With services inflation still elevated, the Bank of England is treading more carefully towards lower interest rates than the Federal Reserve, and that suggests the committee will vote for no change this month. That could start to change, however, assuming signs of lower wage/price expectations begin to show through in the official numbers.

Bank of England treading more cautiously than the Fed

The Bank of England may have started cutting rates ahead of the Federal Reserve, but you wouldn’t know it listening to recent comments from the UK's central bank. The tone of the August meeting and subsequent speeches have made it abundantly clear that officials don’t want markets running away with the idea that this is going to be a rapid easing cycle.

Markets have taken notice. Not only are investors pricing fewer cuts before the end of this year, but they expect rate cuts to land at a higher level in the UK than the US too. That wasn’t the case before the summer.

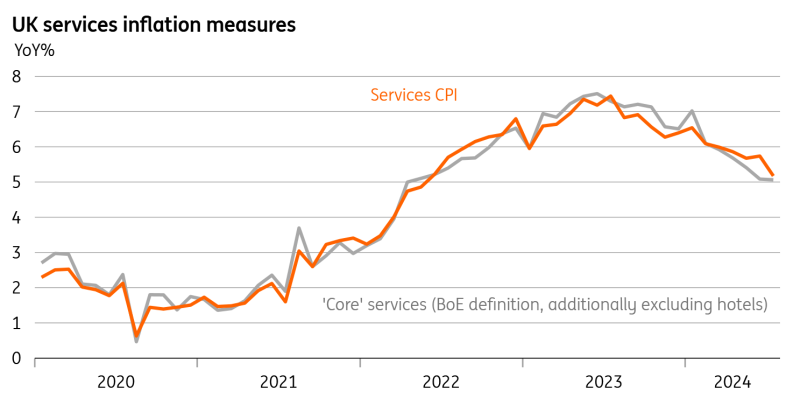

Some of that caution can also be explained by services inflation. At 5.2%, it’s still above that of the US and eurozone, much like wage growth. Admittedly, that is a fair way below the Bank’s most recent forecast and July’s number was below consensus too. But just like the upside surprises that had come before it, this is mainly down to volatility in components the BoE isn’t so bothered about. Hotel prices are one such example.

The labour market data, though of dubious quality right now, isn’t screaming a need to ramp up the pace just yet. Vacancies are virtually back to pre-Covid levels, but officials are still wary that wage growth has consistently outpaced previous forecasts.

Services CPI has been thrown around by some volatile components

Source: Macrobond, ING calculations

The bar to a September cut seems fairly high

The bar to a cut at September’s meeting therefore seems fairly high, with officials preferring to wait until November before lowering rates again. We don’t get any new forecasts this time either, nor a press conference, and we suspect the policy statement will be absent of any major signals on where rates need to go from here.

Governor Andrew Bailey used his speech at Jackson Hole recently to set out three scenarios for “persistent” inflation, ranging from the benign (services inflation falls of its own accord, regardless of what the BoE does), to one where it turns out price/wage setting behaviour has permanently shifted in a way that forces rates to stay high for longer. That simply reflects the increasingly visibly divided committee on where rates need to go next.

Bailey himself seems to be leaning towards a more dovish interpretation of the inflation outlook. And the Bank’s August forecasts show that, based on rates falling to 4% by the end of 2025, inflation would end up a little below target. But the fact that August’s rate cut was voted through by the narrowest of margins shows that not everyone is convinced. We suspect this month we’ll see a 7-2 vote in favour of keeping rates on hold, with Swati Dhingra and Dave Ramsden – both of whom had voted for cuts before July – sitting in the minority.

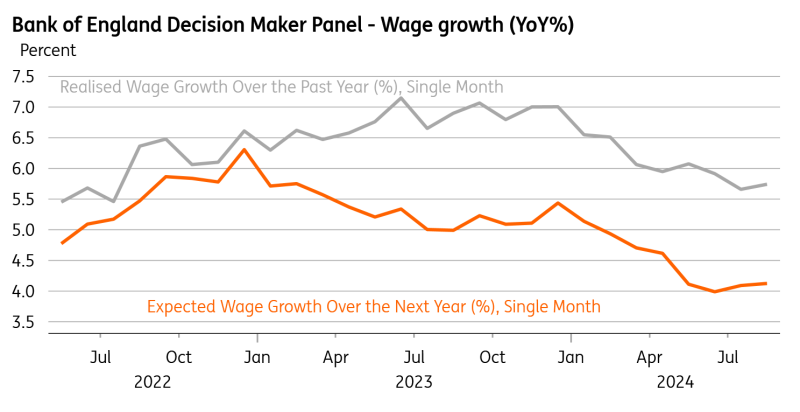

Wage growth expectations are cooling down

Source: Macrobond

Faster cuts are coming beyond November

But by the time of November’s meeting, and more so by December, we think it will become clearer that rate cuts can pick up speed. Already we can see from the Bank’s Decision Maker Panel survey that both expected and realised wage/price growth have fallen materially so far this year. Assuming that continues and it starts to show through more visibly in the official data, we think back-to-back rate cuts beyond November can take Bank Rate down to 3.25% by the end of next summer.

That would mean the UK doesn’t look that different to the Fed and that markets are being too cautious about the path of rate cuts to come.

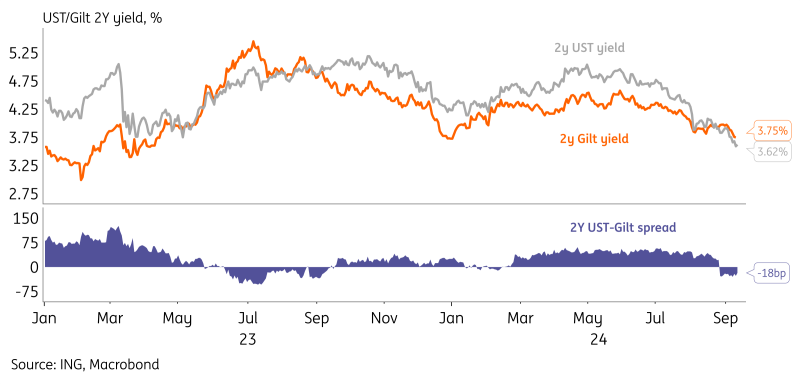

Gilt yields lower by the fall in US yields, but could go lower still

With the first Fed cut incoming, UST yields dragged global yields lower, but Gilt yields have so far shown relative resilience. The 2Y Gilt yield is now around 20bp above the 2Y UST yield, which reflects the diverging expectations about central bank cuts. Where the US economic data has been disappointing as of late, UK data was often more upbeat than consensus expectations – and in turn, the pricing of BoE cuts by markets is relatively less dovish.

Going forward, we think rate markets may be overly extrapolating the potential economic outperformance of the UK. The economic slowdown is not just a US story; the rest of Europe and China too are showing clear signs of cooling. We've written previously about the observation that the BoE landing point as priced by markets is now above that of the Fed, which deviates from our long-term view.

Gilt yields are now above USTs, which could be unsustainable

Sterling may struggle to push much further ahead

Sterling has had a good 2024, with the BoE's broad, trade-weighted sterling index currently up nearly 3.5% year-to-date. Rate differentials have certainly played a part, as discussed above. We find it hard to attribute/quantify sterling outperformance to Labour's landslide win and warmer relations with Brussels. And indeed it may be that the moderate US slowdown and the seeming stagnation in continental Europe are making the UK and sterling look good. We also think Merger & Acquisition activity could be playing a role here, with over $200bn of announced deals targeting the UK this year.

Yet, if the BoE does start to play catch-up with the Fed – and to a lesser degree, the European Central Bank – we anticipate that sterling may start to struggle. It may be too soon to expect that to happen at the September BoE meeting unless the vote split for unchanged rates is surprisingly close or there is some important change in the statement. But by year-end, we would expect the BoE to have turned more dovish and EUR/GBP and GBP/USD to be trading near the 0.85 and 1.29 levels respectively.

Read the original analysis: Bank of England to keep rates on hold, but faster cuts are coming

Content disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more here: https://think.ing.com/content-disclaimer/

Recommended Content

Editors’ Picks

EUR/USD finds fresh demand, nears 1.1100 ahead of US data

EUR/USD has found fresh demand and closes in on 1.1100 in the European session on Friday. The pair builds on the previous recovery amid extended US Dollar weakness and a cautiously optimistic market mood. Traders digest the less dovish ECB policy decision ahead of the US sentiment data.

GBP/USD consolidates gains near 1.3150 amid notable USD supply

GBP/USD is consolidating recovery gains while trading near 1.3150 in the European session on Friday. Despite a tepid risk tone, the pair capitalizes on increased bets for an outsized Fed rate cut, which continue to weigh on the US Dollar. US UoM Consumer Sentiment data awaited.

Gold gets lift as media revives debate over Fed rate cuts

Gold is exchanging hands in the high $2,560s on Friday, trading about 0.40% higher on the day after posting new record highs on Thursday when it broke decisively out of a range it had been oscillating in since it peaked on August 20.

Bitcoin and Ethereum traders could watch this signal for the next bull run

Crypto mining is the process by which new Bitcoin and Ethereum enter circulation. Data from crypto intelligence tracker shows that wallets of Bitcoin and Ethereum miners noted a decline in their holdings of the assets in the first half of the year.

European Central Bank widely expected to cut interest rates in September

The European Central Bank is expected to cut key rates by 25 bps at the September policy meeting. ECB President Christine Lagarde’s presser and updated economic forecasts will be closely scrutinized for fresh policy cues.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.