on US troops in Korea, it’s unclear what concessions Korea will actually make.

Even if the current government makes a deal with the Trump administration, it's not clear that it will be implemented. The opposition Democratic Party (DP) is leading in the polls. If the DP candidate is elected, he may not agree with some of the deals made by the current government. Given that the opposition party controls the parliament, implementation would likely be delayed. The DP is likely to take a stronger stance on military spending and agricultural products. We still believe that negotiations are more feasible after the presidential election on 3 June.

WGBI inclusion delayed to next April

The FTSE confirmed that the Korean Treasury Bond will be included in the WGBI index. Inclusion, though, will begin next April, not this October. This delay is due to system preparation and ensuring a smoother transition rather than political instability in Seoul. However, this news worked against the Korean won (KRW), pushing the currency to the lowest level since 2009.

BoK dilemma between weak KRW and weak growth

Amid rising uncertainty over tariffs, wildfires in the southern provinces and a delay in fiscal support, the Korean economy is likely to grow below 1% in 2025. We have lowered our GDP forecast for 2025 from 1.1% year-on-year to 0.8%. First quarter GDP is likely to grow 0.2% quarter on quarter. The current account surplus widened quite sharply in February, thanks to the frontloading of exports. This likely remained the case in March. It should work in favour of first-quarter growth despite weak domestic demand.

However, the policy vacuum caused by President Yoon’s formal exit last week could slow fiscal support and restructuring efforts in the construction sector. This will weigh on growth from the second quarter. All signs point to more Bank of Korea easing. However, the weak KRW and volatile financial markets are likely to pose major challenges to a prompt BoK policy response.

Expect an April cut, rather than waiting until May

It's a close call, but the BoK is likely to deliver a rate cut in April. Even though the KRW is the lowest it has been in about six years, there’s no guarantee it will stabilise within a month. Our one-month KRW forecast is 1,500. The authorities will try to calm the market, but given the global risk-off sentiment, their ability to stabilise things is questionable. Some argue that the weak KRW prompted the BoK to pause its rate cut cycle in January. But we believe the situation is different today than it was in January. Back then, the weakness was driven by the domestic political turmoil. It has now dissipated somewhat.

Political divisions remain, and so will political uncertainty. But recent KRW weakness is driven more by global events. Thus, the BoK’s response may be different than in January. Also, the global and South Korean growth outlooks are now gloomier than at the start of 2025. In addition, we’re not sure that the Federal Reserve will give a hint of rate cuts in the near term at its May meeting. ING expects the Fed to cut in July. The Fed's forward guidance could be a catalyst for KRW moves.

A second possible scenario is the BoK staying on hold in April but with clear hints of a cut in May. This is what we saw in January. Still, this isn’t likely to prevent the KRW from weakening, as the market prices this in beforehand. For these reasons, we now see a slightly higher chance of an April cut rather than one in May.

Read the original analysis: Bank of Korea likely to cut rates in April despite the won’s weakness

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

Gold moves to record highs past $3,340 Premium

Gold now gathers extra steam and advances beyond the $3,340 mark per troy ounce on Wednesday, hitting all-time highs amid ongoing worries over escalating US-China trade tensions, a weaker US Dollar and lack of news from Powell's speech.

Australian Dollar receives support from improved global risk mood, US Retail Sales eyed

The Australian Dollar extends its winning streak against the US Dollar for a sixth consecutive session on Wednesday, with the AUD/USD pair holding firm after the release of Australia’s Westpac Leading Index. The index’s six-month annualised growth rate eased to 0.6% in March from 0.9% in February.

EUR/USD remains in a consolidative range below 1.1400

EUR/USD navigates the latter part of Wednesday’s session with marked gains, although another test of the 1.1400 level remained elusive. The strong bounce in spot came on the back of a marked move lower in the US Dollar, which remained apathetic following the neutral stance from Chair Powell.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin price stabilizes around $83,500 on Wednesday after facing multiple rejections around the 200-day EMA. Bloomberg reports that China is open to trade talks with President Trump’s administration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.